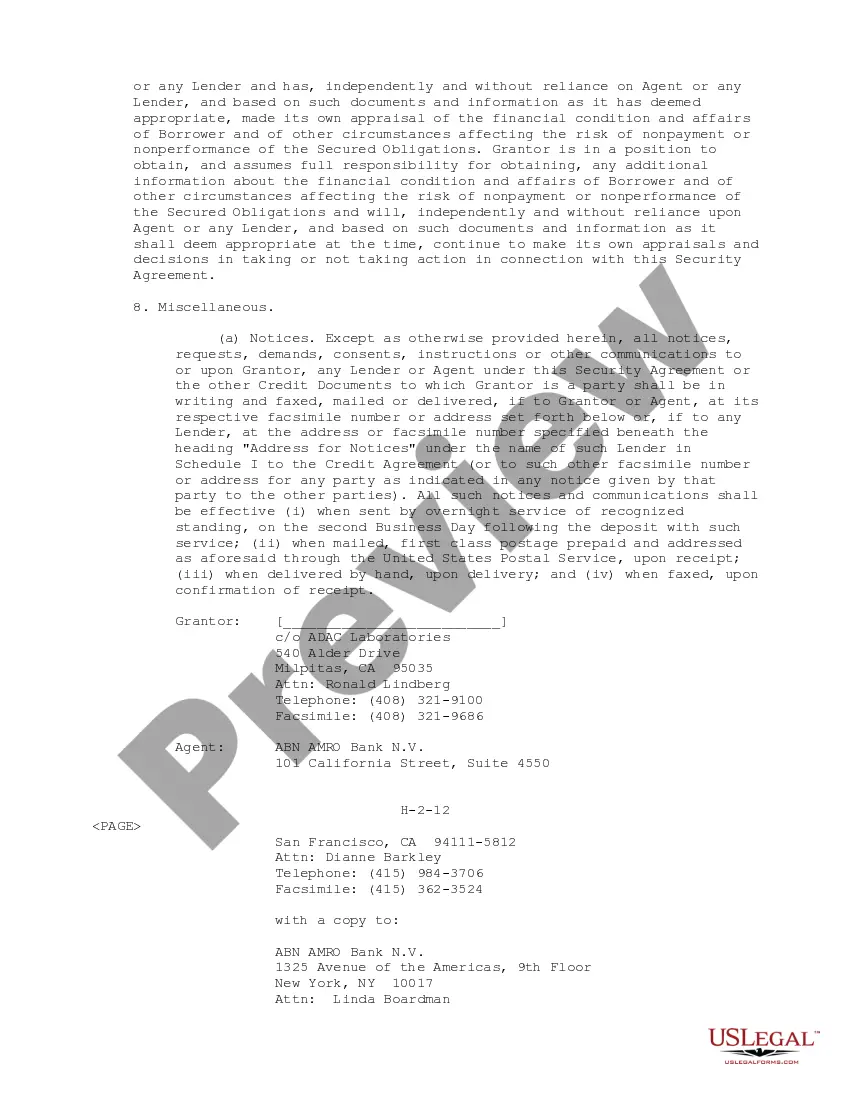

Hawaii Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

Choosing the right authorized record web template could be a have difficulties. Naturally, there are a variety of themes available online, but how will you discover the authorized kind you require? Make use of the US Legal Forms internet site. The assistance gives a large number of themes, for example the Hawaii Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent, that can be used for organization and private demands. All of the kinds are checked by professionals and meet up with state and federal demands.

Should you be presently listed, log in for your accounts and click on the Download key to have the Hawaii Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent. Utilize your accounts to appear from the authorized kinds you might have ordered in the past. Visit the My Forms tab of your accounts and get an additional backup from the record you require.

Should you be a new customer of US Legal Forms, listed here are easy recommendations so that you can comply with:

- Very first, ensure you have chosen the correct kind to your metropolis/state. You may check out the form using the Preview key and browse the form description to guarantee this is the right one for you.

- In case the kind fails to meet up with your expectations, take advantage of the Seach field to find the appropriate kind.

- Once you are certain that the form is acceptable, click the Buy now key to have the kind.

- Choose the costs strategy you want and type in the needed details. Make your accounts and pay money for the order making use of your PayPal accounts or charge card.

- Select the data file formatting and acquire the authorized record web template for your system.

- Total, revise and produce and indication the received Hawaii Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent.

US Legal Forms is definitely the largest library of authorized kinds where you will find various record themes. Make use of the company to acquire expertly-created documents that comply with condition demands.

Form popularity

FAQ

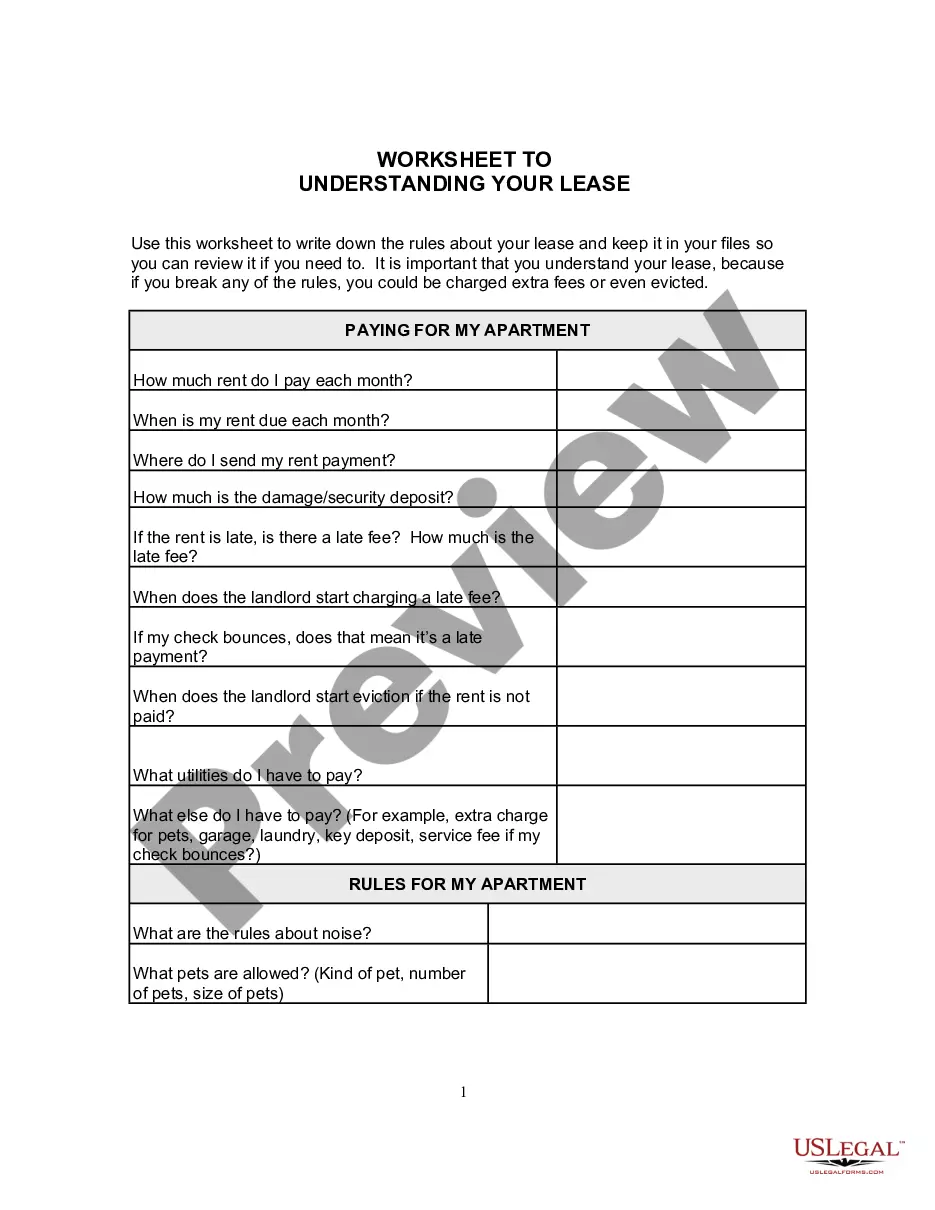

Collateral. Collateral is an asset you can pledge to the lender as an additional form of security, should you not be able to repay the loan. Collateral can help a borrower secure the financing they need and can help the lender recoup their investment if the borrower defaults on the loan. Understanding the 5 Cs of Credit - SouthState Bank southstatebank.com ? growing-your-business southstatebank.com ? growing-your-business

What are Collateral Loans? Collateral loans are often called secured loans, as your own property guarantees the loan. The property can be anything from a car or house to an expensive ring or investment portfolio. Land that you own is commonly used as collateral.

? Collateral: Property, including accounts and chattel paper (i.e., a note evidencing a debt secured by personal property), which is subject to a security interest. ? Secured Transactions shsu.edu ? klett shsu.edu ? klett

What Is Collateral? Collateral in the financial world is a valuable asset that a borrower pledges as security for a loan. For example, when a homebuyer obtains a mortgage, the home serves as the collateral for the loan. For a car loan, the vehicle is the collateral.

Types of Collateral When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include cars?only if they are paid off in full?bank savings deposits, and investment accounts. Collateral Definition, Types, & Examples - Investopedia investopedia.com ? terms ? collateral investopedia.com ? terms ? collateral

Something you own. It may be a financial item like money, bonds, shares or a bank account or physical item like a house, land or a car. that is put up to guarantee a loan. If the loan is not repaid, the lender may sell the asset to get its money back. See also mortgage.

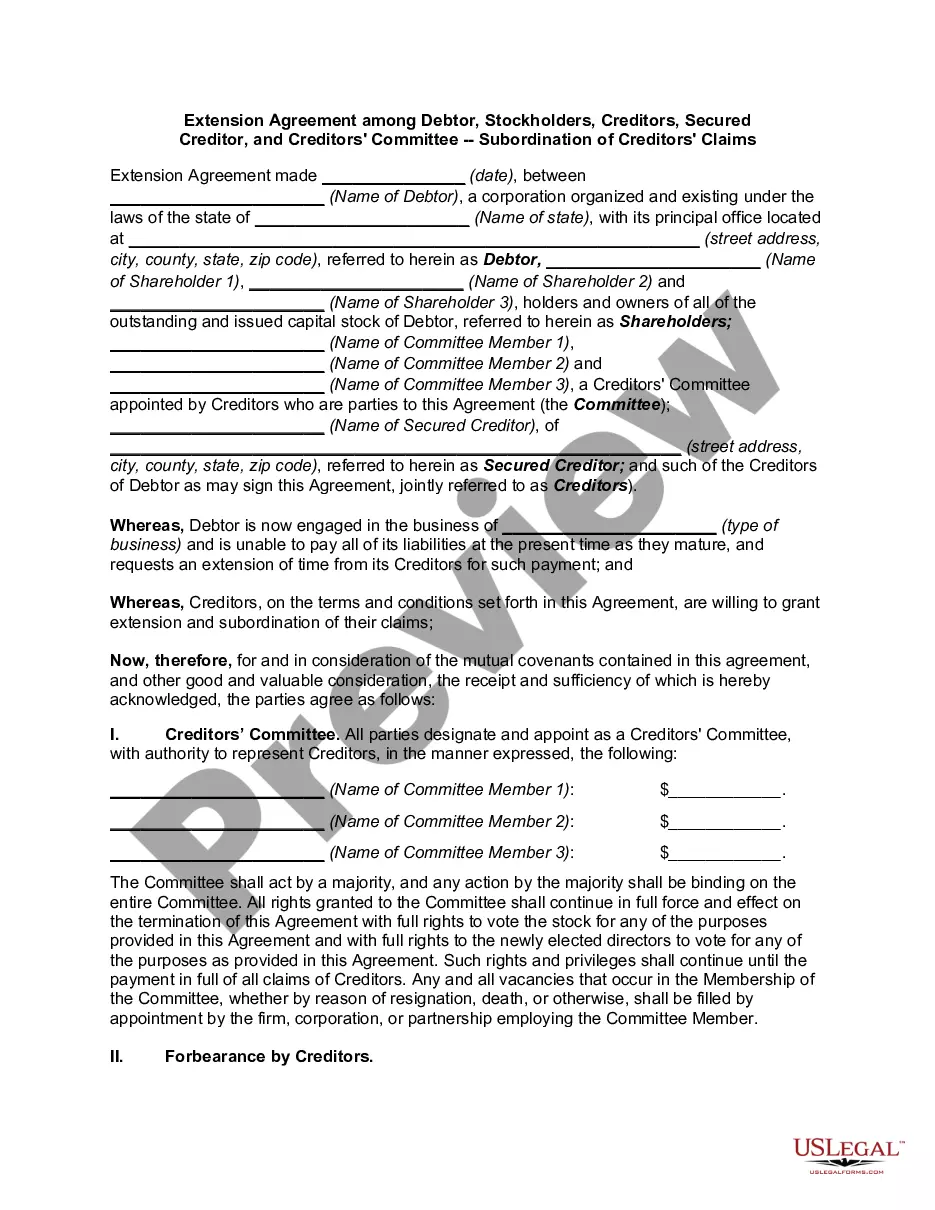

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements. Security Agreement: Definition, Purpose, and Provisions investopedia.com ? terms ? security-agreem... investopedia.com ? terms ? security-agreem...

Your home, vehicle or another asset of value, such as jewellery, could all possibly be used as security against a loan. Property is the asset that is most commonly used as loan security.