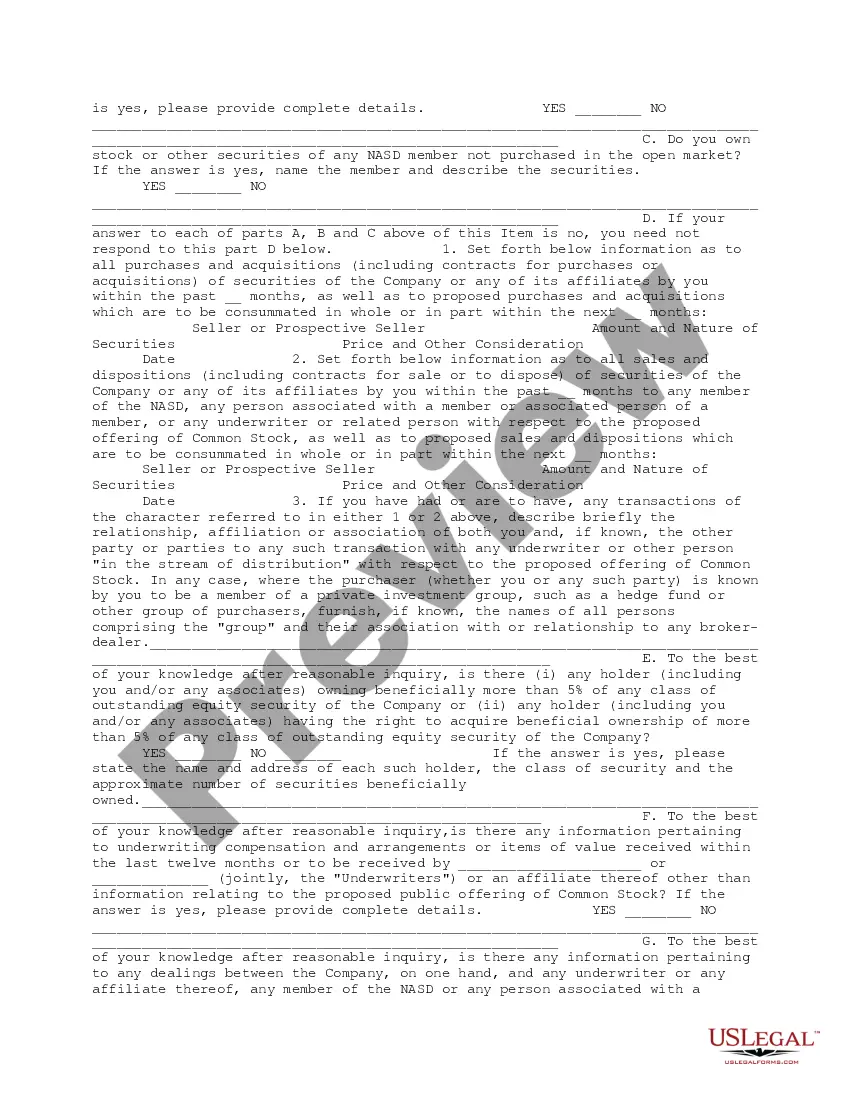

This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from the holders of at least 5 percent of the outstanding securities of the company in business transactions.

Hawaii Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent

Description

How to fill out Comprehensive Questionnaire For Shareholders Including Officers And Directors Holding At Least Five Percent?

Have you ever been in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, including the Hawaii Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent, which can be customized to comply with state and federal regulations.

Once you find the correct form, simply click Get now.

Choose the pricing plan you want, fill in the required information to create your account, and complete the transaction using your PayPal or credit card. Select a convenient file format and download your copy. Locate all the document templates you have purchased in the My documents section. You can obtain another version of the Hawaii Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent at any time if needed. Click on the required form to download or print the format. Use US Legal Forms, the most extensive collection of legal templates, to save time and avoid mistakes. This service offers well-crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/region.

- Use the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form does not match what you are looking for, use the Search field to find the template that fits your needs and requirements.

Form popularity

FAQ

In California, minority shareholders have the right to access crucial information about the corporation in which they hold an interest. They have the right to inspect the record of shareholders as well as the right to inspect the books, accounting records and the minutes of corporate meetings or proceedings.

Shareholders and directors have two completely different roles in a company. The shareholders (also called members) own the company by owning its shares and the directors manage it. Unless the articles say so (and most do not) a director does not need to be a shareholder and a shareholder has no right to be a director.

Actions Requiring Board / Stockholder ApprovalElection of officers; hiring or dismissal of executive employees.Setting compensation of principal employees.Establishment of pension, profit-sharing, and insurance plans.Selection of directors to fill vacancies on the Board or a committee.More items...

Shareholders and directors have two completely different roles in a company. The shareholders (also called members) own the company by owning its shares and the directors manage it. Unless the articles say so (and most do not) a director does not need to be a shareholder and a shareholder has no right to be a director.

Rights of all shareholders All company shareholders have the right to: Inspect company information, including the register of members (s. 116 Companies Act 2006) and a record of resolutions and minutes (s. 358) without any charge.

Shareholder approval will only be required for issuances to a related party, and will not be required for issuances to 1) a subsidiary, affiliate, or other closely related person of a related party, or 2) any company or entity in which a related party has a substantial direct or indirect interest.

Transactions with directorsShareholder approval is also required where a company is proposing to give a guarantee or provide security in connection with a loan made by any person to such a director.

The most common decisions requiring shareholder approval are: changes to your articles of association. grant of authority to issue new shares. disapplication of pre-emption rights before offering new shares to a new investor.

First, deals that require shareholder approval, as per exchange listing rules, are large and important to acquirers, and hence attract greater attention from acquirer Page 12 10 shareholders. These significant deals motivate acquirer shareholders to scrutinize and to be more involved in the decision-making process.

They elect a board of directors to lead their companies and look out for their investment interests. Boards have a legal responsibility to govern on behalf of the stockholders and help companies prosper. Directors sometimes own shares in a company, just as stockholders do.