Hawaii Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005

Description

This form is data enabled to comply with CM/ECF electronic filing standards. This form is for post 2005 act cases.

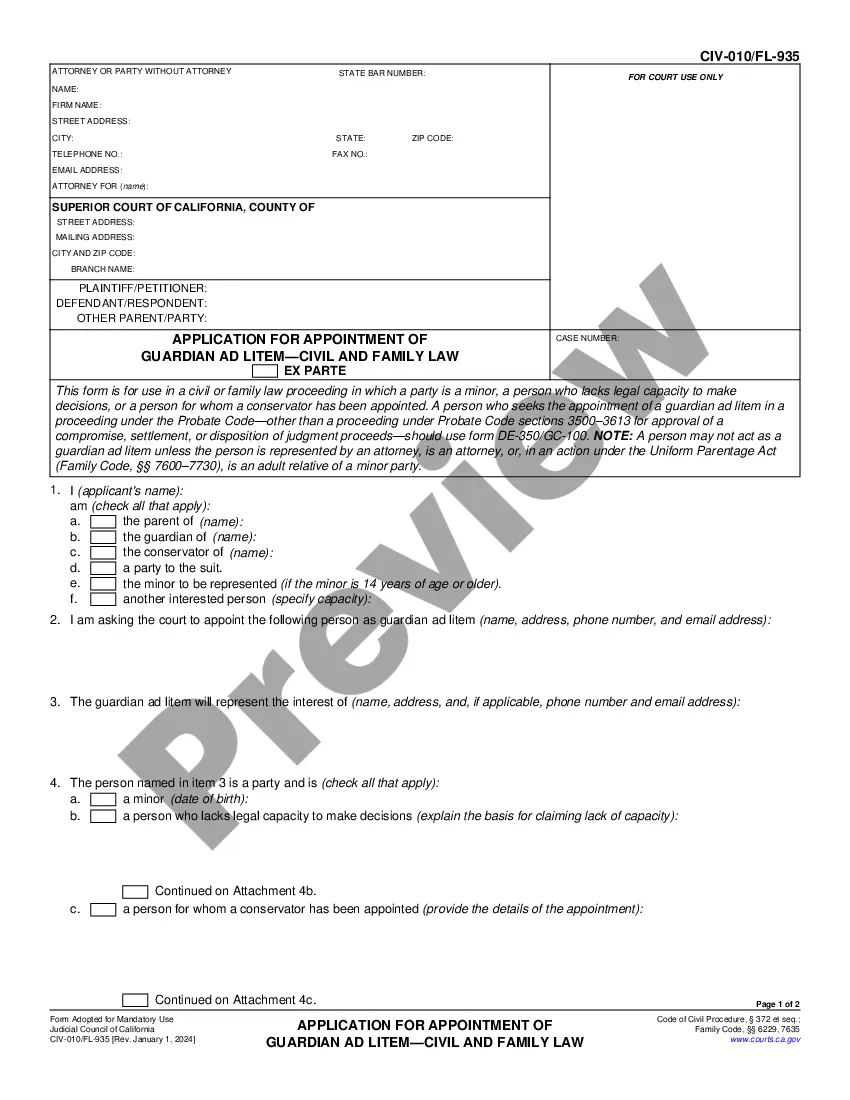

How to fill out Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005?

Discovering the right legitimate document design could be a have a problem. Of course, there are a lot of templates available on the net, but how will you obtain the legitimate type you need? Take advantage of the US Legal Forms website. The services delivers a huge number of templates, like the Hawaii Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005, that can be used for organization and personal needs. Every one of the types are inspected by pros and meet state and federal demands.

In case you are currently signed up, log in in your accounts and click on the Download key to find the Hawaii Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005. Use your accounts to appear from the legitimate types you possess acquired in the past. Visit the My Forms tab of your own accounts and get another copy of the document you need.

In case you are a new end user of US Legal Forms, allow me to share straightforward recommendations for you to comply with:

- Initial, be sure you have selected the correct type for your personal town/area. It is possible to look through the shape utilizing the Review key and study the shape outline to ensure this is the best for you.

- When the type does not meet your expectations, utilize the Seach area to obtain the right type.

- Once you are certain the shape is acceptable, click on the Acquire now key to find the type.

- Choose the costs prepare you would like and type in the necessary information. Make your accounts and pay money for the transaction utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the file formatting and obtain the legitimate document design in your device.

- Comprehensive, modify and print and indication the received Hawaii Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005.

US Legal Forms will be the biggest library of legitimate types where you can find a variety of document templates. Take advantage of the service to obtain expertly-produced paperwork that comply with express demands.

Form popularity

FAQ

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.

Schedule D is part of a series of documents a debtor files with the bankruptcy court. It is formally called "Official Bankruptcy Form 106D" or "Schedule D - Creditors Who Have Claims Secured by Property." Unlike unsecured debts like medical bills or credit cards, secured debts have collateral like cars and houses.

Unsecured Creditors, like credit card issuers, suppliers, and some cash advance companies (although this is changing), do not hold a lien on its debtor's property to assure payment of the debt if there is a default. The secured creditor holds priority on debt collection from the property on which it holds a lien.

Official Form 106Sum. Summary of Your Assets and Liabilities and Certain Statistical Information. 12/15. Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for supplying correct information.