Hawaii Post-Employment Information Sheet

Description

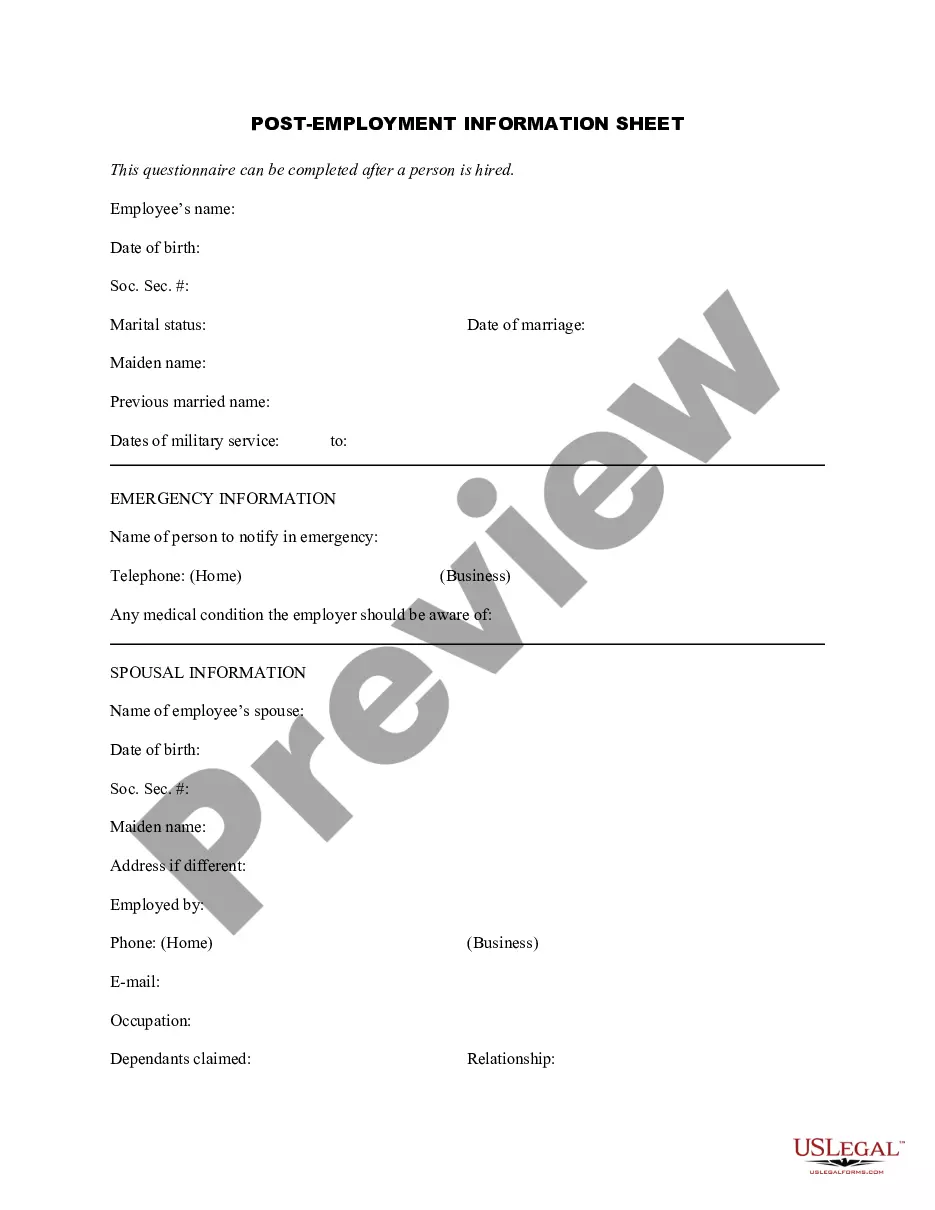

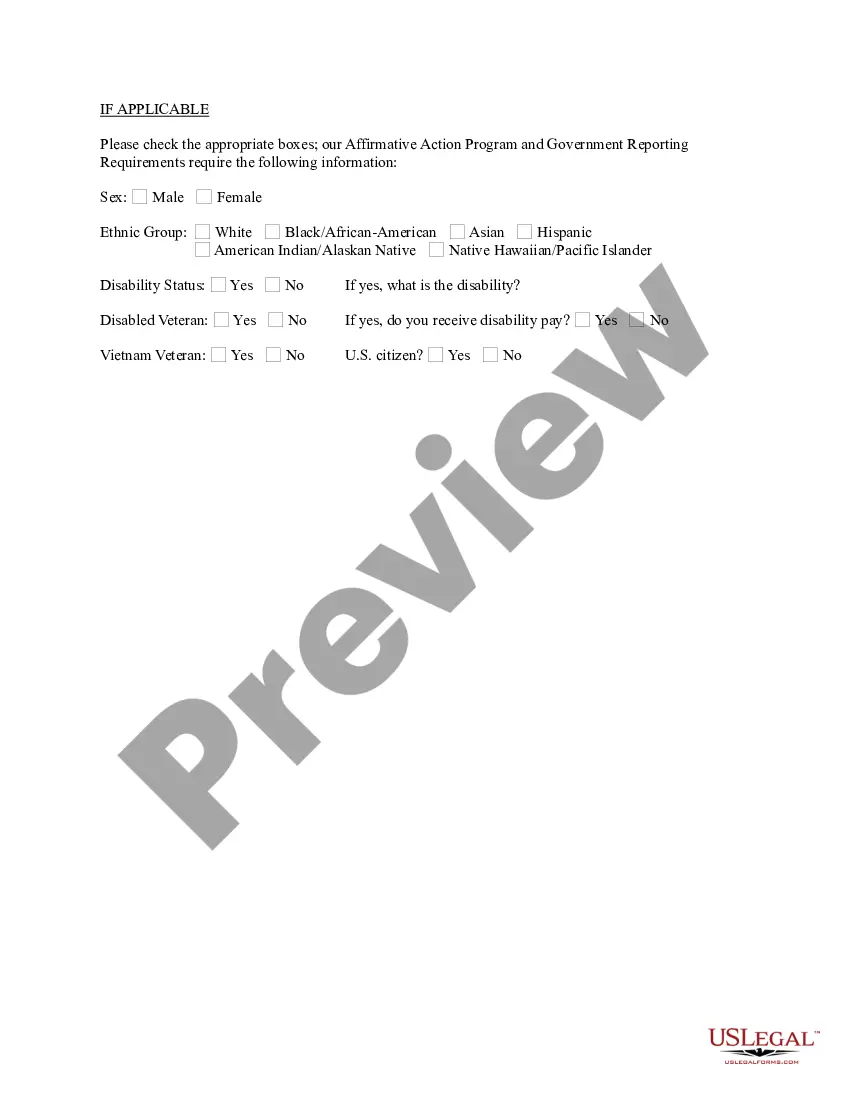

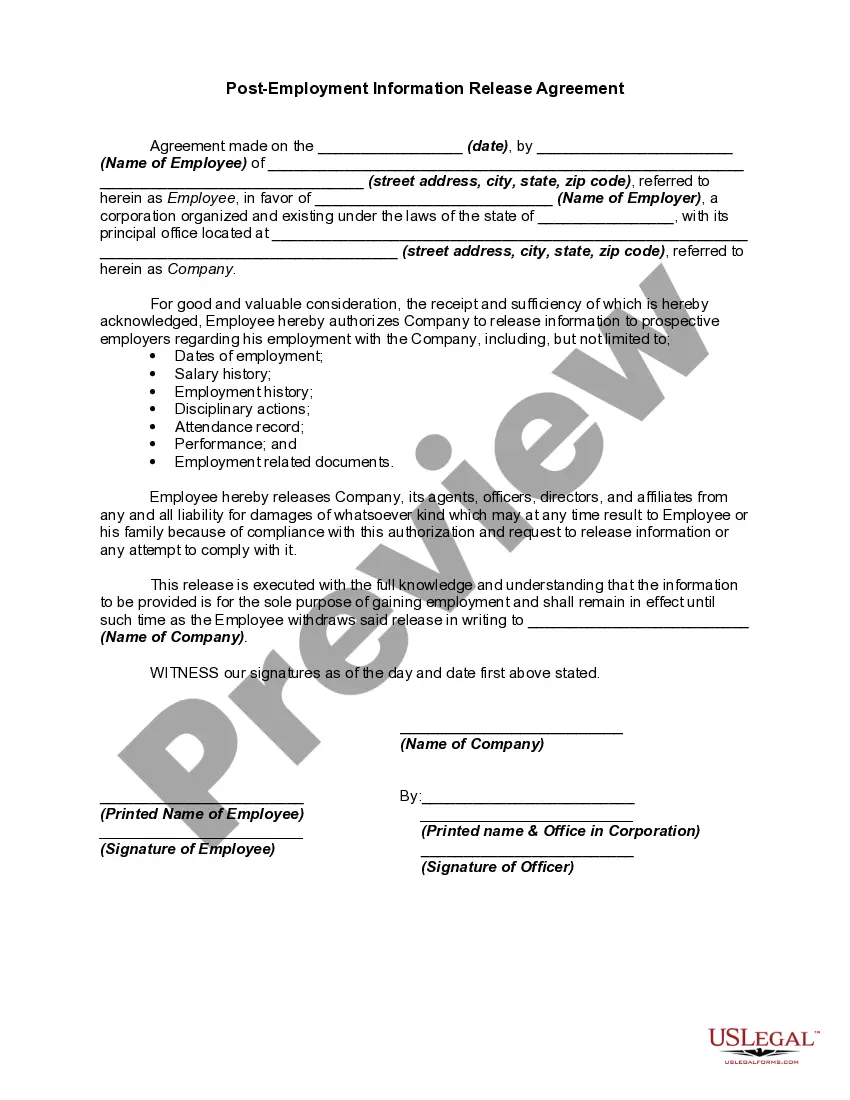

How to fill out Post-Employment Information Sheet?

If you need to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online.

Take advantage of the site’s user-friendly and efficient search feature to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you've found the form you want, select the Order Now button. Choose the pricing plan that suits you and enter your details to sign up for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to retrieve the Hawaii Post-Employment Information Sheet with just a couple of clicks.

- If you are currently a US Legal Forms customer, sign in to your account and click the Download button to find the Hawaii Post-Employment Information Sheet.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find additional versions of the legal form template.

Form popularity

FAQ

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

You can ask for a certificate through a formal request letter. When writing the letter, include the following details: Why you're writing the letter - Start your letter by telling your employer or HR officer that you need a certificate of employment.

Are unemployment benefits taxable? Yes. You may elect to withhold 10% for federal taxes and 5% for Hawaii state taxes from your regular UI benefits. To request withholdings of Federal and/or State taxes, go to: .

For the certificate to be issued, either the employer or the minor or other representative may assist in the following: Obtain an Application for Minor's Certificate of Employment (form CL-1) from a DLIR Child Labor Office, or on the department's website at .

The UI number is assigned only after confirmation of the existence of taxable payroll in Hawaii. To obtain a determination on your unemployment insurance liability and to find out if you will be issued a UI number, go to .

A. Form UC-B6, Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report is mailed to the last known mailing address on file for all active employers, fifteen days prior to the end of EACH calendar quarter.

This tax package contains the necessary forms and instructions to file your quarterly Unemployment Insurance Tax Reports. Reports should contain wage data for one quarter only.

Hawaii employers must report new hires within 20 days from the date of hire or rehire by sending the employee's Form W-4 to: Child Support Enforcement Agency. New Hire Reporting. Kakuhihewa Building. 601 Kamokila Blvd., Suite 251. Kapolei, HI 96707.You can read more information about new hire reporting here.

UC-B6, Quarterly Wage, Contribution and Employment and Training Assessment Report Hawaii employers are required to fb01le quarterly unemployment insurance tax reports on the new and interactive Employer Website at: .

Wage and Tax Statements (Form W-2) Hawaii Income Tax Withheld and Wages Paid (Form HW-2) Hawaii Employers Annual Return and Reconciliation (Form HW-3) Hawaii Withholding Tax Return (Form HW-14)