Hawaii Employment Status Form

Description

How to fill out Employment Status Form?

If you desire to finalize, acquire, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and user-friendly search function to find the documents you need.

A variety of templates for both business and personal purposes are organized by categories and keywords, or states.

Every legal document template you obtain is yours indefinitely. You can access every form you've saved in your account.

Select the My documents section and choose a form to print or download again. Compete and acquire, and print the Hawaii Employment Status Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to locate the Hawaii Employment Status Form with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to access the Hawaii Employment Status Form.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

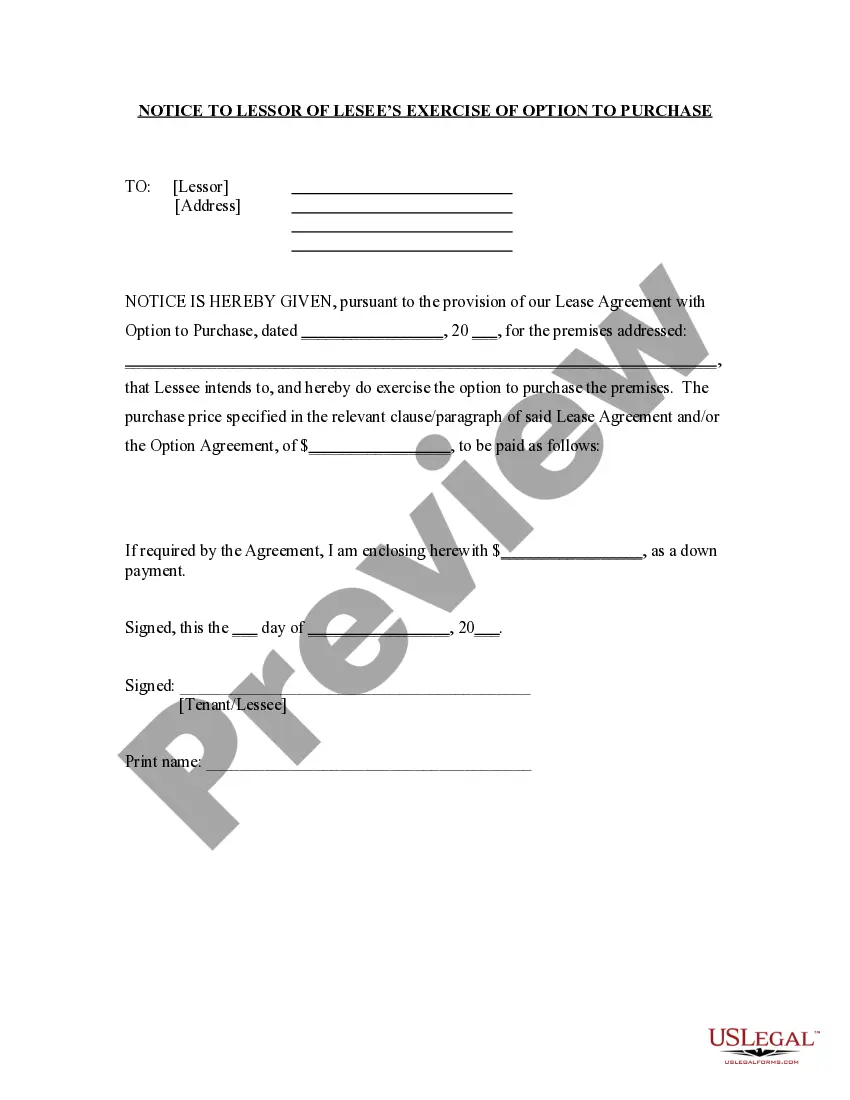

- Step 2. Utilize the Preview option to review the form's content. Always remember to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Get now button. Select the pricing plan you prefer and enter your information to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Hawaii Employment Status Form.

Form popularity

FAQ

A. Form UC-B6, Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report is mailed to the last known mailing address on file for all active employers, fifteen days prior to the end of EACH calendar quarter.

The state Department of Labor and Industrial Relations has established a new website for claimants to check the status of their claims. The website is . By inserting their last name, email address and Social Security number, claimants can immediately check their status.

Unemployment Insurance Click on UC-348 Verification of Partial Unemployment Status.

Most claims will take between 15 21 days before you receive your first payment unless your employer contests the claim.

UC-B6, Quarterly Wage, Contribution and Employment and Training Assessment Report Hawaii employers are required to fb01le quarterly unemployment insurance tax reports on the new and interactive Employer Website at: .

For the certificate to be issued, either the employer or the minor or other representative may assist in the following: Obtain an Application for Minor's Certificate of Employment (form CL-1) from a DLIR Child Labor Office, or on the department's website at .

Because vacation pay is considered reportable earning, your PEUC claim will be in a pending status because you have a potential overpayment of benefits. There are pending issues on your claim.

You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321. We use information from you and your last employer to determine if you qualify. TWC sends your last employer a letter with the reason you gave for no longer working there.

Department of Unemployment Assistance (DUA) contact informationAutomated Telecert Line at (617) 626-6338 is operational daily from 6 a.m. to 10 p.m. to request weekly benefits.Automated Payment Status Line at (617) 626-6563 is operational to check your claim or benefit payment status.More items...

Are unemployment benefits taxable? Yes. You may elect to withhold 10% for federal taxes and 5% for Hawaii state taxes from your regular UI benefits. To request withholdings of Federal and/or State taxes, go to: .