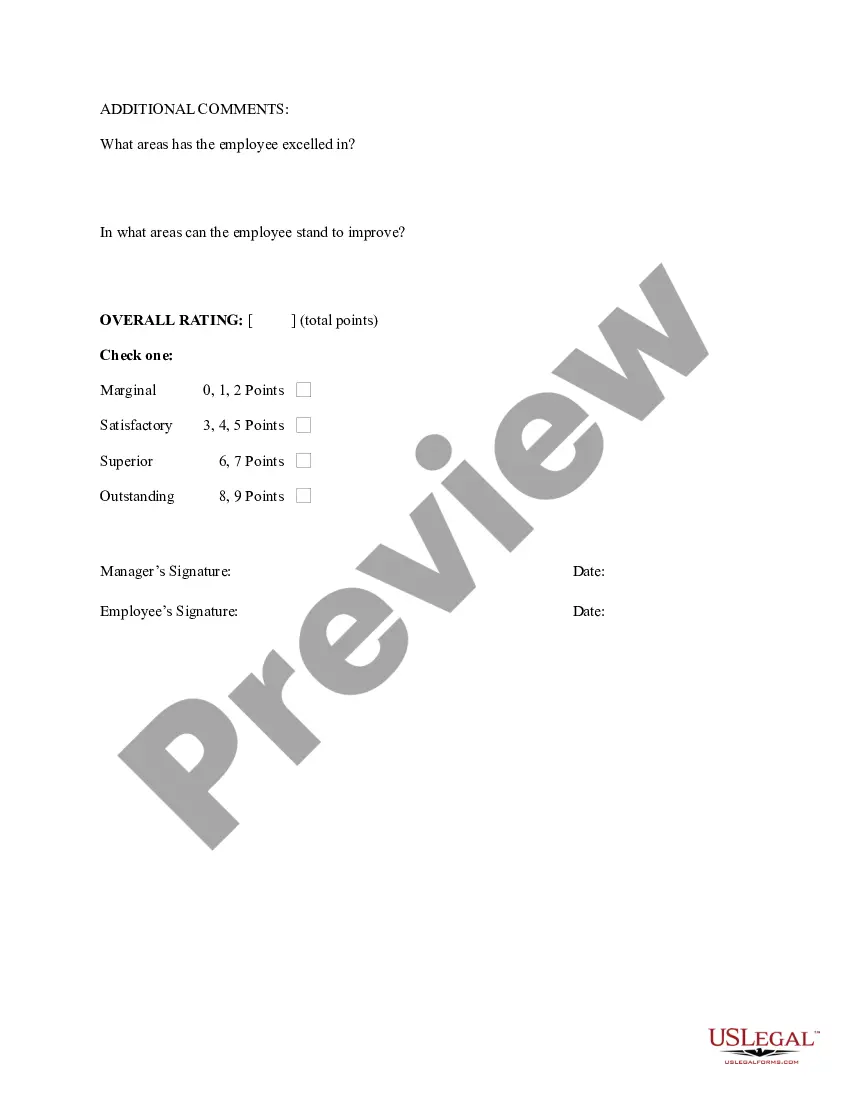

Hawaii Hourly Employee Evaluation

Description

How to fill out Hourly Employee Evaluation?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a wide variety of legal document categories you can download or create.

By using the website, you can access numerous forms for business and personal purposes, organized by type, state, or keywords. You can find the latest editions of forms such as the Hawaii Hourly Employee Evaluation in moments.

If you already have an account, Log In and retrieve the Hawaii Hourly Employee Evaluation from your US Legal Forms library. The Download button will appear on each form you check.

Once satisfied with the form, confirm your choice by clicking the Get now button. Then, select your desired payment plan and provide your details to register for the account.

Process the transaction. Use your credit card or PayPal account to complete the purchase. Choose the format and download the form to your device. Make adjustments. Fill out, edit, and print and sign the downloaded Hawaii Hourly Employee Evaluation. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, should you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Hawaii Hourly Employee Evaluation with US Legal Forms, the most extensive collection of legal template categories. Utilize a vast selection of professional and state-specific templates that cater to your business or personal needs and requirements.

- Gain entry to all previously downloaded forms in the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate template for your location. Click the Preview button to view the form’s details.

- Review the form description to confirm that you have chosen the right document.

- If the form does not meet your needs, utilize the Search box at the top of the page to find a suitable one.

Form popularity

FAQ

Total Income Needed The average income needed to live comfortably in Hawaii, based on the expenses outlined above, is $122,000 for a family of 4 (2 adults and 2 children). In this scenario, each adult would need to consistently earn at an hourly rate of $17.70.

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.

Hawaii labor laws require employers to pay employees overtime at a rate of 1½ time their regular rate of pay when they work over 40 hours in a workweek. HI Wage and Hour Laws. Federal overtime laws may also apply. For federally-defined exemption and other federal overtime laws see FLSA: Overtime.

1. Discrimination/HarassmentHawaii Civil Rights Commission. 830 Punchbowl Street, Room 411. Honolulu, HI 96813.Phone: (808) 586-8636.Fax: (808) 586-8655.E-Mail: info@hicrc.org.Web Address: .

The Hawaii Minimum Wage is the lowermost hourly rate that any employee in Hawaii can expect by law. There are legal minimum wages set by the federal government and the state government of Hawaii. The federal minimum wage is $7.25 per hour and the Hawaii state minimum wage is $10.10 per hour.

Generally, Hawaii is an at will State. This means an employer does not need to give you a reason to let you go, lay you off, or fire you unless: You have a contract with the employer that requires you be notified of the reason.

Employers can't retaliate against employees who disclose their wages to other employees, discuss their wages or inquire about the wages of other employees. Remedies for violations of the law are included in Hawaii's antidiscrimination law.

They find that a single working adult without keiki and with benefits needed to earn $21.85 per hour, or $23.82 in 2020 in Hawaii. Without benefits, that individual needed $25.22 per hour, or $27.48 in 2020, to be economically secure. The National Low-Income Housing Coalition calculates a housing wage for each state.

An employer may not prohibit an employee from disclosing his or her own wages, discussing the wages of others, inquiring about another employee's wages, or aiding or encouraging any other employee to exercise rights under the Equal Pay Act.

$7.25 / hour Hawaii's state minimum wage rate is $10.10 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.