Wyoming Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit

Description

How to fill out Agreement For Services Between An Attorney And Accountant With Respect To An Internal Revenue Service Audit?

You may commit time online attempting to find the legal record web template which fits the federal and state requirements you require. US Legal Forms gives a large number of legal varieties that happen to be reviewed by experts. It is simple to obtain or print the Wyoming Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit from the assistance.

If you already have a US Legal Forms account, it is possible to log in and then click the Download switch. Afterward, it is possible to total, revise, print, or indicator the Wyoming Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit. Every single legal record web template you buy is the one you have eternally. To have yet another duplicate of any bought type, proceed to the My Forms tab and then click the related switch.

If you are using the US Legal Forms website the very first time, follow the simple recommendations listed below:

- Very first, be sure that you have selected the correct record web template to the area/area of your liking. Look at the type outline to make sure you have chosen the proper type. If accessible, take advantage of the Review switch to appear through the record web template also.

- In order to locate yet another edition of your type, take advantage of the Look for area to find the web template that suits you and requirements.

- Upon having located the web template you desire, simply click Get now to proceed.

- Select the rates program you desire, type your references, and sign up for an account on US Legal Forms.

- Comprehensive the purchase. You should use your credit card or PayPal account to cover the legal type.

- Select the format of your record and obtain it to the product.

- Make alterations to the record if necessary. You may total, revise and indicator and print Wyoming Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit.

Download and print a large number of record templates utilizing the US Legal Forms website, that offers the greatest variety of legal varieties. Use specialist and status-distinct templates to handle your business or individual demands.

Form popularity

FAQ

Use Form 2848 to authorize an individual to represent you before the IRS.

The IRS receives copies of your W-2s and 1099s, and their systems automatically compare this data to the amounts you report on your tax return. A discrepancy, such as a 1099 that isn't reported on your return, could trigger further review. So, if you receive a 1099 that isn't yours, or isn't correct, don't ignore it.

A correspondence audit is a simple review of tax returns conducted by the IRS. This kind of audit is normally aimed at charities and other nonprofits. The IRS agent responsible initiates contact by mail or phone requesting clarification on issues or problems with an organization's tax return(s).

Unlimited Representation Rights: Enrolled agents, certified public accountants, and attorneys have unlimited representation rights before the IRS. Tax professionals with these credentials may represent their clients on any matters including audits, payment/collection issues, and appeals.

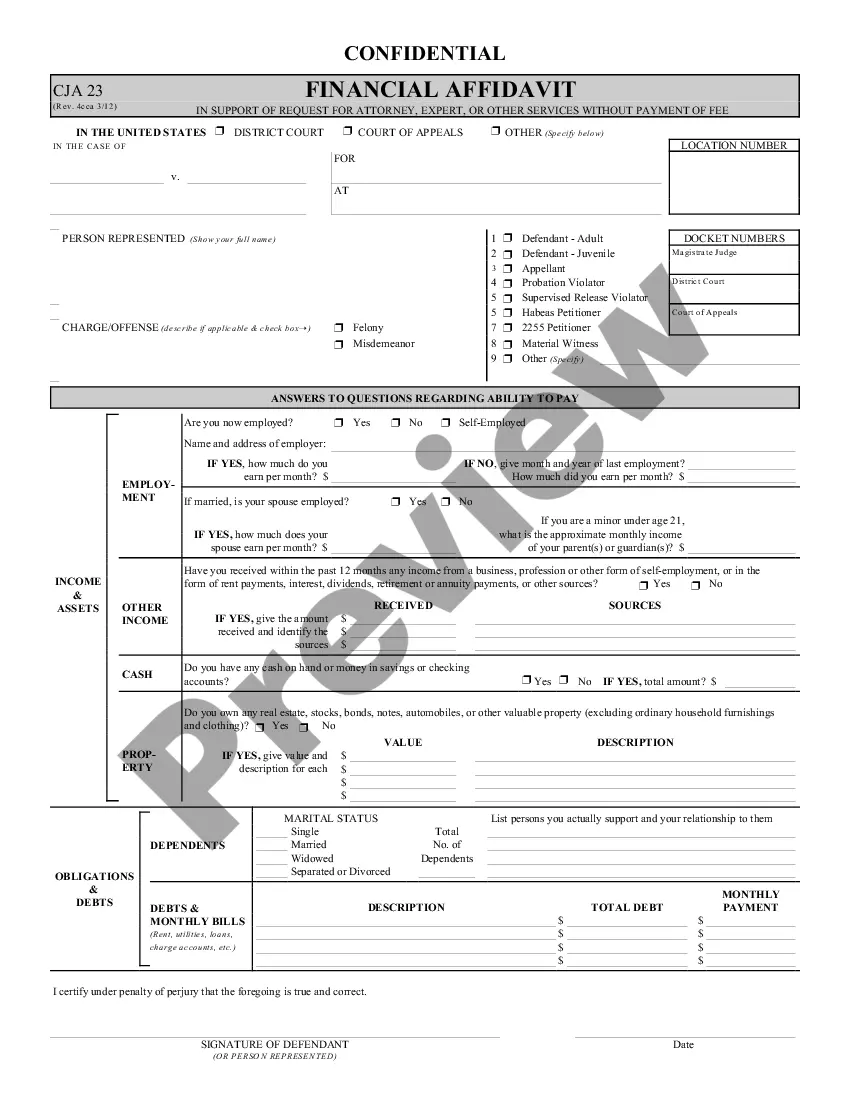

In the course of the audit, the IRS may request access to the taxpayer's receipts, invoices, records, credit card statements, cancelled checks, and other documents. Many audits involve a bank deposit analysis.

Unenrolled return preparers must possess a valid and active Preparer Tax Identification Number (PTIN) to represent a taxpayer before the IRS, and must have been eligible to sign the return or claim for refund under examination.

Do not lie or make misleading statements: The IRS may ask questions they already know the answers to in order to see how much they can trust you. It is best to be completely honest, but do not ramble and say anything more than is required.

Form 8821 authorizes an unenrolled return preparer to inspect or receive a taxpayer's confidential information in any office of the IRS (including TAS) for the type of tax and tax periods reflected on Form 8821. Form 8821 does not authorize an unenrolled return preparer to represent the taxpayer before the IRS.

Your representative must be an individual eligible to practice before the IRS. This includes: Attorneys, certified public accountants (CPAs) and enrolled agents. Enrolled retirement plan agents and enrolled actuaries with respect to Internal Revenue Code sections described in Circular 230.

When conducting your audit, we will ask you to present certain documents that support the income, credits or deductions you claimed on your return. You would have used all of these documents to prepare your return. Therefore, the request should not require you to create something new.