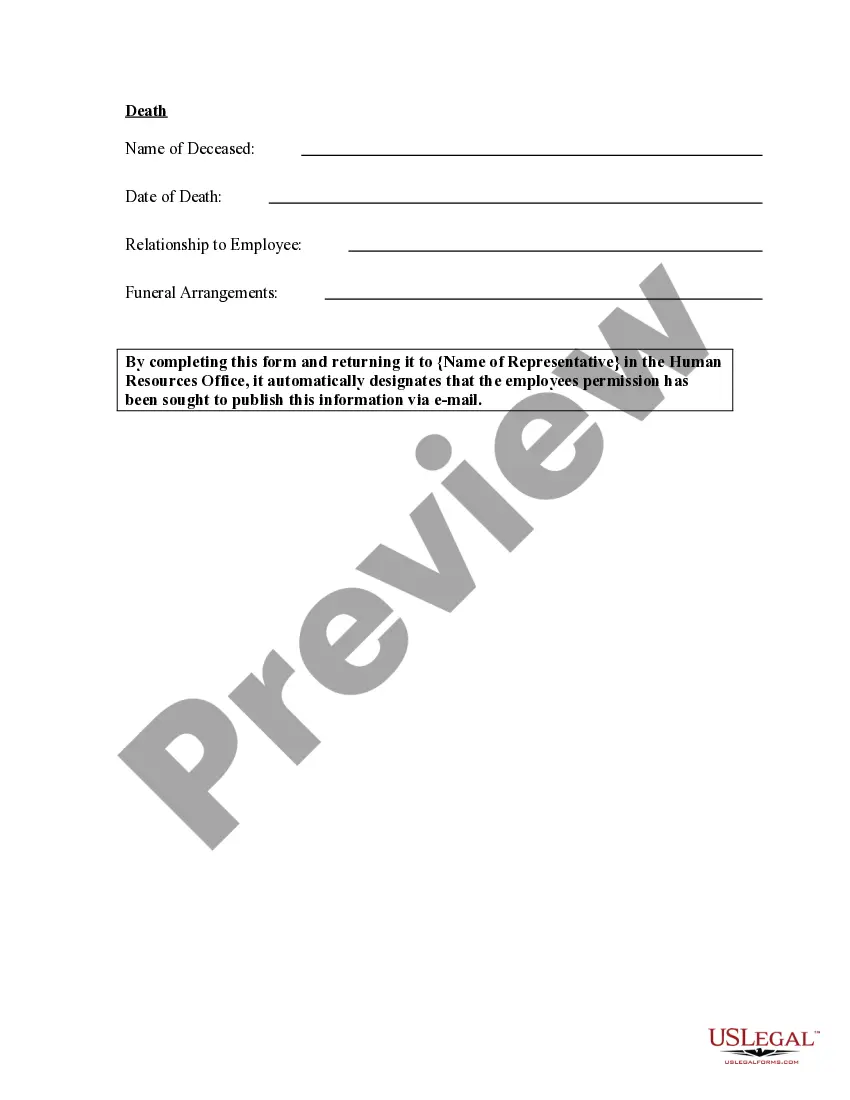

Hawaii Employee News Form

Description

How to fill out Employee News Form?

US Legal Forms - one of the most important collections of legal templates in the United States - offers a selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by type, state, or keywords. You can find the latest versions of forms like the Hawaii Employee News Form within moments.

If you already have a subscription, Log In and download the Hawaii Employee News Form from the US Legal Forms repository. The Download button will be available on every form you view. You can access all previously acquired forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Hawaii Employee News Form. Each template you add to your account has no expiration date and belongs to you indefinitely. Thus, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Hawaii Employee News Form through US Legal Forms, the largest library of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have chosen the correct form for your locale/region.

- Click the Review button to examine the content of the form.

- Check the form details to confirm you have selected the correct document.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, affirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

AM I ELIGIBLE FOR PUA? Self-employed individuals, independent contractors, or gig workers who have had to suspend their work because of COVID-19, or had a significant reduction in work, may be eligible for PUA.

Struggle to find employees continues as extra $300 unemployment benefit ends in Hawaii. HONOLULU (KHON2) It has been a struggle for businesses large and small across the state to attract employees.

Applicants must fill out the CL-1 Form. Applications for this certificate can be downloaded at: . Completed applications may be faxed to the Wage Standards Division.

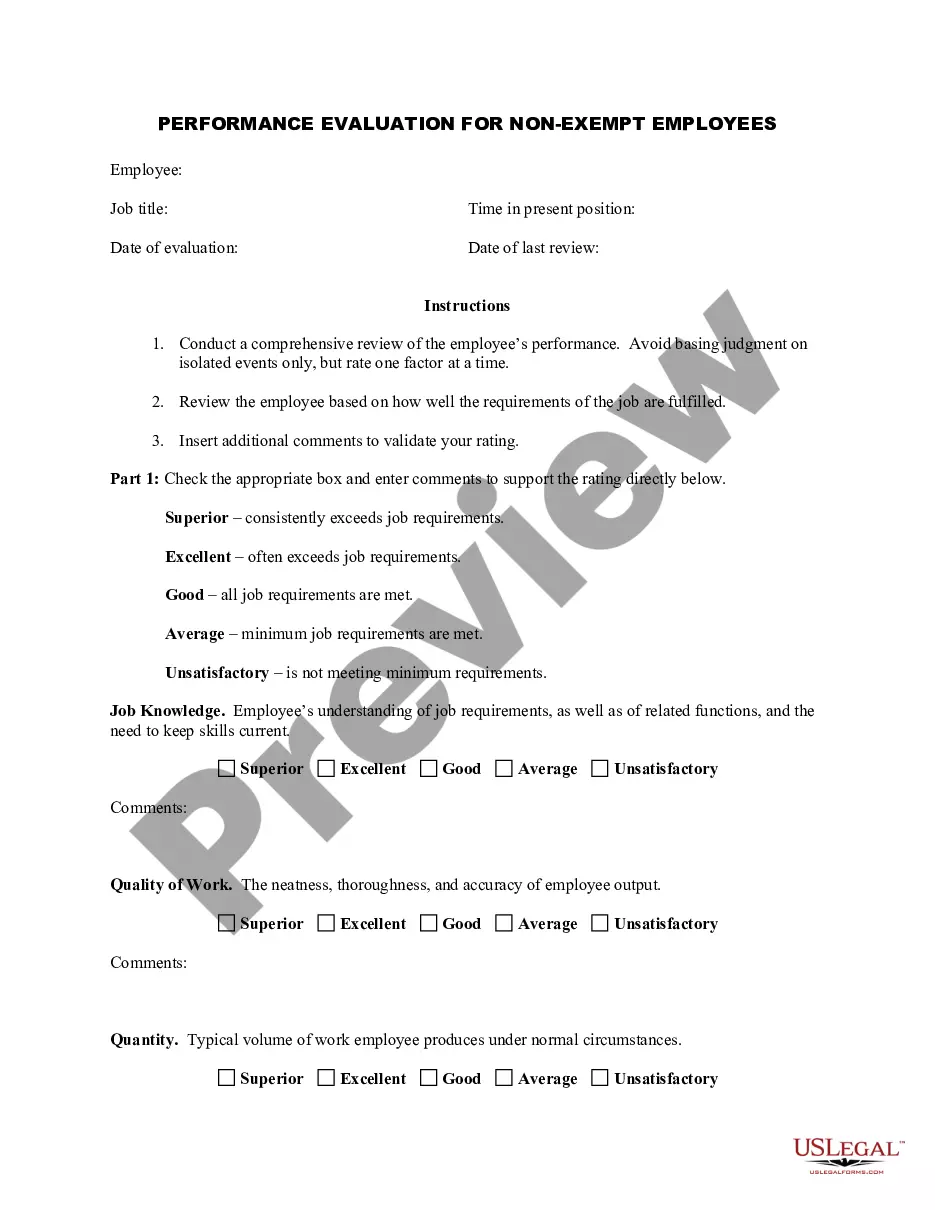

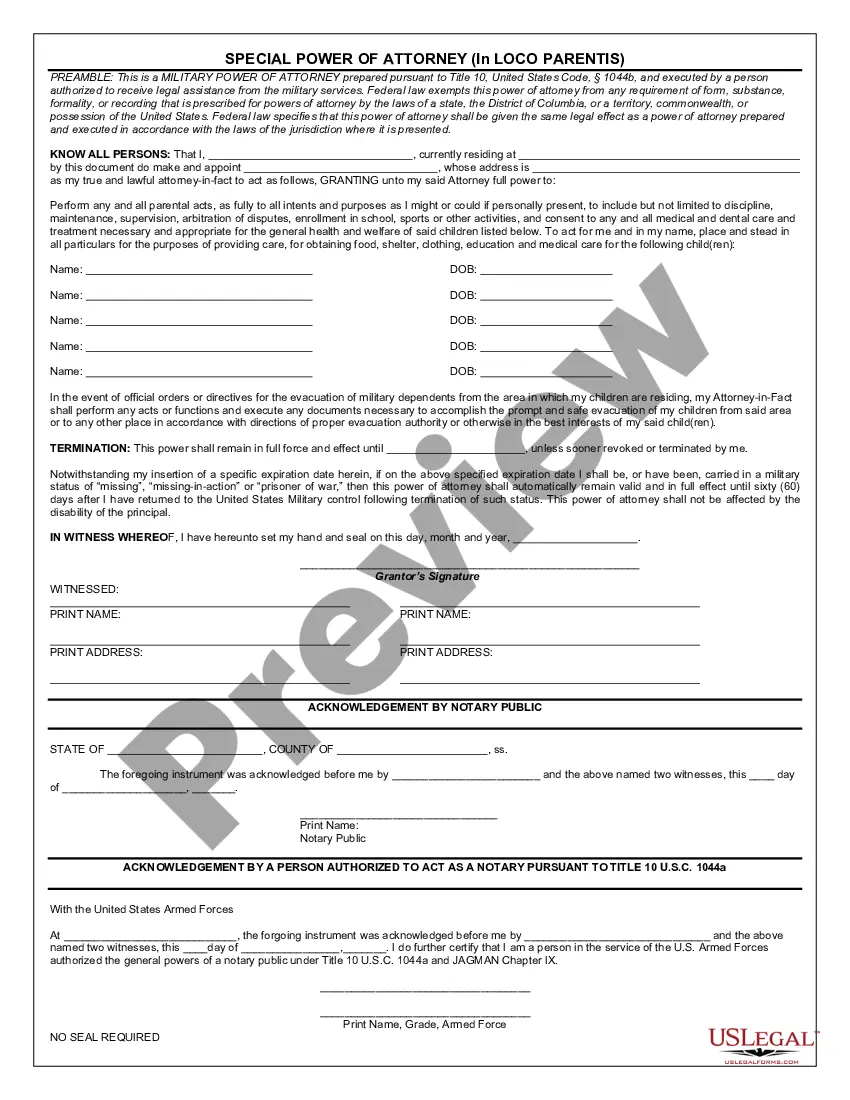

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

A. Form UC-B6, Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report is mailed to the last known mailing address on file for all active employers, fifteen days prior to the end of EACH calendar quarter.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Department of Commerce and Consumer Affairs.

Do I qualify for Unemployment Insurance? Your claim will be based on wages paid to you in your base period. To establish a Hawaii claim: 1) You must have been paid wages in at least two quarters of your base period; and 2) You must have been paid wages of at least 26 times your weekly benefit amount.

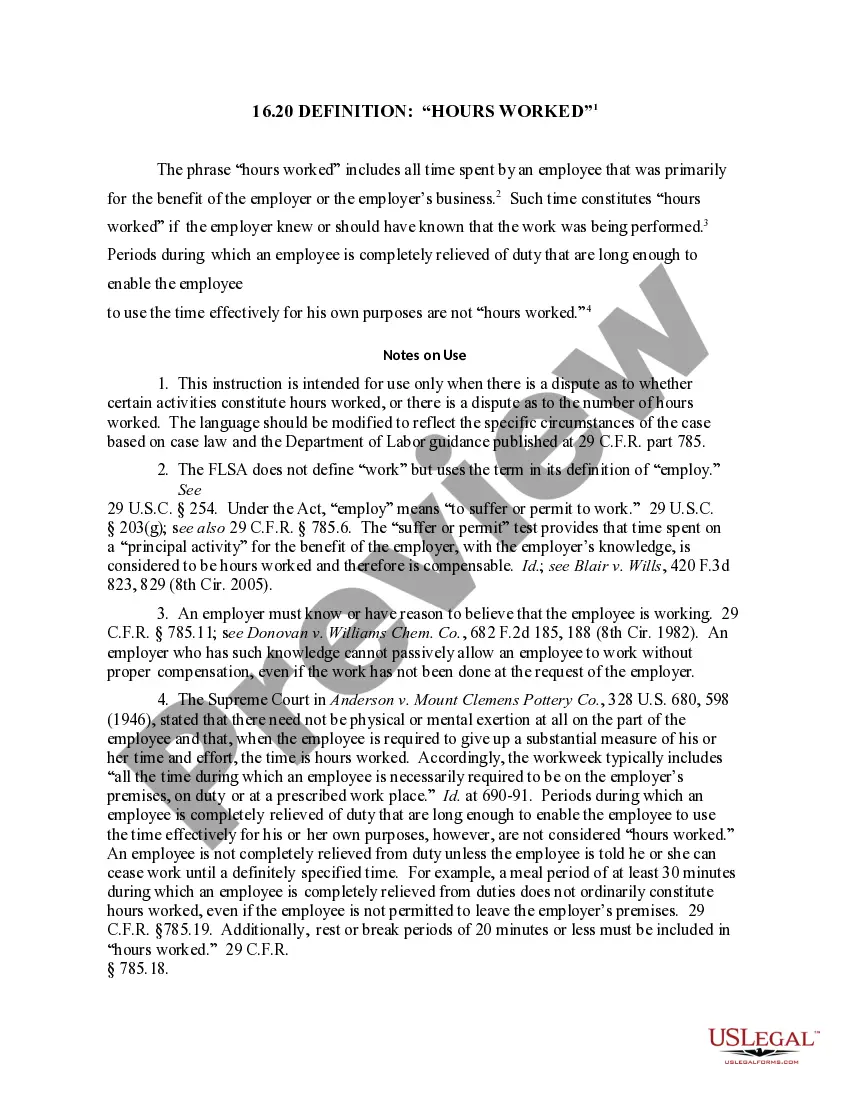

In most cases, if you have employees working in Hawaii, you must pay unemployment taxes on their wages. Tax reports are due quarterly. Liable employers must submit a tax report every quarter, even if there are no paid employees that quarter and/or taxes are unable to be paid.

If you were fired because you lacked the skills to perform the job or simply weren't a good fit, you won't necessarily be barred from receiving benefits. However, if you were fired for misconduct relating to your job, you will be ineligible for benefits.