Hawaii Asset Information Sheet

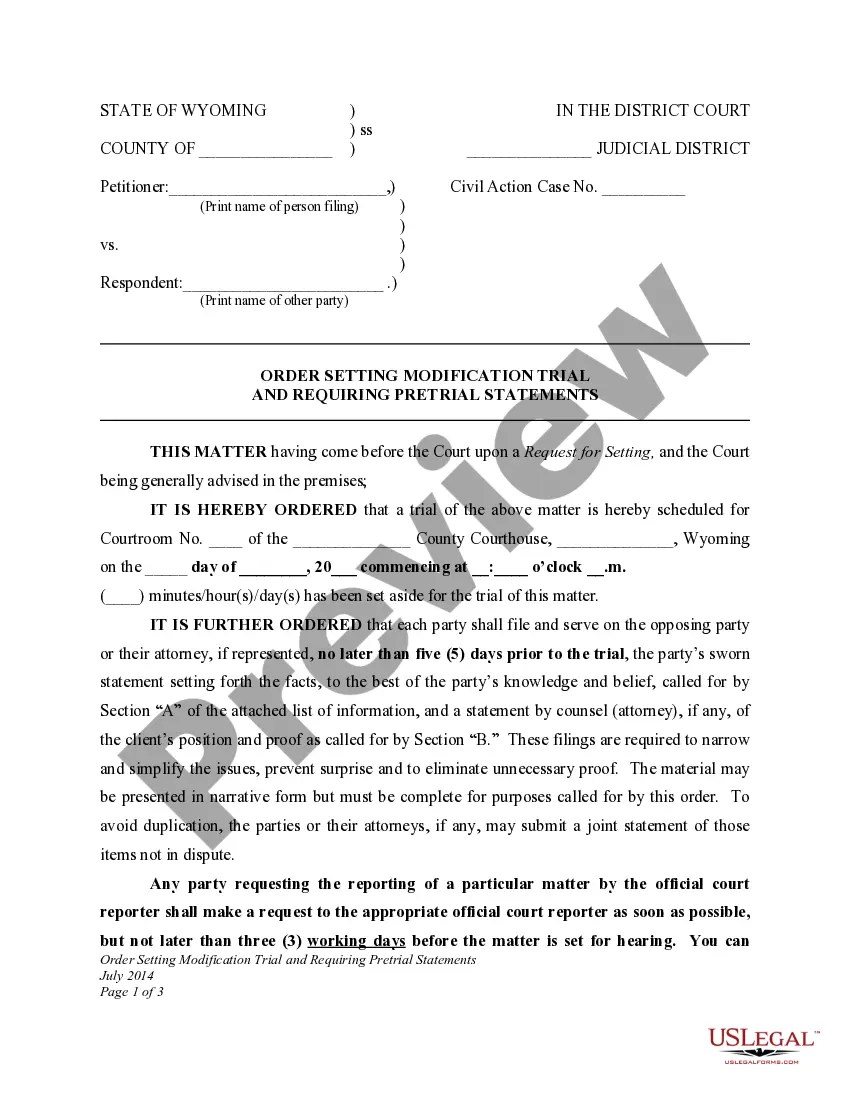

Description

How to fill out Asset Information Sheet?

Locating the appropriate legal document template can be quite a challenge.

Of course, there are numerous templates accessible online, but how can you acquire the legal form you require.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the Hawaii Asset Information Sheet, which you can utilize for both business and personal needs.

Firstly, ensure you have selected the right form for your city/state. You can review the document using the Preview button and read the description to confirm it is suitable for you.

- All forms are reviewed by professionals and comply with federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Hawaii Asset Information Sheet.

- Use your account to browse through the legal forms you have previously purchased.

- Go to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

Form popularity

FAQ

Unclaimed property laws can be confusing and can create traps for the uninformed. Under Minnesota's law, a business that fails to report in a timely manner and remit unclaimed property may be hit with severe penalties and interest. As a result, businesses need to understand and comply with the unclaimed property laws.

Unclaimed property owners may search for unclaimed property by name online at the State of Hawaii Unclaimed Property Search link or by requesting a name search by calling the State of Hawaii Unclaimed Property office.

States have established processes whereby legal owners of assets can reclaim unclaimed funds. When claiming unclaimed funds that have risen in value, taxes may be assessed at the time. If you claim property, it will be treated as ordinary income and taxed accordingly unless the property is related to a tax refund.

Dormancy periods range from one year to fifteen years. notice, informing the owner that the holder will escheat the property to the State of Hawaii. Holders must report property determined to be unclaimed for owners with a last known address in Hawaii.

Individual Income Tax Return. (Rev. 2020) NONRESIDENT and PART-YEAR RESIDENT.

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

HARPTA? The buyer is required to withhold 7.25% of the amount realized on the disposition of Hawaii real property. If the buyer fails to do so, the buyer is liable for the amount that should have been withheld.

11. Individual Income Tax Return (Resident Form)

Please address your written suggestions to the Department of Taxation, P.O. Box 259, Honolulu, HI, 96809-0259, or email them to Tax.

New York State had by far the largest total of unclaimed property, and its rate of unclaimed property per capita was nearly twice that of the number two state, Massachusetts.