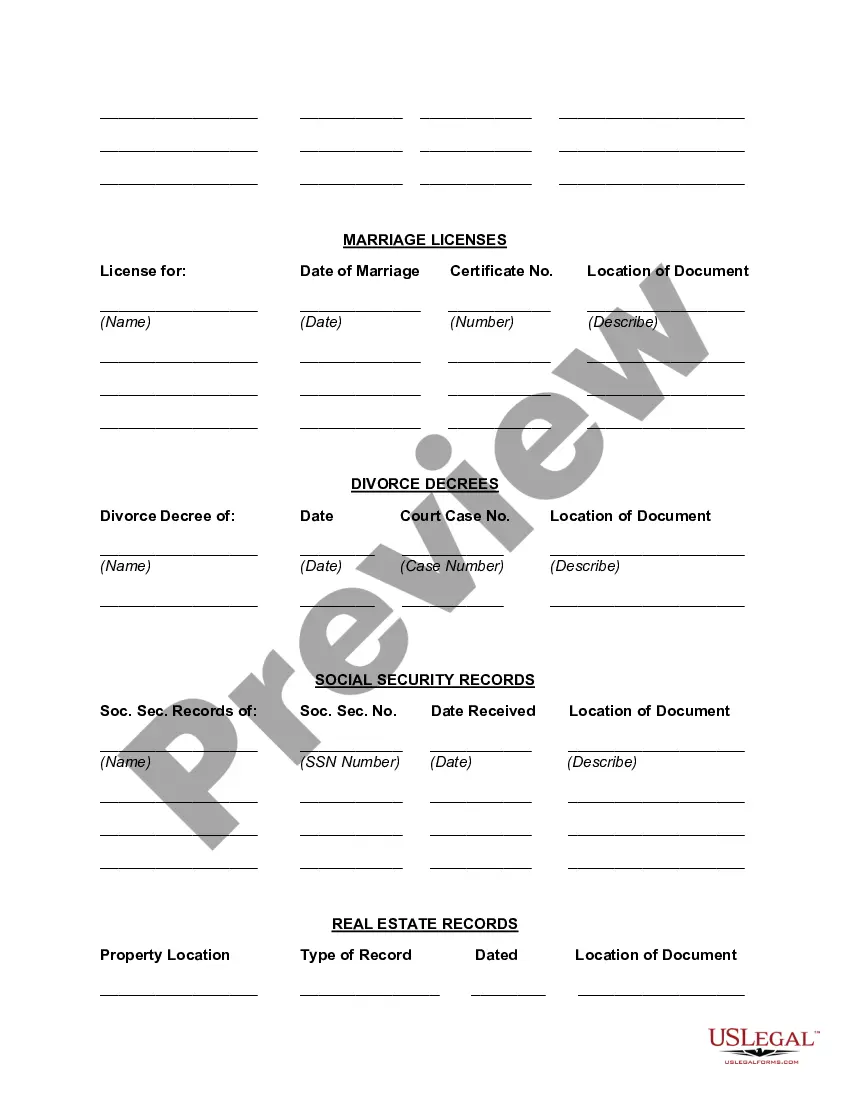

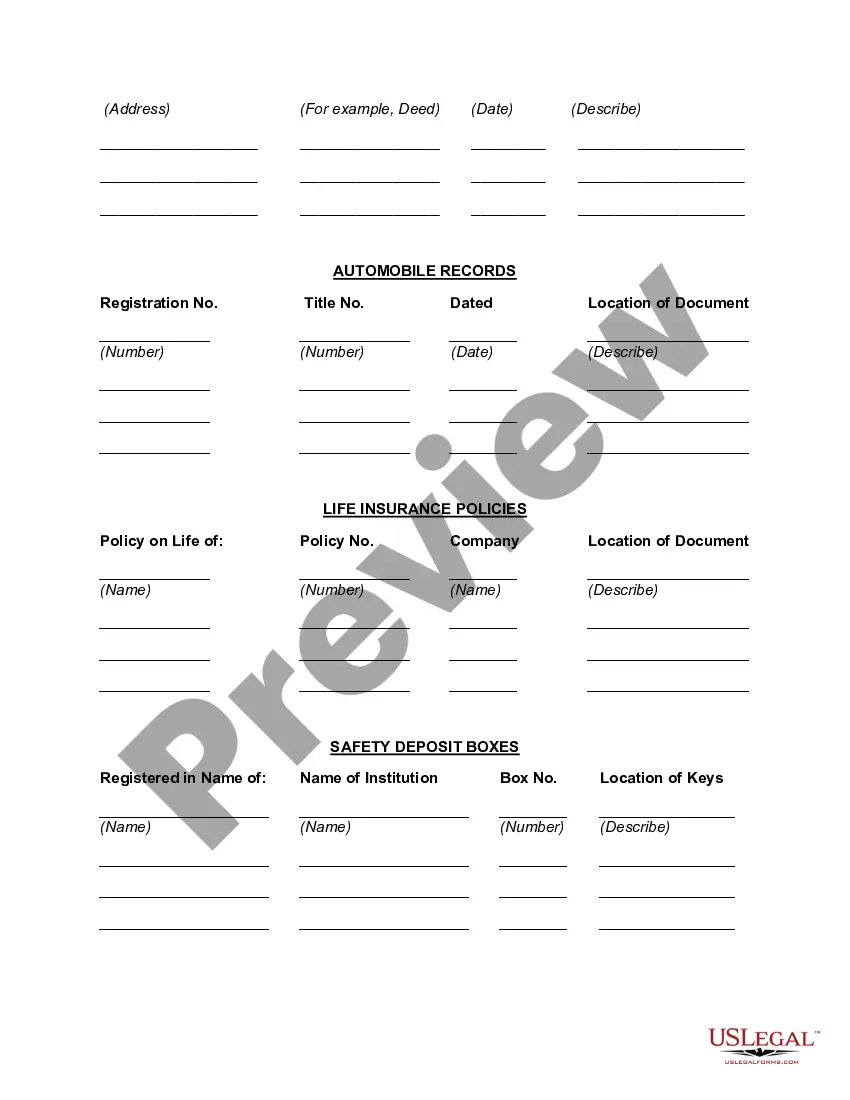

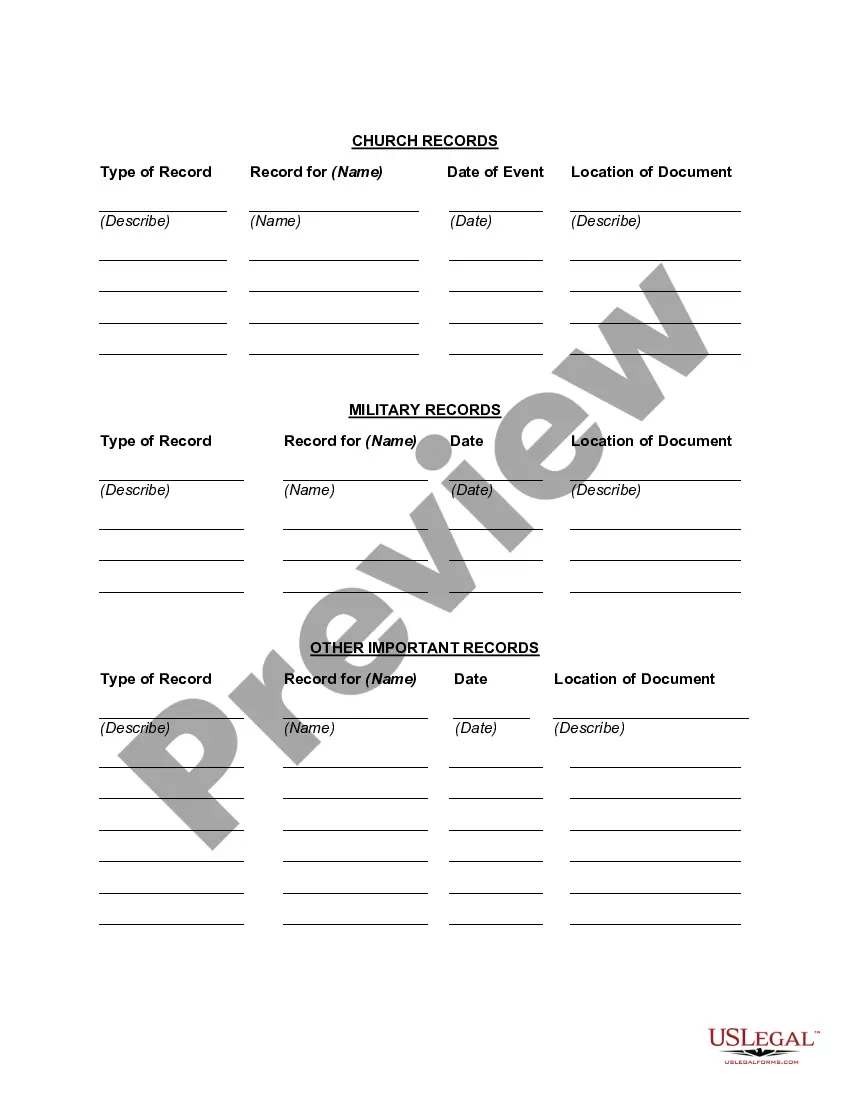

Hawaii Worksheet for Location of Important Documents

Description

How to fill out Worksheet For Location Of Important Documents?

If you wish to be thorough, acquire, or create official document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Benefit from the site's straightforward and user-friendly search to locate the documents you require.

A selection of templates for business and personal purposes is organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you acquired in your account.

Visit the My documents section and select a form to print or download again. Complete and retrieve, and print the Hawaii Worksheet for Location of Important Documents with US Legal Forms. Numerous professional and state-specific forms are available for your business or personal needs.

- Utilize US Legal Forms to find the Hawaii Worksheet for Location of Important Documents with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Hawaii Worksheet for Location of Important Documents.

- You can also access forms you previously purchased in the My documents section of your account.

- For first-time users of US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the appropriate region/state.

- Step 2. Use the Preview option to review the form's content. Be sure to read through the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Select the pricing plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Hawaii Worksheet for Location of Important Documents.

Form popularity

FAQ

The form N-139 in Hawaii is used to report additional income, specifically for agricultural and forestry operations. It helps taxpayers account for income that may not be reported elsewhere on the tax return. Using the Hawaii Worksheet for Location of Important Documents can streamline this process by organizing your income details effectively. This organization minimizes errors and helps maintain compliance with Hawaii tax laws.

File your general excise and use tax returns with: Hawaii Department of Taxation P.O. Box 1425 Honolulu, HI 96806-1425. The general excise tax is a tax imposed on the gross income you receive from any business activ- ity you have in Hawaii.

Complete Form BB-1, State of Hawaii Basic Business Application, and select GE One-Time Event to register for a one-time event. Use Form G-45, Periodic General Excise/ Use Tax Return, to report and pay the tax due from your one-time event.

What is the difference between the G-45 and the G-49 Forms? The G-45 is the 'periodic' form which is filed either monthly, quarterly, or semiannually. The G-49 is the annual or so called "reconciliation" form which is filed annually.

Filing Frequency You must file monthly if you will pay more than $4,000 in GET per year. You may file quarterly if you will pay $4,000 or less in GET per year. You may file semiannually if you will pay $2,000 or less in GET per year.

Corporation - A request for an automatic 6-month extension of time to file a Hawaii Corporate Income Tax Return (Form N-30) must be submitted on Form N-301 Application for Automatic Extension of Time to File Hawaii Return for a Corporation, Partnership, Trust, or REMIC, by the original due date of the return.

How to Fill Out an HW-4 Form?Employee information - completed by the employee. Write down your full name, social security number, and address.Employer information - completed by the employer. Indicate the employer's name, address, and Hawaii tax identification number.

General Excise Tax The tax is imposed on the gross income received by the person en- gaging in the business activity. Activities subject to the tax include wholesaling, retailing, farming, services, construction contracting, rental of per- sonal or real property, business interest income, and royalties.

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

What is the difference between the G-45 and the G-49 Forms? The G-45 is the 'periodic' form which is filed either monthly, quarterly, or semiannually. The G-49 is the annual or so called "reconciliation" form which is filed annually.