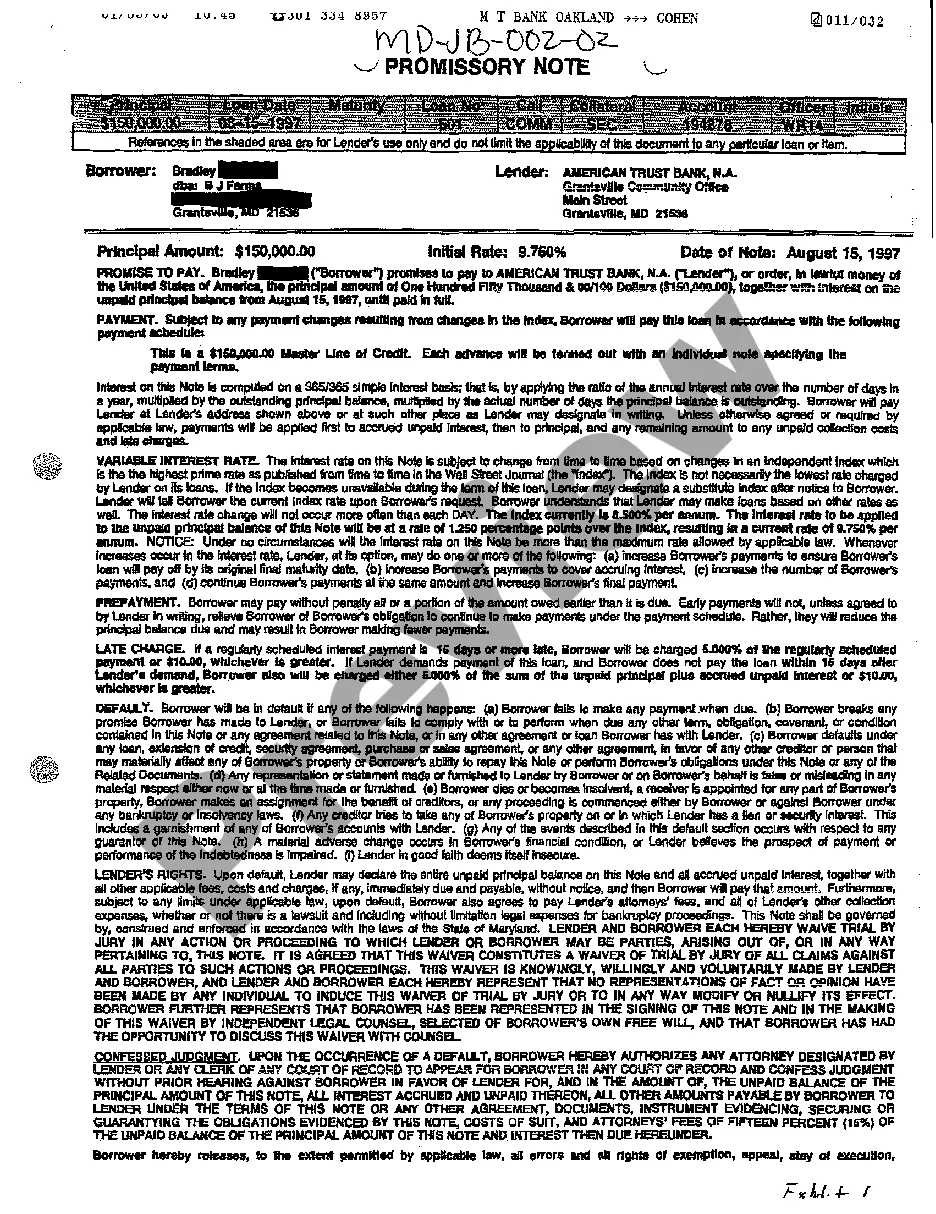

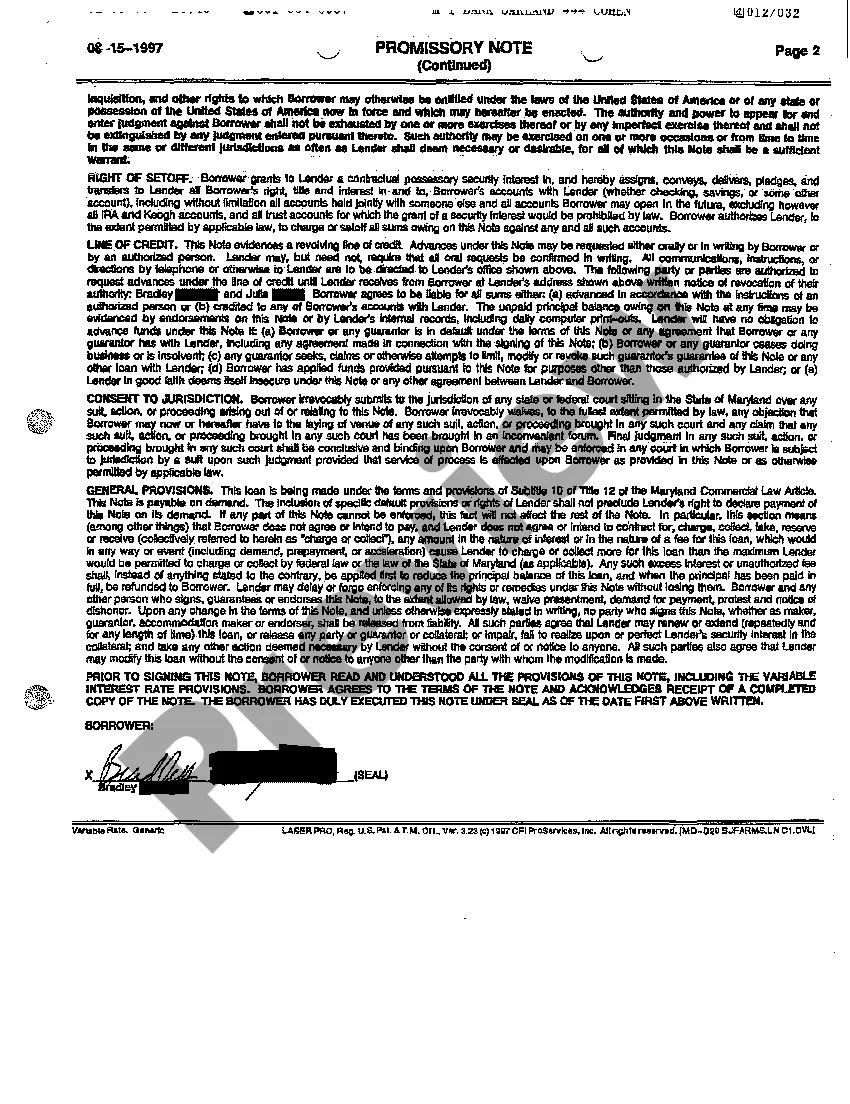

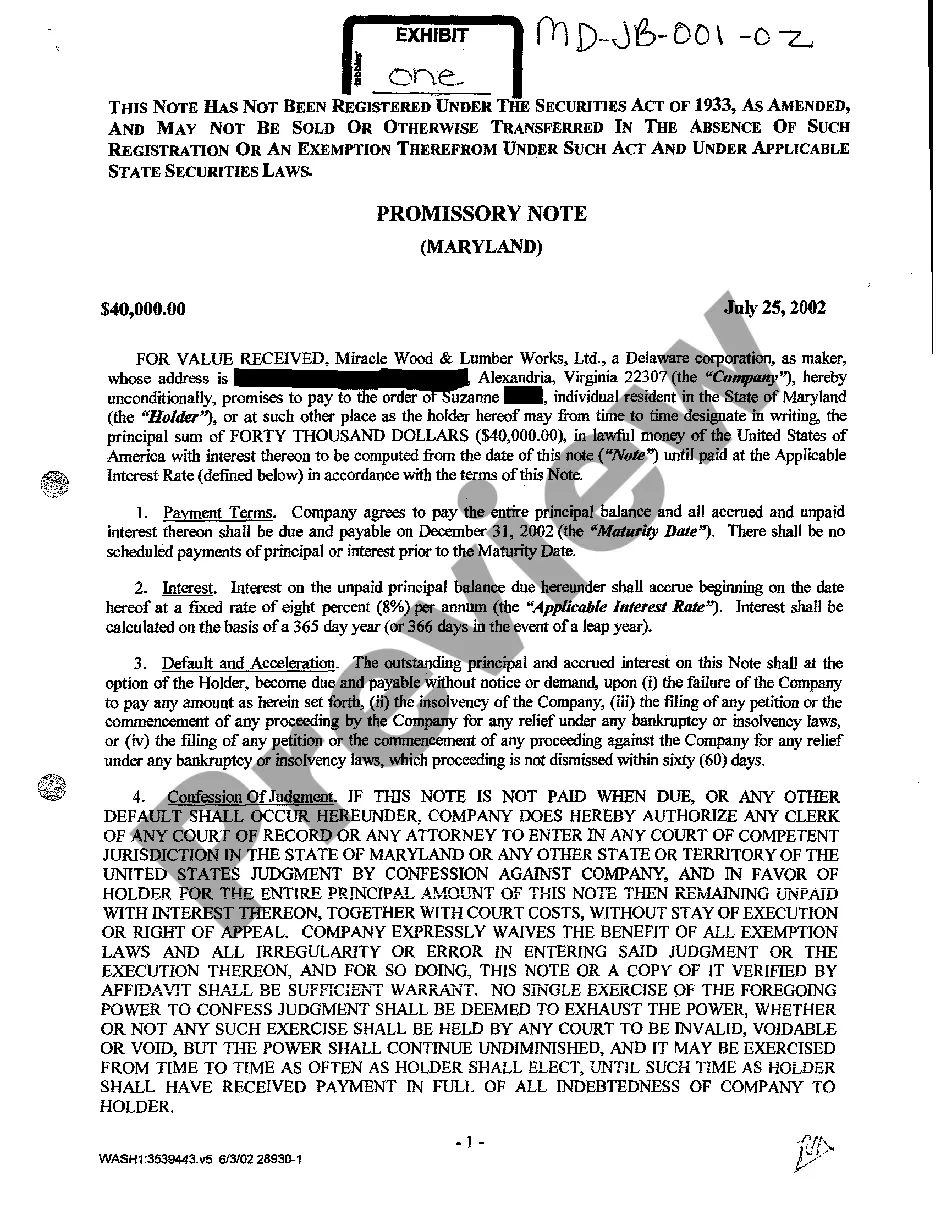

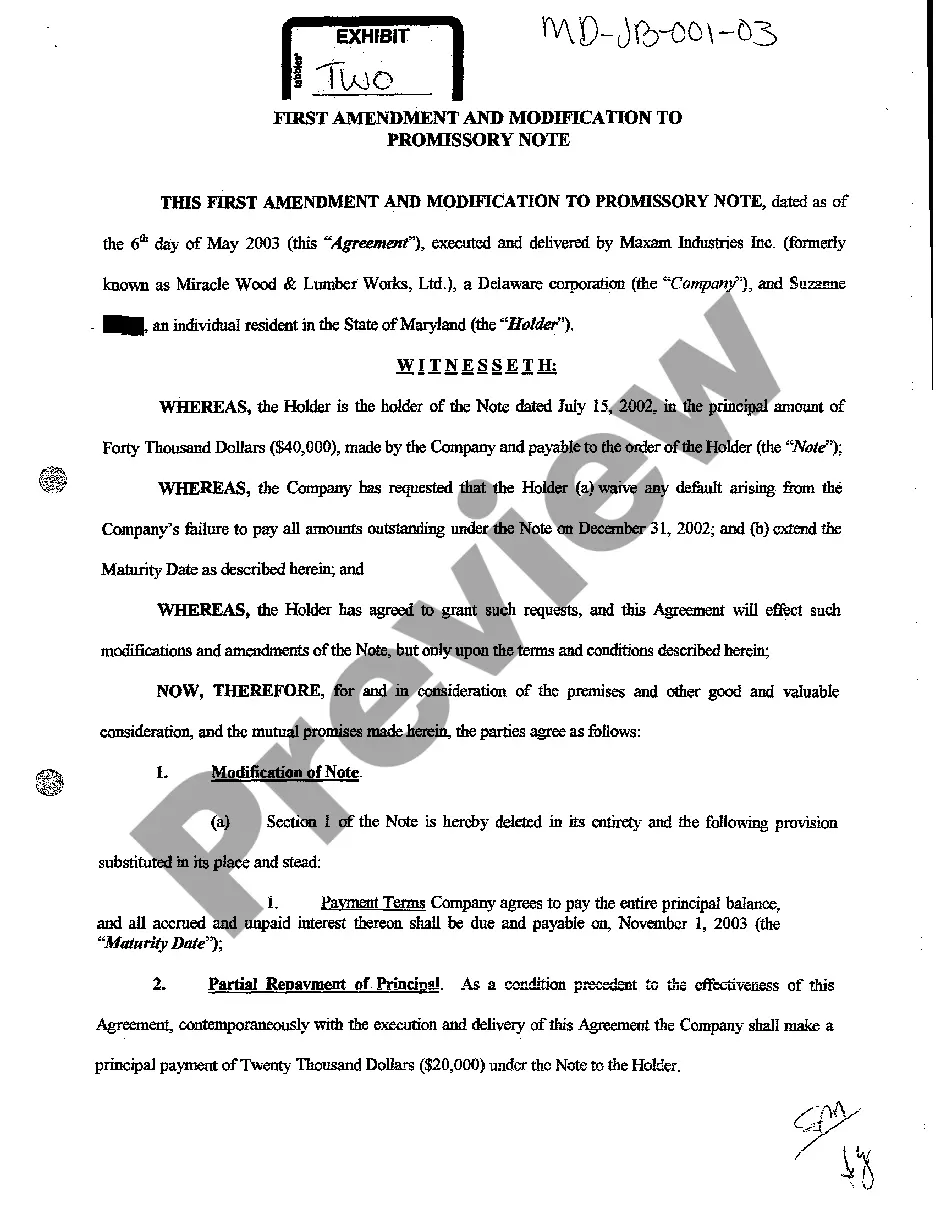

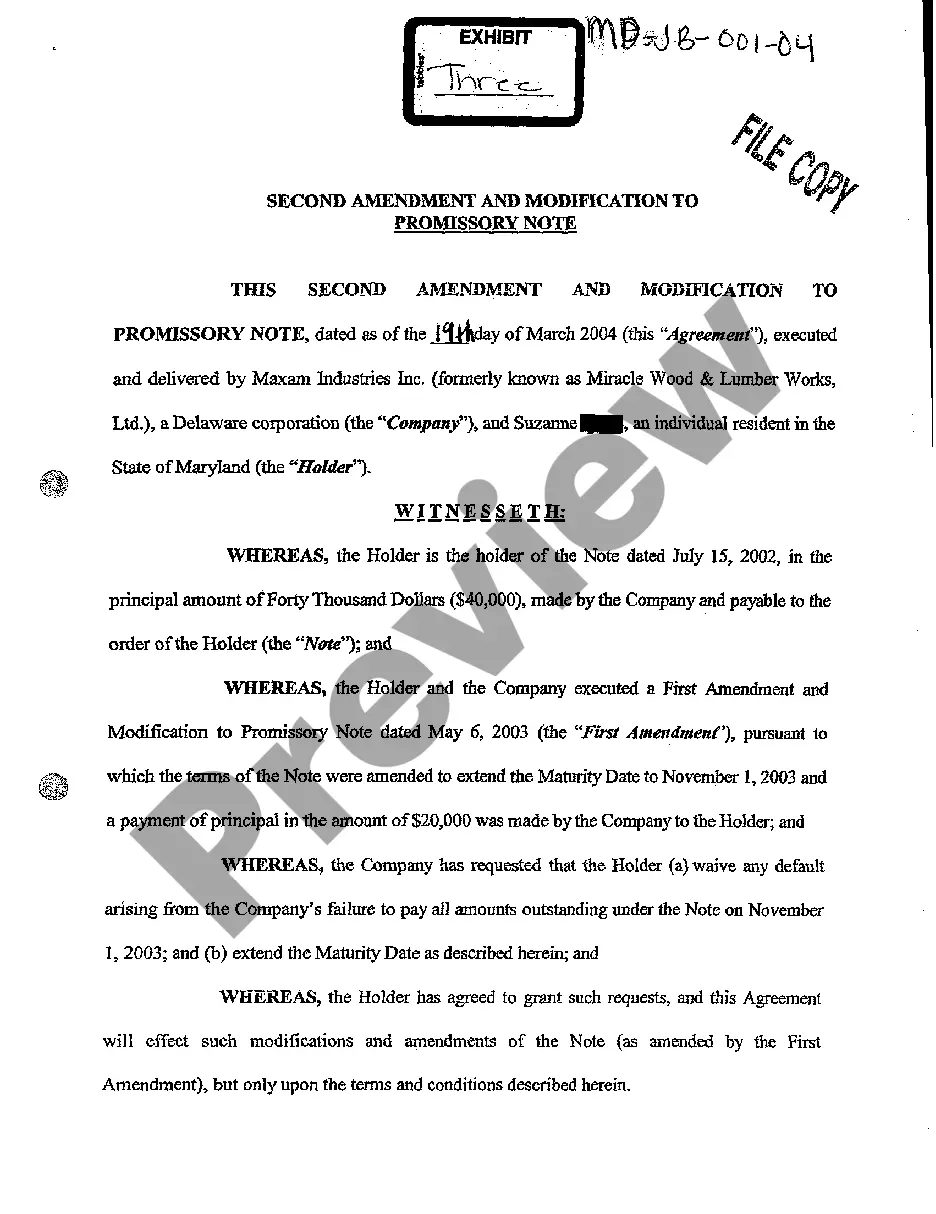

Maryland Exhibit 1 Promissory Note

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Exhibit 1 Promissory Note?

You are invited to the most extensive legal documents library, US Legal Forms.

Here, you can discover any template, including Maryland Exhibit 1 Promissory Note forms, and download them (as many as you wish/require).

Prepare official documentation in mere hours instead of days or weeks, without the need to spend excessively on an attorney.

If the template meets your needs, simply click Buy Now. To create your account, choose a pricing plan. Use a credit card or PayPal to subscribe. Download the document in your desired format (Word or PDF). Print the document and fill it in with your or your business’s details. After completing the Maryland Exhibit 1 Promissory Note, send it to your lawyer for validation. It's an extra step, but a crucial one to ensure you’re completely protected. Join US Legal Forms now and gain access to thousands of reusable templates.

- Obtain your state-specific document in just a few clicks and feel confident knowing it was created by our state-certified lawyers.

- If you are already a registered user, simply Log In to your account and click Download next to the Maryland Exhibit 1 Promissory Note you need.

- Since US Legal Forms operates online, you will typically have access to your stored documents, regardless of the device you are using.

- View them in the My documents section.

- If you do not yet possess an account, what are you waiting for.

- Follow our instructions listed below to get started.

- If this is a state-specific template, verify its applicability in the state you reside in.

- Review the description (if available) to determine if it’s the correct template.

Form popularity

FAQ

The legal requirements for a Maryland Exhibit 1 Promissory Note include a clear statement of the debt, the repayment terms, and the signatures of both the lender and borrower. It must specify the interest rate, if any, and the due date for repayment. Additionally, both parties should retain a copy of the executed note for their records. Using US Legal Forms simplifies this process, helping you create a legally compliant promissory note effortlessly.

Collecting on a Maryland Exhibit 1 Promissory Note begins by sending a reminder to the borrower about their repayment obligations. If payments are not received, you may need to explore negotiation or legal action to recover the owed amount. Utilizing legal platforms like USLegalForms can offer resources and advice on how to proceed effectively.

If you lose your Maryland Exhibit 1 Promissory Note, it is essential to notify the lender immediately. The lender may request a replacement or alternative documentation to protect their interests. Also, you can seek legal advice to understand the best steps to recover or recreate the note securely.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid.The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.