Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit association may be subject to certain legal requirements, even though it hasn't filed for incorporation under its state's incorporation laws. For example, an unincorporated association will generally need to file tax returns, whether as a taxable or tax-exempt entity. Additionally, there may be state registration requirements.

Hawaii Articles of Association of Unincorporated Church Association

Description

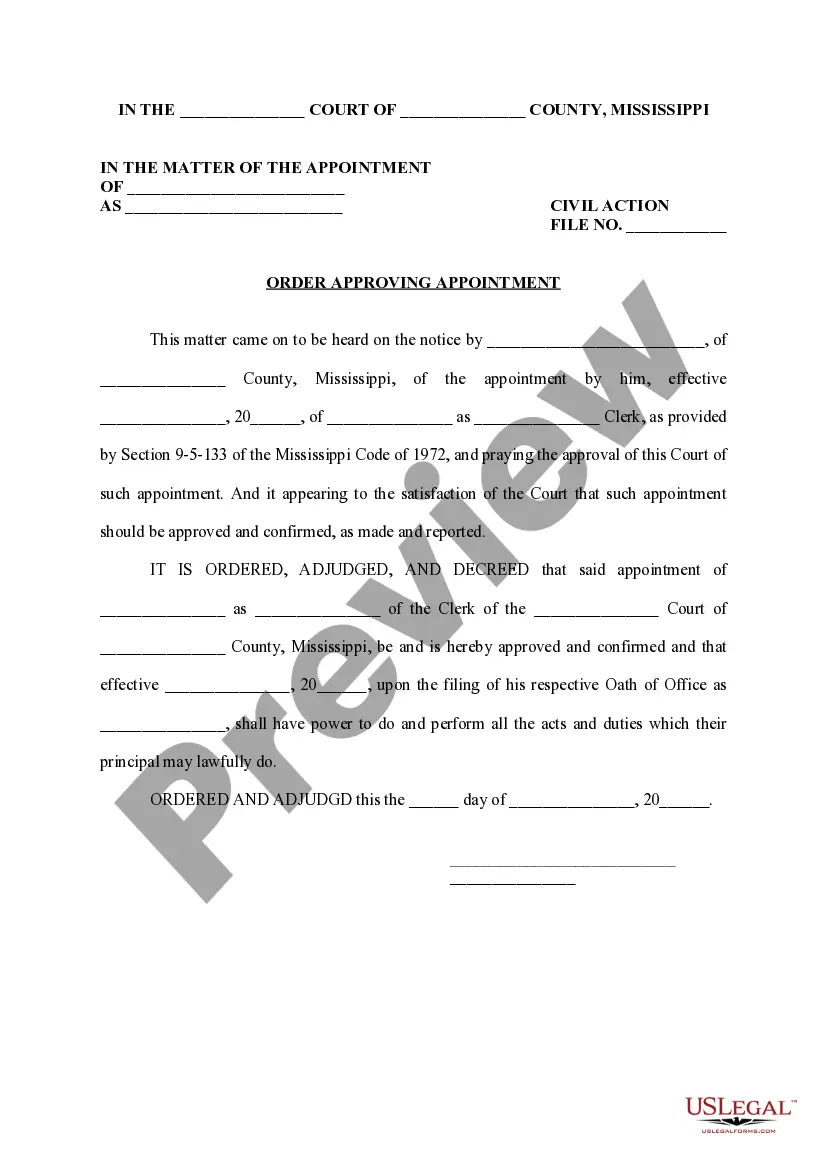

How to fill out Articles Of Association Of Unincorporated Church Association?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a variety of legal file templates that you can download or print. By utilizing the site, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can access the latest versions of forms like the Hawaii Articles of Association of Unincorporated Church Association in moments. If you possess a subscription, Log In and download the Hawaii Articles of Association of Unincorporated Church Association from the US Legal Forms library.

The Download button appears on every form you view. You have access to all previously downloaded forms in the My documents tab of your account.

Choose the file format and download the form to your device.

Make edits. Fill out, modify, print, and sign the downloaded Hawaii Articles of Association of Unincorporated Church Association. Each template added to your account does not expire and is yours permanently. So, if you need to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Hawaii Articles of Association of Unincorporated Church Association with US Legal Forms, one of the most extensive repositories of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form’s content. Verify the form summary to confirm you have chosen the right one.

- If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button. Then, select the pricing plan you prefer and enter your information to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

Yes, a nonprofit can function as an unincorporated association, especially in contexts like the Hawaii Articles of Association of Unincorporated Church Association. This structure allows groups to operate without formal incorporation, although it exposes them to certain legal risks. Members of an unincorporated association can still pursue charitable goals without the added complexities of incorporation. Understanding the nature of your organization is crucial for compliance with legal requirements.

The minimum number of board members for a nonprofit varies by state, but for a Hawaii Articles of Association of Unincorporated Church Association, the requirement is at least three members. This ensures that the organization has enough individuals to make decisions and handle governance effectively. Having a minimum of three members also helps to prevent deadlock during decision-making processes. Thus, this basic structure is vital for operational success.

When forming a board for a nonprofit organization, particularly for a Hawaii Articles of Association of Unincorporated Church Association, a good range is between three to fifteen members. This size allows for diverse perspectives while maintaining effective communication. It is essential to ensure that the board is large enough to encompass various skills and experiences but small enough to foster unity. Ultimately, the size should reflect the goals and needs of your nonprofit.

An unincorporated association is a group of individuals who come together for a common purpose without forming a formal legal entity. This can include churches and community organizations. In Hawaii, unincorporated church associations must be mindful of their Articles of Association to ensure compliance with state laws while operating effectively.

Yes, unincorporated associations, including churches, may need to file a tax return depending on their annual gross income. If the revenue exceeds specific thresholds, the organization must comply with federal requirements. To manage this process smoothly, unincorporated church associations in Hawaii should consult their Articles of Association for guidance.

Several factors can jeopardize a 501c3 organization’s status, including excessive lobbying or political activity, failure to comply with financial reporting requirements, and engaging in unrelated business activities. Unincorporated church associations in Hawaii must be vigilant to maintain their tax-exempt status. Following the guidelines laid out in the Articles of Association can help mitigate these risks.

The 80 20 rule, or Pareto Principle, suggests that 80% of a nonprofit’s outcomes come from 20% of its efforts or sources. This principle is essential for organizations to understand what drives their success. By recognizing key contributors, unincorporated church associations in Hawaii can shape their Articles of Association to focus efforts on these vital areas.

The 33 1 3 support test measures a nonprofit's funding mix, ensuring it does not rely too heavily on any single source of income. This test requires a nonprofit to receive at least one-third of its financial support from public contributions or grants. For Hawaii-based unincorporated church associations, passing this test demonstrates financial stability and aligns with establishing effective Articles of Association.

In Hawaii, a nonprofit must have a minimum of three board members to properly govern the organization. These members should be individuals who actively contribute to the association's objectives. For unincorporated church associations, establishing a solid board is crucial for developing effective Hawaii Articles of Association.

The 27 month rule for 501c3 organizations is a stipulation that allows a nonprofit to maintain its tax-exempt status even if it takes time to become operational. Essentially, it grants an organization a 27-month window to meet the necessary requirements. It’s valuable for unincorporated church associations in Hawaii, as it gives them some leeway in establishing their Articles of Association.