A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

Hawaii Articles of Incorporation for Church Corporation

Description

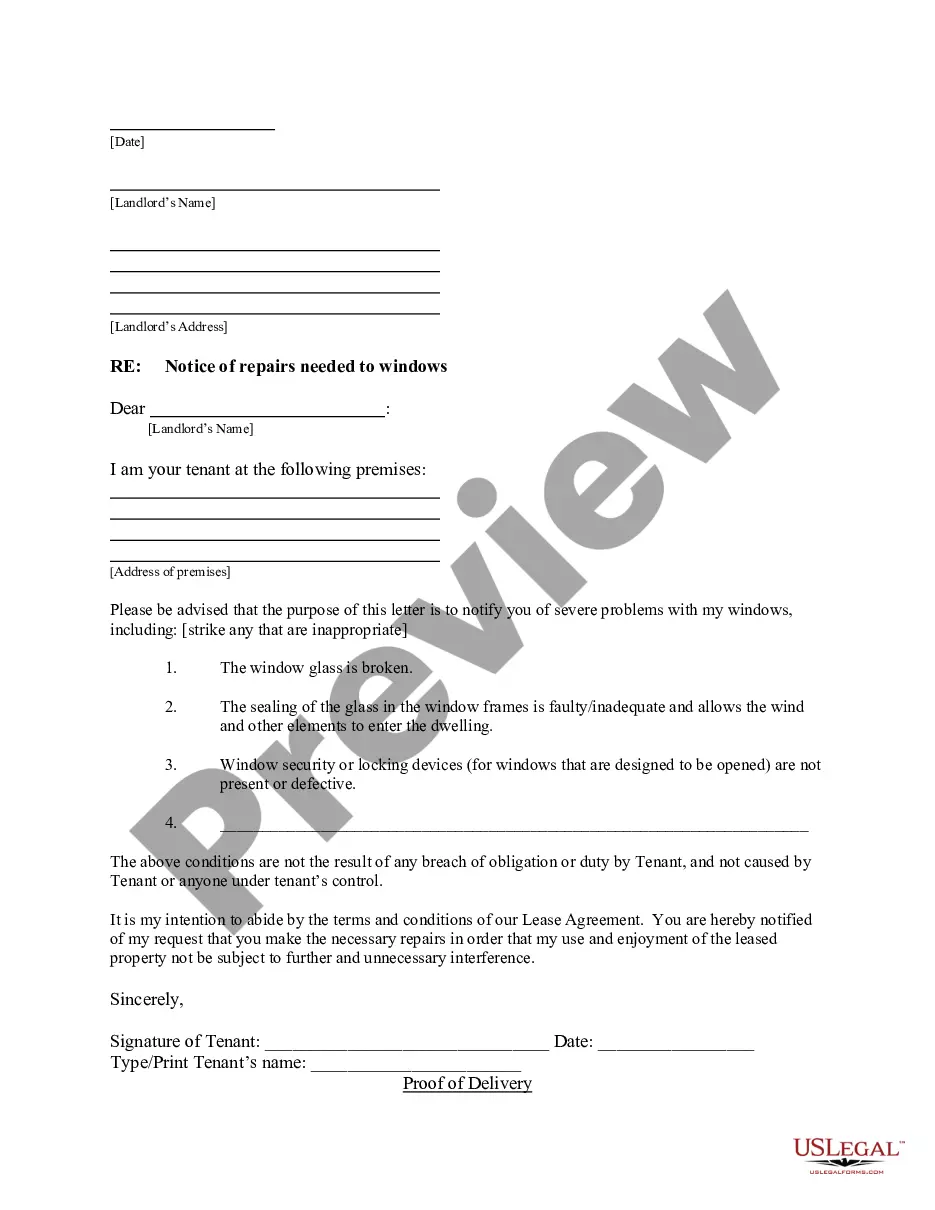

How to fill out Articles Of Incorporation For Church Corporation?

Have you ever found yourself in a situation where you require documents for either business or personal reasons almost continuously? There are numerous authentic document templates available online, but locating ones you can trust is not easy.

US Legal Forms provides thousands of form templates, such as the Hawaii Articles of Incorporation for Church Corporation, that are designed to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Hawaii Articles of Incorporation for Church Corporation template.

- Obtain the form you need and ensure it is for the correct city/county.

- Utilize the Review button to examine the form.

- Check the information to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that suits your needs and requirements.

- Once you find the appropriate form, click on Acquire now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Select a convenient document format and retrieve your version.

Form popularity

FAQ

Articles of Incorporation are legal documents that officially establish a corporation. These documents outline essential details such as the organization's name, purpose, registered agent, and structure. For those forming a church corporation, filing the right Hawaii Articles of Incorporation for Church Corporation can define your organization's legal foundation, ensuring compliance with state laws and enabling you to operate effectively.

The distinction between a non-profit corporation and a 501(c)(3) is primarily legal and tax-related. A non-profit corporation is a legal entity organized for a public or mutual benefit, whereas a 501(c)(3) is a tax classification granted by the IRS that provides tax exemptions to qualifying non-profits. Creating Hawaii Articles of Incorporation for Church Corporation is the first step toward achieving both the non-profit status and the potential for 501(c)(3) designation.

No, Articles of Incorporation and 501(c)(3) status are distinct concepts. The Articles of Incorporation are the foundational documents that establish your organization legally, while 501(c)(3) refers to a specific tax-exempt status granted by the IRS. For church corporations, preparing accurate Hawaii Articles of Incorporation for Church Corporation is a key first step before pursuing 501(c)(3) status, as it helps ensure compliance with regulations.

To create Articles of Incorporation for a non-profit organization, you must first gather essential information about your organization, including its name, purpose, and governance structure. Next, you will need to complete the necessary forms that comply with state regulations. Utilizing a service like US Legal Forms can simplify this process, as they provide templates specifically tailored for Hawaii Articles of Incorporation for Church Corporation, ensuring you meet legal requirements.

An LLC, or Limited Liability Company, does not have Articles of Incorporation; instead, it files Articles of Organization. These documents serve a similar purpose by establishing the LLC as a legal entity. If you are in Hawaii and forming a church corporation, remember to file the Hawaii Articles of Incorporation for Church Corporation, as this will help you meet your legal obligations.

To find Florida Articles of Incorporation, you can visit the Florida Division of Corporations website or contact their office directly. They provide access to various forms and resources needed to establish a corporation in Florida. If you need specific forms for a church corporation, it is best to look at state-specific resources or consider using US Legal Forms, which offers templates tailored to church corporation needs.

You can get your Articles of Incorporation by filing the appropriate documents with the state. If you are forming a church corporation in Hawaii, ensure you complete the Hawaii Articles of Incorporation for Church Corporation form correctly. Using services like US Legal Forms can help streamline the process and ensure that you meet all necessary legal requirements.

To obtain Articles of Incorporation, you need to file the necessary documents with the state where your business will operate. In Hawaii, this involves completing the specific form for church corporations and submitting it to the Department of Commerce and Consumer Affairs. Utilizing a platform like US Legal Forms can simplify this process, providing you with the correct templates and guidance for Hawaii Articles of Incorporation for Church Corporation.

No, Articles of Incorporation and Employer Identification Numbers (EIN) serve different purposes. Articles of Incorporation establish your business as a legal entity, while an EIN is a tax identification number issued by the IRS. If you are forming a church corporation in Hawaii, you will need both the Articles of Incorporation for Church Corporation and an EIN for tax reporting and compliance.

Incorporating a church as a nonprofit corporation is often recommended over forming an LLC. This structure provides liability protection for the church's members and leaders, helping to safeguard their personal assets. Moreover, incorporation allows churches to apply for tax-exempt status under the 501c3 designation, which comes with various benefits. For assistance with the process, consider using uslegalforms to streamline your Hawaii Articles of Incorporation for Church Corporation.