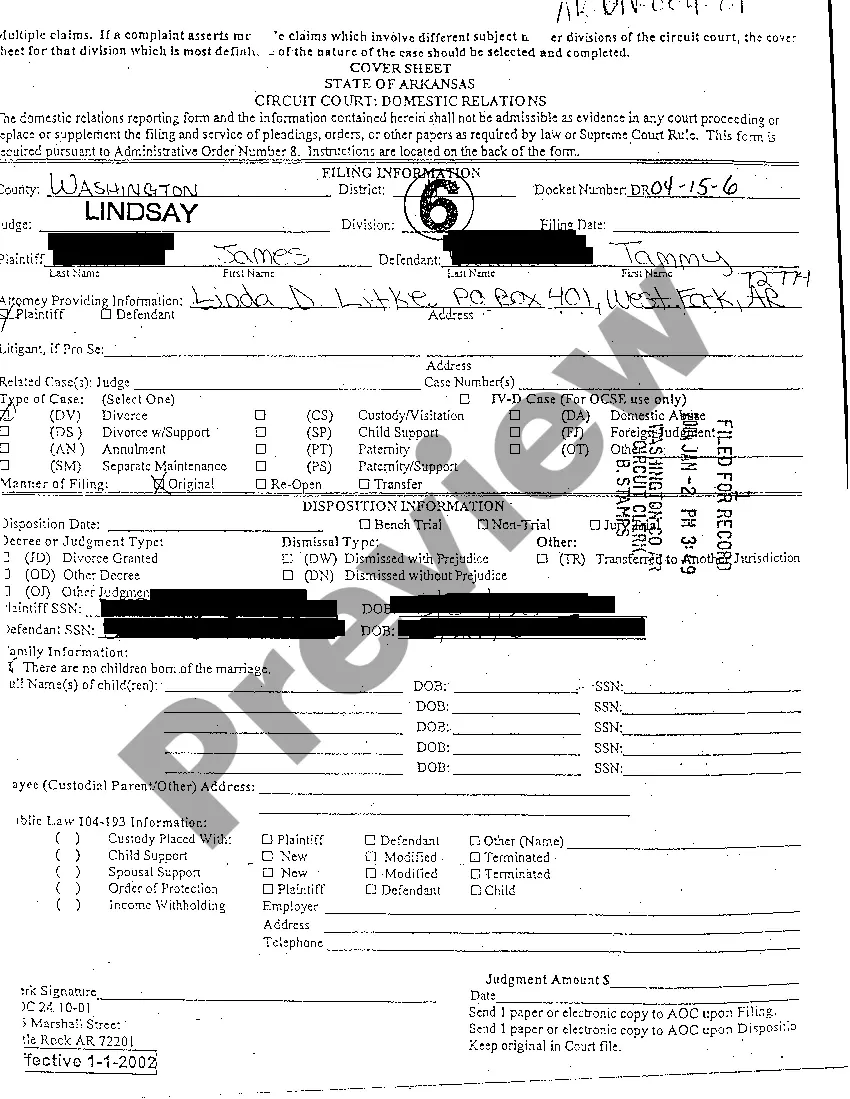

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

US Legal Forms - one of the largest collections of valid documents in the United States - offers a range of valid form templates that you can obtain or print. By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or search terms.

You can access the latest versions of forms like the Hawaii Notice of Non-Responsibility of Spouse for Debts or Liabilities in just minutes.

If you already have a monthly subscription, Log In and obtain the Hawaii Notice of Non-Responsibility of Spouse for Debts or Liabilities from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms within the My documents section of your account.

Every template you add to your account does not have an expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Hawaii Notice of Non-Responsibility of Spouse for Debts or Liabilities with US Legal Forms, the most extensive collection of valid document templates. Utilize a vast number of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have chosen the correct form for your city/county. Select the Preview button to check the form's details. Review the form description to confirm that you have chosen the correct one.

- If the form does not meet your requirements, utilize the Search area at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

- Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

- Edit. Fill out, modify, print, and sign the downloaded Hawaii Notice of Non-Responsibility of Spouse for Debts or Liabilities.

Form popularity

FAQ

To modify child custody in Hawaii, you must demonstrate a significant change in circumstances that affects the child's well-being. The court will also consider the child's best interests during this process. Utilizing the Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities can help establish a clear financial standing while you navigate custody modifications. For guidance, US Legal Forms provides resources to streamline your approach.

In general, a husband may not be responsible for his wife's debts if a Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities has been filed. This notice effectively limits a spouse's financial obligation to the debts incurred by the other spouse. However, exceptions may exist, especially if both spouses are joint account holders or if the debt is related to shared assets. It is essential to understand your rights and responsibilities to avoid complications.

Legally, you are not generally responsible for debts your spouse incurred before your marriage. However, if debts were accumulated during the marriage and they are in both names, joint responsibility may apply. To ensure clarity in your financial relationship, consider documents like a Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities. Evaluating your situation can help you manage any potential liabilities.

In Hawaii, you typically are not responsible for collection actions related to your spouse's debts if they were accrued prior to your marriage. Nevertheless, if you co-signed loans or become a joint account holder, creditors may pursue you for those debts. To clarify your legal stance, filing a Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities can be beneficial. Being proactive about your financial obligations protects your credit.

Hawaii follows the principle of community property, meaning that most debts and assets acquired during marriage are considered joint property. This law indicates that both spouses share financial responsibility for liabilities incurred during their marriage. Therefore, understanding these laws is vital for managing finances together. A Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities may be an essential tool to delineate individual responsibilities.

In most cases, you are not legally responsible for your wife's debts if they were incurred before the marriage. However, debts acquired during the marriage may involve shared liability, especially if both names are on the account. To protect yourself from unexpected liabilities, a Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities can serve as a safeguard. It’s important to stay informed about your financial rights as a couple.

In Hawaii, marriage does not automatically make you responsible for your spouse's debts. Generally, creditors cannot pursue you for debts incurred by your spouse before the marriage. However, it's crucial to understand your financial obligations, especially concerning liabilities that might arise during the marriage. To clarify your position, consider filing a Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities.

Generally, you are not responsible for your wife's debt if you have established a Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities. This notice provides legal clarity and helps protect your personal finances. However, if you jointly owe debts, the situation may differ. Seeking legal guidance can ensure you understand your responsibilities fully and explore options for safeguarding your assets.

You can protect yourself from your wife's debt by filing a Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities. This document informs creditors that you do not share responsibility for her debts. Additionally, keeping your financial accounts separate and avoiding co-signing loans can further shield you. Understanding your rights and obligations is crucial, so consider reaching out to legal professionals for tailored advice.

Creditors typically cannot pursue your personal assets for your wife's debts if you have filed a Hawaii Notice of Non-Responsibility of Wife for Debts or Liabilities. This legal notice clearly states that you are not liable for debts incurred solely by your wife. However, exceptions may exist, especially if you co-signed on loans or joint accounts. Consulting with a legal expert can help clarify your specific situation.