Hawaii Assignment of Accounts Receivable

Description

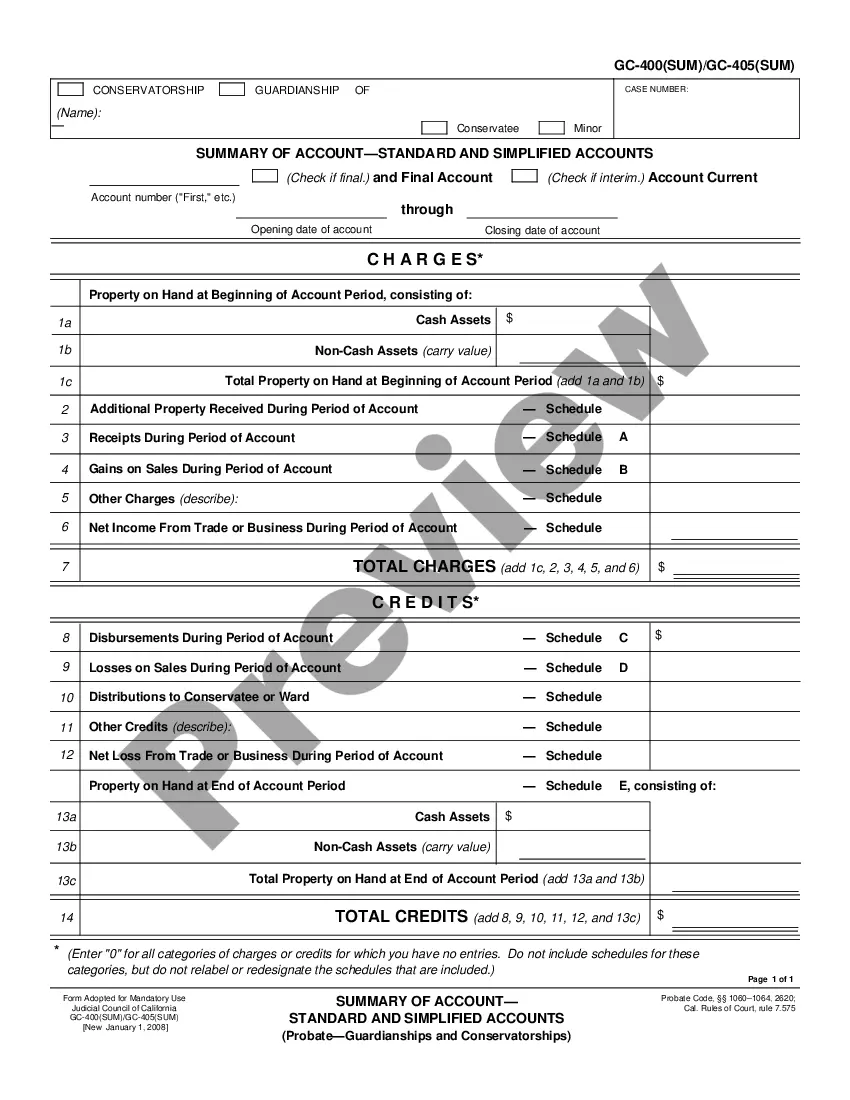

How to fill out Assignment Of Accounts Receivable?

US Legal Forms - among the largest repositories of legal templates in the United States - offers a vast selection of legal document samples that you can download or print.

By utilizing the platform, you can access thousands of forms for both business and personal purposes, categorized by types, states, or keywords. You can obtain the most recent versions of forms, such as the Hawaii Assignment of Accounts Receivable, within moments.

If you already have an account, Log In and download the Hawaii Assignment of Accounts Receivable from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously saved forms under the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the payment.

Select the format and download the form to your device. Edit. Complete, modify, print, and sign the saved Hawaii Assignment of Accounts Receivable. Each form you added to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Hawaii Assignment of Accounts Receivable with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you want to use US Legal Forms for the first time, here are some simple steps to get you started.

- Make sure you have selected the appropriate form for your locality. Click the Preview button to review the form's content.

- Check the form details to ensure you have chosen the correct form.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Two examples of accounts receivable include customer invoices for services rendered and unpaid sales for goods sold. For instance, if a business provides services to a client and extends payment terms, the outstanding invoice represents an account receivable. Another example is a company selling products to retailers on credit, creating receivables that they will collect at a later date. Managing these effectively is where understanding the Hawaii Assignment of Accounts Receivable becomes crucial.

A notice of assignment of receivables serves as an official communication to inform debtors that their account has been assigned. This notice outlines the new party responsible for collecting the payments, thus preventing confusion. Utilizing US Legal's templates can help you create an effective notice tailored for your needs.

A notice of assignment signifies to the debtor that another party now holds the rights to collect payment on their account. This document is crucial for ensuring that all parties are aware of their obligations and rights after the assignment occurs. It is an important step to maintain transparency during the transaction of the Hawaii Assignment of Accounts Receivable.

A notice of assignment of accounts is a formal notification sent to debtors, informing them that their payment obligations have been transferred to another entity. This notice helps ensure that debtors direct their payments to the correct party going forward. Including a clear notice can streamline communication and reduce payment disputes in the context of Hawaii Assignment of Accounts Receivable.

To assign accounts receivable in Hawaii, you first identify which receivables you wish to transfer. Next, you will need to draft a formal assignment agreement detailing the terms and notify the debtors involved. Using the US Legal platform can simplify this process, offering templates and guidance tailored to facilitate efficient assignments.

Yes, you can file your Hawaii state tax online using the Hawaii Tax Online Services platform. This user-friendly platform streamlines the filing process and provides helpful resources to guide you. For businesses engaged in Hawaii Assignment of Accounts Receivable, staying on top of tax obligations is crucial for overall financial health. Online filing saves time and enhances accuracy, making it an efficient choice.

To file a G49 form in Hawaii, you must submit it to the Department of Taxation. You can file the form online through the Hawaii Tax Online Services, which allows for a streamlined process. Familiarizing yourself with the Hawaii Assignment of Accounts Receivable can help you understand how to optimize your financial reporting. Ensuring accurate filing can prevent potential issues down the road.

The right to assign receivables is a contractual ability that allows a business to transfer its rights to collect on outstanding invoices to another party. This right is typically outlined in the business's contracts and agreements. Having this right ensures flexibility in managing financial resources and enhancing operational efficiency. Our Hawaii Assignment of Accounts Receivable services can guide you through this process.