Hawaii Sample Letter for Return of Check Missing Signature

Description

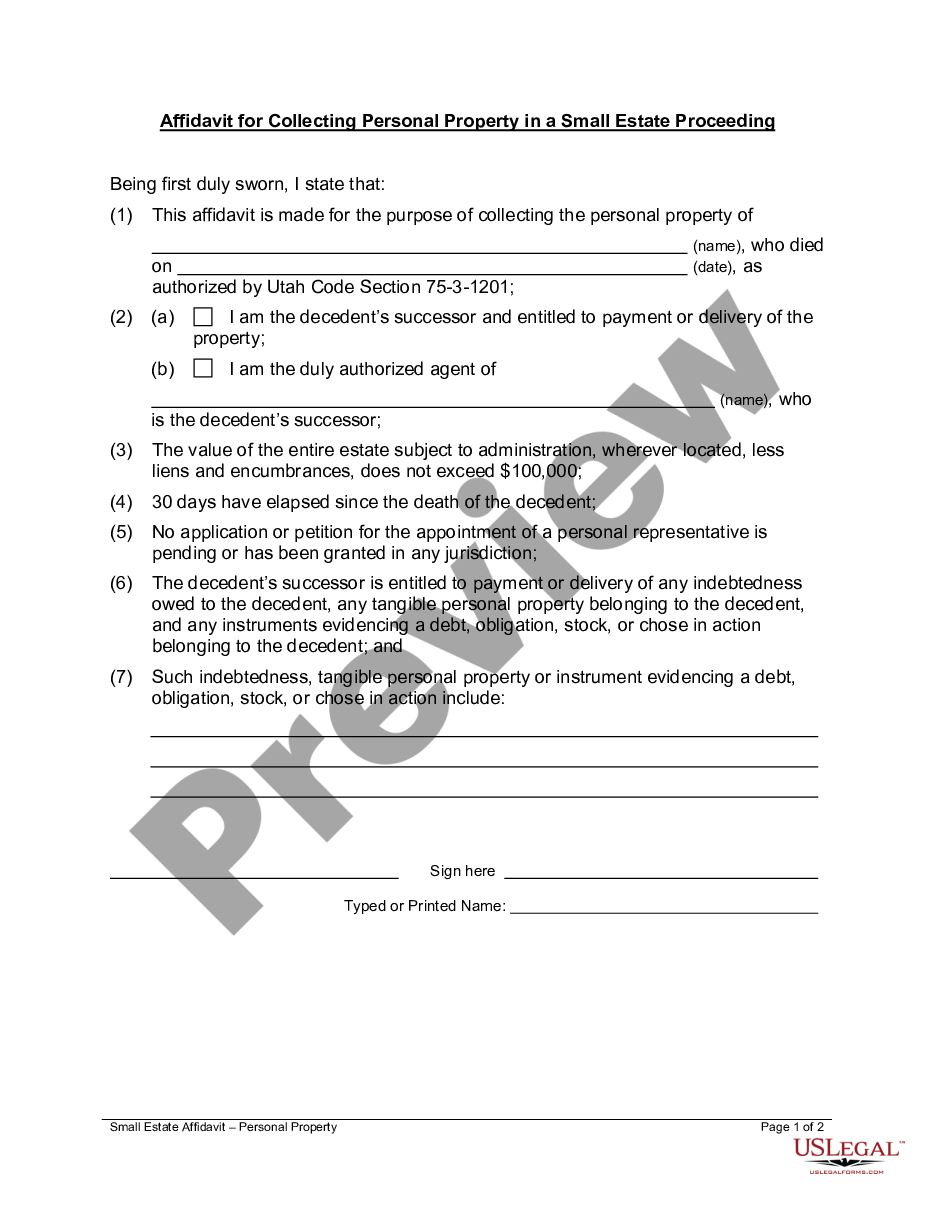

How to fill out Sample Letter For Return Of Check Missing Signature?

Finding the correct legal document template can be challenging. Naturally, there are numerous templates online, but how do you locate the legal form you require? Access the US Legal Forms website.

The service offers thousands of templates, including the Hawaii Sample Letter for Return of Check Missing Signature, which you can utilize for business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download option to find the Hawaii Sample Letter for Return of Check Missing Signature. Use your account to check the legal forms you have previously purchased. Visit the My documents tab in your account to download another copy of the documents you need.

Choose the file format and download the legal document template to your device. Complete, amend, print, and sign the acquired Hawaii Sample Letter for Return of Check Missing Signature. US Legal Forms is the premier repository of legal documents where you can discover a variety of document templates. Utilize the service to acquire expertly crafted documents that adhere to state requirements.

- First, ensure that you have chosen the correct form for your region/location.

- You can preview the form using the Preview option and review the form description to confirm this is the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are sure that the form is suitable, click the Get now option to obtain the form.

- Select the payment plan you prefer and input the required information.

- Create your account and complete the payment for the order using your PayPal account or credit card.

Form popularity

FAQ

Failing to sign your tax return can lead to rejection of the filing by the tax authority, which means your return will not be processed. This can result in an automatic penalty for late filing and potentially increase the amount due. Addressing this issue quickly with a Hawaii Sample Letter for Return of Check Missing Signature could help clarify any mistakes and expedite correction. Always ensure that your documents are complete to avoid complications.

Paying Hawaii state taxes late can result in both penalties and interest charges on the amount owed. The penalty typically starts at 5% for the first month and increases thereafter. To mitigate these penalties, consider filing an appeal or using resources like a Hawaii Sample Letter for Return of Check Missing Signature to discuss your situation with the state. Keeping open lines of communication can help minimize the repercussions of late payments.

Filing taxes without your signature is generally invalid, which may cause issues with your tax return. You should contact the tax preparer to resolve the situation and secure the correct documents. Utilizing a Hawaii Sample Letter for Return of Check Missing Signature can aid in documenting your concerns and expediting any necessary adjustments. Proper communication ensures your tax matters are handled correctly.

If you file your state taxes late, you may face penalties and interest on the unpaid amount. It's important to address late filings promptly to minimize these penalties. Using a Hawaii Sample Letter for Return of Check Missing Signature can help streamline communications with the tax authority regarding any payments made. This ensures that you stay on top of your tax obligations.

To mail Hawaii form N-15, you should send it to the appropriate Department of Taxation office. If you are filing a paper return, ensure you send it to the correct address listed in the form instructions to avoid delays. When sending important documents like the Hawaii Sample Letter for Return of Check Missing Signature, consider using a traceable mailing method for added security. This way, you can confirm receipt by the department and ensure your submission is handled efficiently.

Mailing Hawaii tax forms should always be directed to the address provided on the specific tax form you are submitting. Procedures and addresses can change, so be sure to refer to the Hawaii Department of Taxation's official website for up-to-date information. Properly routing your documents can save you from unnecessary delays or issues. If you face complications, a Hawaii Sample Letter for Return of Check Missing Signature can aid in resolving them efficiently.

You can mail your Hawaii state tax returns to the address specified on the state tax form. It's crucial to ensure your returns reach the appropriate department to avoid delays. Always consult the latest guidelines on the Hawaii Department of Taxation website. If any issues arise, having a Hawaii Sample Letter for Return of Check Missing Signature can be beneficial as it outlines your concerns clearly.

To obtain a Hawaii tax clearance certificate, you must submit an application to the Hawaii Department of Taxation. This certificate verifies that your tax obligations are fulfilled. It's essential for various transactions, including business permits or licenses. Understanding the process will help you draft a Hawaii Sample Letter for Return of Check Missing Signature if your certificate is delayed.

You should mail your Hawaii N-15 form to the Hawaii Department of Taxation at the designated address for tax forms. This information can vary, so it is advisable to confirm the mailing address on the official Hawaii tax website. Timely submission of your forms helps prevent any penalties or interest on unpaid taxes. Always keep in mind the importance of integrating your Hawaii Sample Letter for Return of Check Missing Signature when addressing issues with your forms.

The Hawaii tax form N-15 is used for non-residents who need to file their income taxes. This form allows you to report income earned while you were in Hawaii. Properly filling out this form is essential for non-residents to comply with tax laws. If you need assistance, consider using a Hawaii Sample Letter for Return of Check Missing Signature to clarify any specific issues you might encounter.