Hawaii Personal Monthly Budget Worksheet

Description

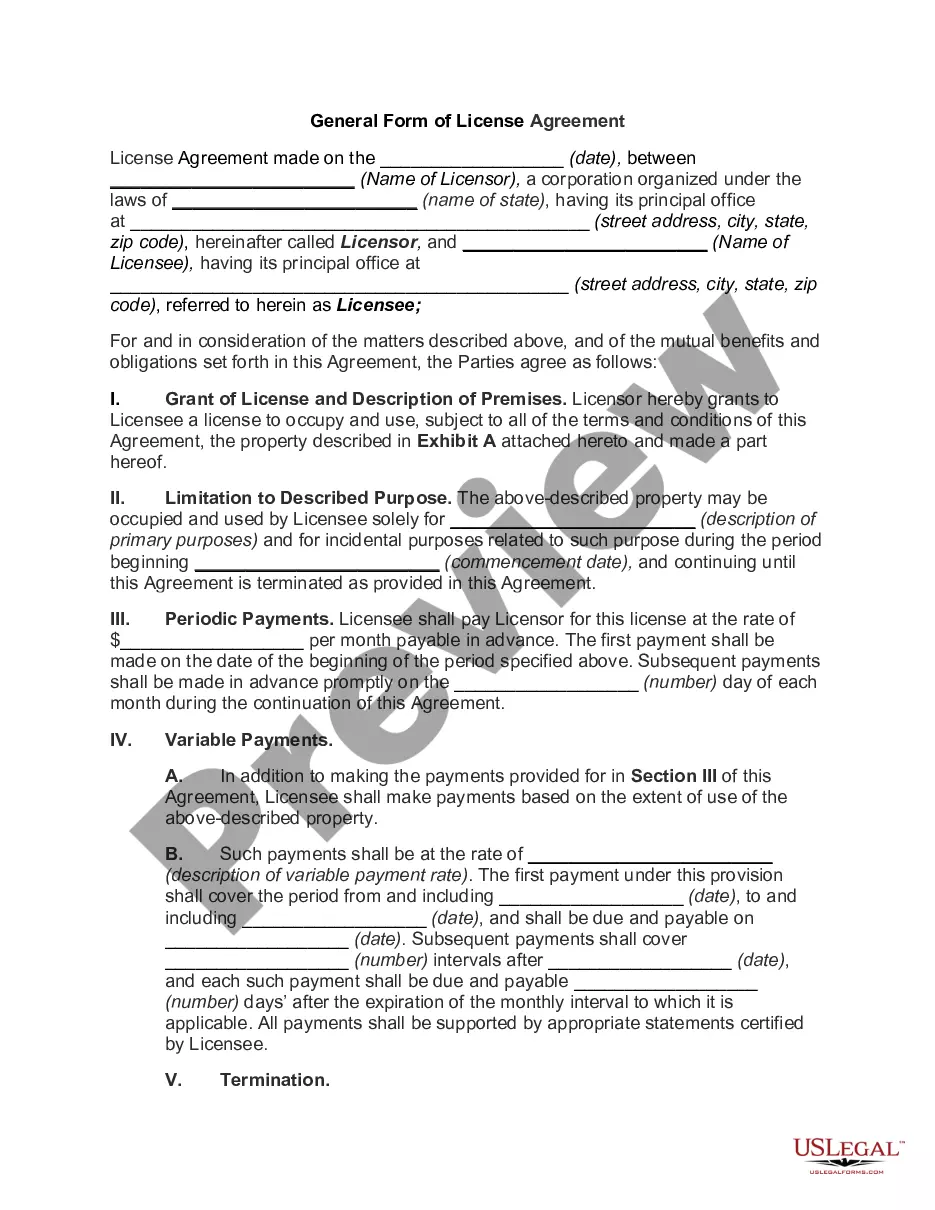

How to fill out Personal Monthly Budget Worksheet?

Are you presently in a location where you require documents for either business or personal purposes on a daily basis.

There are numerous legal document formats accessible online, but finding reliable versions is not easy.

US Legal Forms provides a vast array of form formats, including the Hawaii Personal Monthly Budget Worksheet, which are designed to comply with federal and state regulations.

Once you find the correct form, click on Purchase now.

Select the pricing plan you desire, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Hawaii Personal Monthly Budget Worksheet template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you require and ensure it is for the correct city/state.

- Utilize the Review feature to evaluate the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

The 75-15-10 rule is another budgeting guideline that suggests allocating 75% of your income to needs, 15% to savings, and 10% to discretionary spending. This model emphasizes a higher focus on essential expenses while still promoting savings and some flexibility in spending. Although the 75-15-10 rule may work for some, always assess what suits your financial situation best. Consider using a Hawaii Personal Monthly Budget Worksheet to evaluate which rule aligns with your budgetary goals.

A reasonable monthly budget depends on various factors, including your income, expenses, and financial goals. Generally, a good starting point is following the 50/30/20 rule, which enables a balanced distribution of income. Additionally, consider reviewing your fixed and variable expenses to create a realistic budget that fits your lifestyle. Utilizing a Hawaii Personal Monthly Budget Worksheet makes the budgeting process more manageable and tailored to your needs.

To calculate the 50/30/20 rule, first determine your total monthly income after taxes. Next, multiply that total by 0.50, 0.30, and 0.20 to find out how much to allocate to needs, wants, and savings, respectively. For instance, if your monthly income is $3,000, you would budget $1,500 for needs, $900 for wants, and $600 for savings. A Hawaii Personal Monthly Budget Worksheet can help you structure these calculations clearly.

The 50/30/20 rule is a simple budgeting framework designed to help you manage your finances effectively. It suggests that you allocate 50% of your income to needs, 30% to wants, and 20% to savings. By following this model, you can create a balanced financial plan that allows for both spending and saving. Using a Hawaii Personal Monthly Budget Worksheet can make it easier to apply this rule to your personal finances.

Filling out a monthly budget involves gathering your financial information and entering it into a structured format. Start with your income, then list fixed expenses like rent and variable expenses like dining out. The Hawaii Personal Monthly Budget Worksheet is an excellent tool for this, helping you organize your finances. By consistently monitoring your budget, you can make informed decisions about your spending.

The 50/30/20 rule is a budgeting method where you allocate 50% of your income to needs, 30% to wants, and 20% to savings. This rule helps simplify budgeting by providing a clear structure for managing expenses. Incorporating this strategy using the Hawaii Personal Monthly Budget Worksheet can lead to better financial health. Following the 50/30/20 rule encourages balance and ensures you are financially prepared for unexpected expenses.

The first five things to list in your budget typically include your total income, rent or mortgage, utilities, groceries, and transportation costs. By laying these out clearly, you establish a foundation for your financial planning. The Hawaii Personal Monthly Budget Worksheet can guide you through this process, ensuring you don’t overlook any important categories. By focusing on these initial expenses, you can maintain control over your financial situation.

Writing a personal monthly budget involves creating a clear plan for your finances. Begin by identifying your total income, then outline your essential expenses against it. Utilizing the Hawaii Personal Monthly Budget Worksheet helps you balance these figures effectively. This approach not only ensures you cover necessary costs but also helps you save for future goals.

A budget sheet should clearly outline your income, fixed expenses, variable expenses, savings, and any debt payments. It needs to be organized in a user-friendly manner, often using columns for categories and rows for amounts. The Hawaii Personal Monthly Budget Worksheet provides an effective layout to help you manage your finances and keep everything in one convenient place.

To calculate your monthly budget, first identify your total monthly income and all monthly expenses. Subtract your total expenses from your total income to determine your remaining funds for savings or discretionary spending. By using the Hawaii Personal Monthly Budget Worksheet, you easily visualize your income and expenditures, making calculations straightforward.