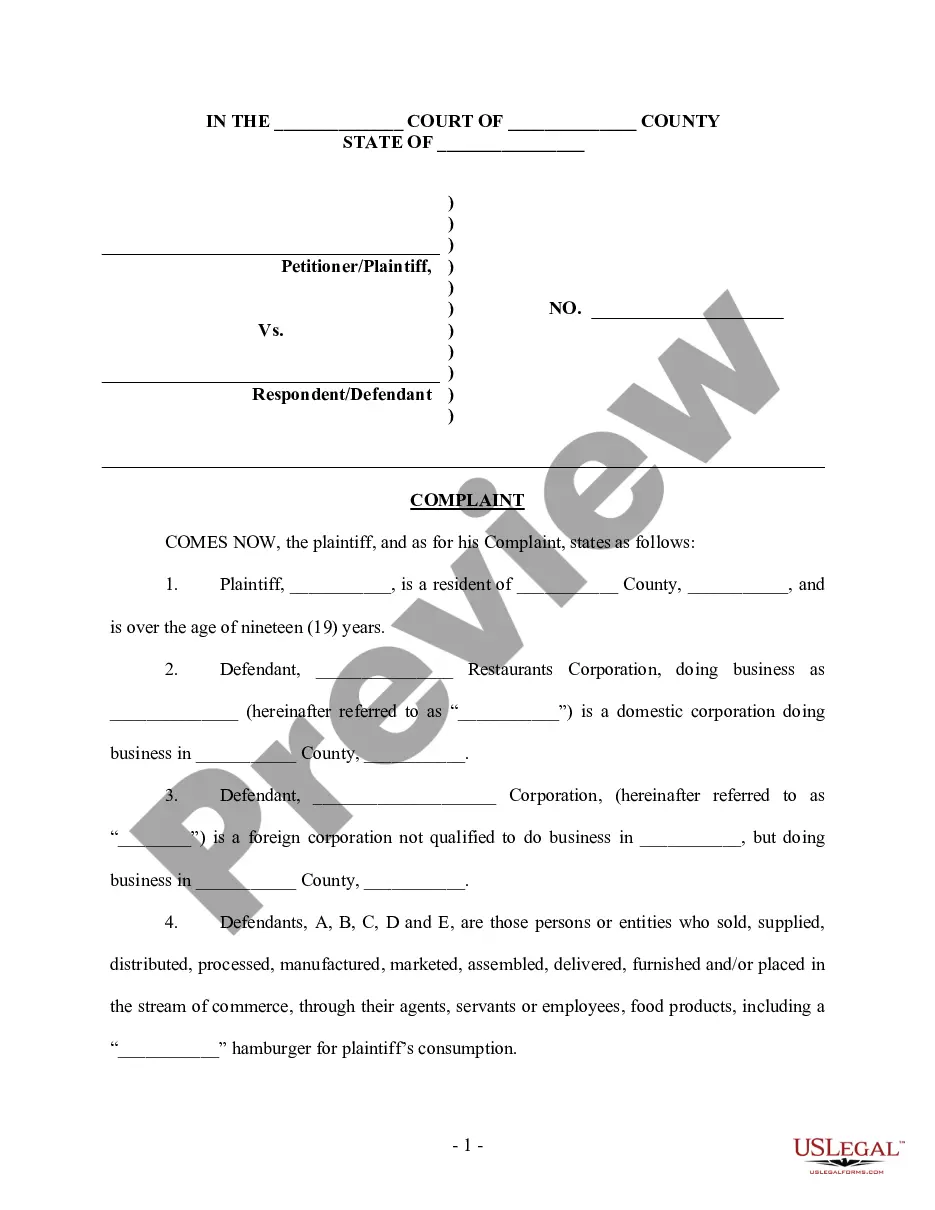

Hawaii Community Property Disclaimer

Description

How to fill out Community Property Disclaimer?

US Legal Forms - one of the largest collections of legitimate templates in the USA - provides a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest editions of forms like the Hawaii Community Property Disclaimer within moments.

Read the form description to confirm that you have chosen the correct document.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have a membership, Log In and download the Hawaii Community Property Disclaimer from the US Legal Forms catalog.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are straightforward steps to get you started.

- Ensure you have selected the correct form for your city/county.

- Select the

Form popularity

FAQ

The nine community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. Each state follows its own laws regarding community property, but they generally share similar principles. Understanding these laws is essential for proper asset management during marriage. A Hawaii Community Property Disclaimer can help clarify local laws and protect your rights.

Assets typically considered community property include income earned during the marriage, real estate purchased together, and joint bank accounts. Certain debts incurred during the marital period may also fall under community property. Meanwhile, separate assets, like inheritances or gifts, remain untouchable. A Hawaii Community Property Disclaimer can clearly outline these distinctions.

In Hawaii, property owned by either spouse before marriage typically remains separate property. This means it is not subject to division upon divorce. However, if the couple commingles funds or makes improvements together, this could impact the classification of that property. Consulting a Hawaii Community Property Disclaimer can provide clarity on these situations.

In Hawaii, the right to quiet enjoyment ensures that tenants can use their rental property without interference. This legal principle protects against disturbances caused by landlords or outside parties. It encompasses not only physical safety but also a peaceful living environment. Including a Hawaii Community Property Disclaimer can help secure these rights within property agreements.

The IRS recognizes community property as any asset or income earned during a marriage in community property states. This includes wages, business profits, and real estate purchased together. Tax implications may arise when spouses file taxes separately. Keeping a Hawaii Community Property Disclaimer can assist in properly managing these responsibilities.

In community property states, community property typically includes everything earned during the marriage, such as wages and benefits, as well as property purchased with those earnings. Debts incurred during the marriage can also be considered community property. However, assets owned before marriage or received as gifts are generally excluded. A Hawaii Community Property Disclaimer can clarify which assets are part of the community.

Community property includes assets like homes, cars, and bank accounts acquired during the marriage. Additionally, income from both partners' jobs also falls under community property. It is important to note that property gifted to one spouse or inherited is usually considered separate property. Employing a Hawaii Community Property Disclaimer can help protect individual interests.

The community property law in Hawaii governs how property is divided between spouses during marriage and upon divorce. Unlike some states, Hawaii views property acquired during the marriage as jointly owned. This means both partners have equal rights to assets earned during the marriage. Understanding this law is crucial, and a Hawaii Community Property Disclaimer can help clarify ownership.

Hawaii does not recognize common law marriage. Instead, the state mandates that couples must obtain a marriage license and perform a ceremonial marriage to be legally recognized. This understanding can impact how property is viewed under a Hawaii Community Property Disclaimer, so it's important to be informed.

Yes, Hawaii is considered a full disclosure state in terms of real estate transactions. Sellers must provide all known material facts about the property to potential buyers, ensuring transparency during transactions. This commitment to clarity can be beneficial, particularly when dealing with issues surrounding a Hawaii Community Property Disclaimer.