Hawaii Revocable Trust for Minors

Description

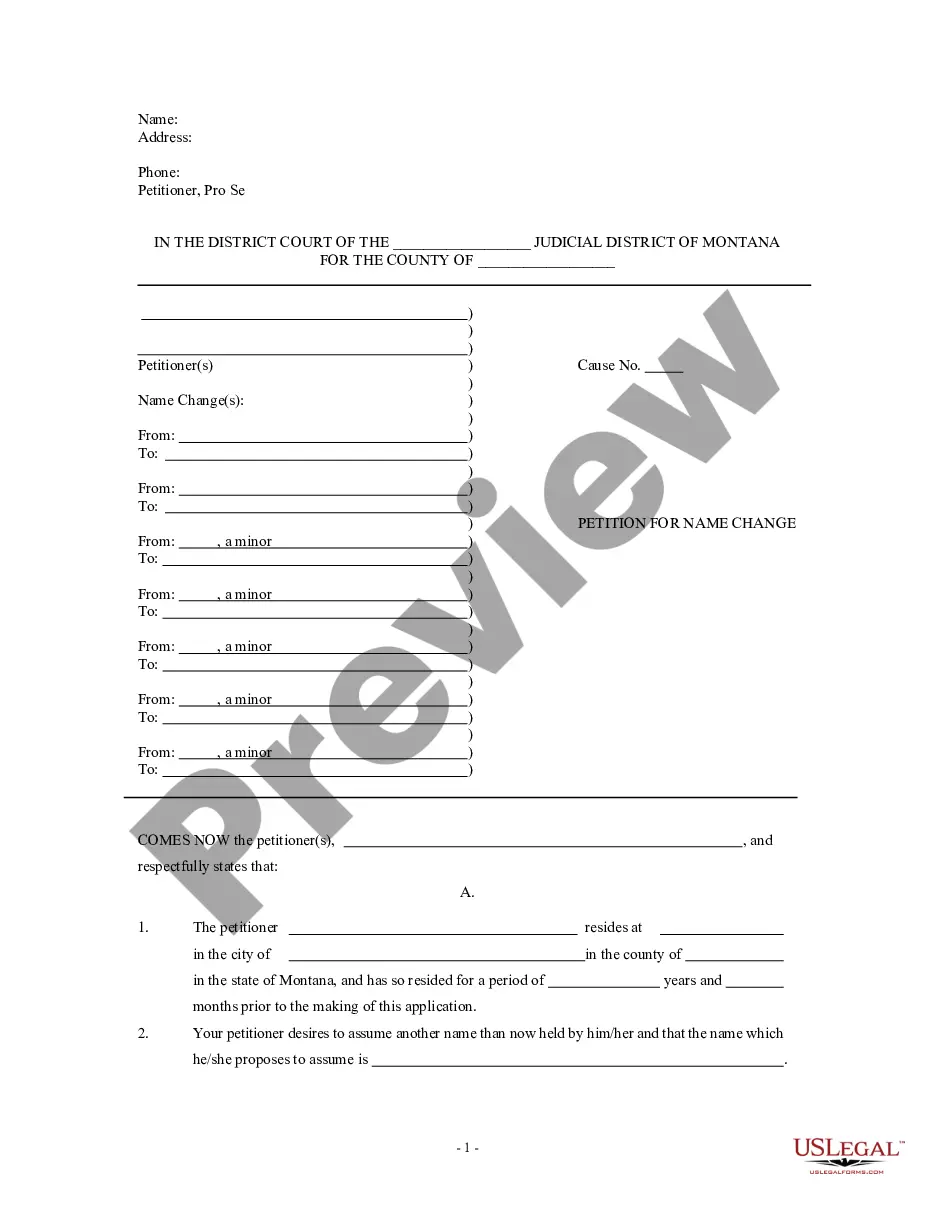

How to fill out Revocable Trust For Minors?

You may spend countless hours online seeking the valid documents template that fulfills the federal and state criteria you require.

US Legal Forms offers a vast array of valid forms that can be reviewed by experts.

It is easy to obtain or create the Hawaii Revocable Trust for Minors through my service.

If available, use the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Hawaii Revocable Trust for Minors.

- Every valid document template you purchase is yours to keep indefinitely.

- To get an additional copy of any purchased document, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms site for the first time, follow these straightforward instructions below.

- First, make sure you have chosen the correct document template for the area/city of your preference.

- Review the document description to confirm you have selected the right template.

Form popularity

FAQ

Yes, one of the significant benefits of establishing a Hawaii Revocable Trust for Minors is that it can help your assets avoid probate. This means your beneficiaries can receive their inheritances faster and with less hassle. By placing your assets in a trust, you streamline the transfer process, protecting your loved ones from lengthy court proceedings. This advantage makes trusts an attractive option for many families.

In Hawaii, a trust does not necessarily need to be notarized, but having it notarized is a good practice. Notarization adds a layer of authenticity, which can help avoid potential disputes in the future. When you create a Hawaii Revocable Trust for Minors, consider this step to enhance the trust’s validity. Engaging with a legal platform like US Legal Forms can also guide you through this process.

Storing trust documents securely is crucial to protect your family's future. You could opt for a safe deposit box at a bank, install a personal fireproof safe, or use a secure cloud storage service. Make sure your trusted family members or advisors know where to find your Hawaii Revocable Trust for Minors documents. This will ensure they can access the trust when needed.

A Hawaii Revocable Trust for Minors is often the best choice for safeguarding assets for children. This type of trust allows parents to retain control while designating how and when their minor children receive assets. Factors such as the specific needs of your family and the goals for your trust should guide your decision. Consulting with an expert can help ensure you select the most suitable option for your situation.

Establishing a Hawaii Revocable Trust for Minors involves several steps. First, you need to draft a trust document that outlines the terms and conditions of the trust, including asset management and beneficiary details. You can then fund the trust by transferring ownership of your assets into it. Utilizing a reliable platform like US Legal Forms can help simplify this process, providing you with the necessary legal documents and guidance.

To create a Hawaii Revocable Trust for Minors, you typically need to be a legal adult in Hawaii, which means you must be at least 18 years old. Additionally, you should be the property owner or have legal authority to manage the assets intended for the trust. It’s essential to clearly outline the beneficiaries and their needs, which ensures that the trust serves its purpose effectively.

A trust for minor children, like a Hawaii Revocable Trust for Minors, holds and manages assets until the child reaches a certain age or meets specific conditions. The trustee is responsible for distributing funds for the minor's education, healthcare, and general wellbeing. This setup ensures that the child's needs are prioritized, even if the parents are not able to provide assistance. It's a reliable way to secure financial support for the child during their formative years.

There is no strict minimum amount required to create a trust in Hawaii, but establishing a trust with sufficient assets is essential to justify the costs associated with it. Many advisors suggest having a minimum fund of around $100,000 for a Hawaii Revocable Trust for Minors to be worthwhile. It’s important to consider the long-term benefits that the trust will provide for the child when determining the amount. Consulting a financial advisor can help clarify this further.

A revocable living trust, specifically a Hawaii Revocable Trust for Minors, is often considered a great option for managing assets for children. This type of trust allows parents to retain control during their lifetime but provides clear directives on how assets are managed for the minors. It ensures that the children's needs are met, and it can be customized to include specific conditions for disbursement. Ultimately, choose a trust that addresses the family's unique needs.

Building a child's trust involves consistent, honest communication and creating a safe environment. You can foster trust by being present in their lives and showing genuine interest in their thoughts and feelings. When discussing important matters, like a Hawaii Revocable Trust for Minors, clarity and openness can also help establish a sense of security for the child. Trust takes time, so patience is essential.