Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

Hawaii Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency?

You are able to devote time on the Internet looking for the authorized file web template that meets the state and federal requirements you will need. US Legal Forms supplies a large number of authorized types that happen to be analyzed by professionals. You can easily download or print the Hawaii Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency from my service.

If you have a US Legal Forms account, you may log in and click on the Acquire option. Afterward, you may complete, revise, print, or indication the Hawaii Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency. Every authorized file web template you buy is yours for a long time. To get another version associated with a bought type, proceed to the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms website the first time, stick to the simple guidelines beneath:

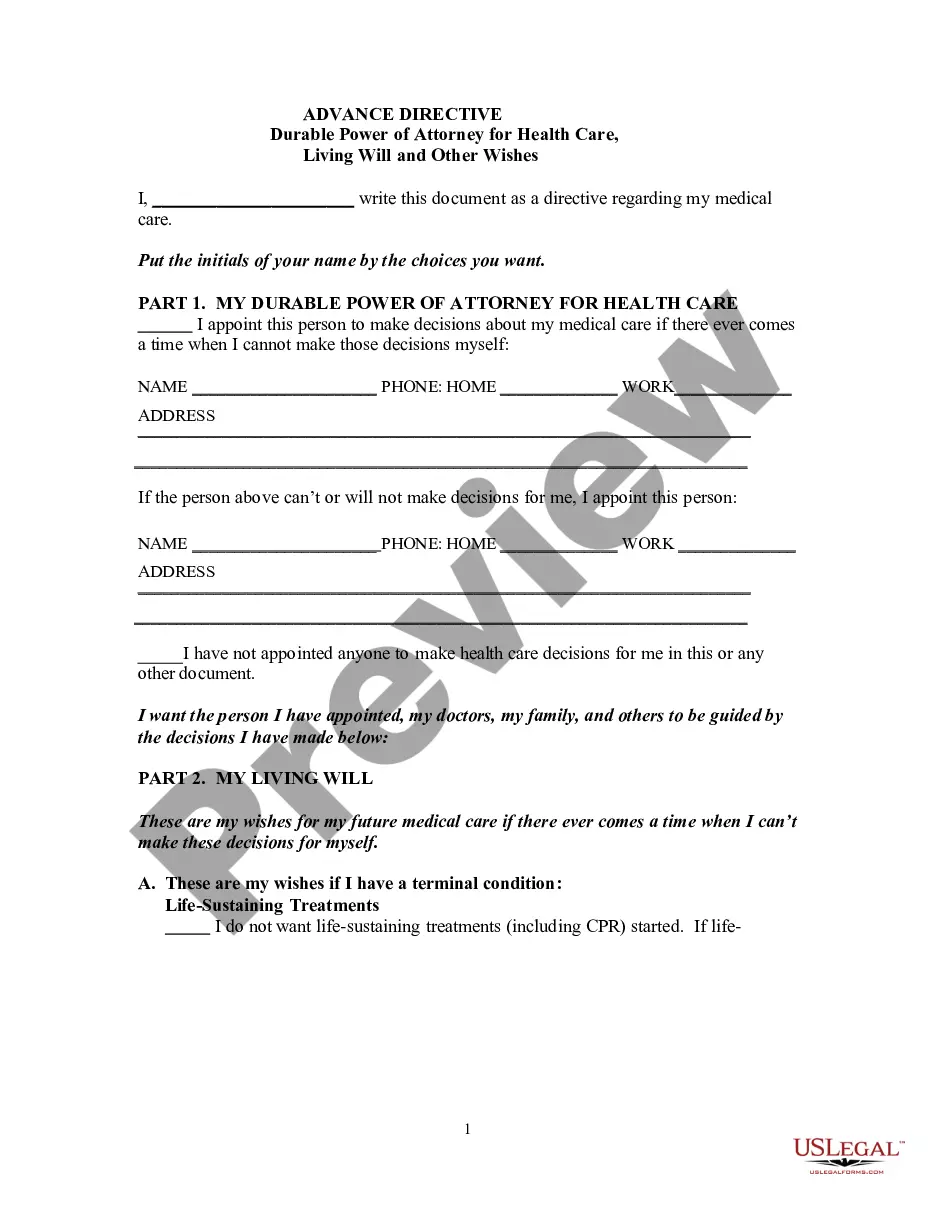

- Very first, make sure that you have selected the correct file web template for the county/city of your choice. Read the type explanation to make sure you have selected the right type. If offered, use the Review option to search with the file web template also.

- If you wish to locate another variation of the type, use the Lookup field to obtain the web template that meets your requirements and requirements.

- Once you have discovered the web template you desire, click Buy now to continue.

- Choose the costs prepare you desire, type your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You can utilize your bank card or PayPal account to purchase the authorized type.

- Choose the structure of the file and download it to the device.

- Make alterations to the file if necessary. You are able to complete, revise and indication and print Hawaii Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

Acquire and print a large number of file web templates making use of the US Legal Forms site, which provides the biggest assortment of authorized types. Use professional and condition-specific web templates to handle your company or person requires.

Form popularity

FAQ

A creditor that obtains a credit score and takes adverse action is required to disclose that score, unless the credit score played no role in the adverse action determination.

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

In the hiring process, adverse action means a company is considering not hiring the applicant or that they may withdraw an offer. Usually, this is based on an adverse report on a consumer report or background check.

First, the furnisher may be willing to fix the error, either because it actually does find an error or to maintain good customer relations. Second, if the furnisher does not respond, the credit reporting agency is legally required to delete the disputed information from your credit report.

If you receive an Adverse Action Notice, it doesn't necessarily mean you also receive a hard credit inquiry. The notice may simply mean that the lender was unable to provide a personalized offer to you. The notice itself is not reflected on your credit report and doesn't impact your credit score.

How do you respond to an adverse action notice? If you get an adverse action notice, you don't have to respond in any way. But if you disagree with the action and want to dispute or appeal the decision, you may have an opportunity to do so.

Common violations of the FCRA include: Creditors give reporting agencies inaccurate financial information about you. Reporting agencies mixing up one person's information with another's because of similar (or same) name or social security number.

You are not obligated to respond to the notice. However, if you believe that information in your credit report is incorrect and you want to have it corrected, you have the right to do so.