Hawaii Articles of Conversion is a document that allows a business to change its legal entity type from one form to another. It is also known as a conversion certificate. The document is filed with the Hawaii Department of Commerce and Consumer Affairs (CCA) and is required for all conversions within the state. The document must include the name of the existing entity, the new entity type and the details of the conversion. There are two types of Hawaii Articles of Conversion: (1) Domestic Conversion and (2) Foreign Conversion. Domestic Conversion involves the conversion of an existing domestic entity such as a corporation or a limited liability company (LLC) to a new entity type. Foreign Conversion involves the conversion of an existing foreign entity to a new entity type. Both types of conversions must be filed with the CCA along with the appropriate filing fees.

Hawaii Articles of Conversion

Description

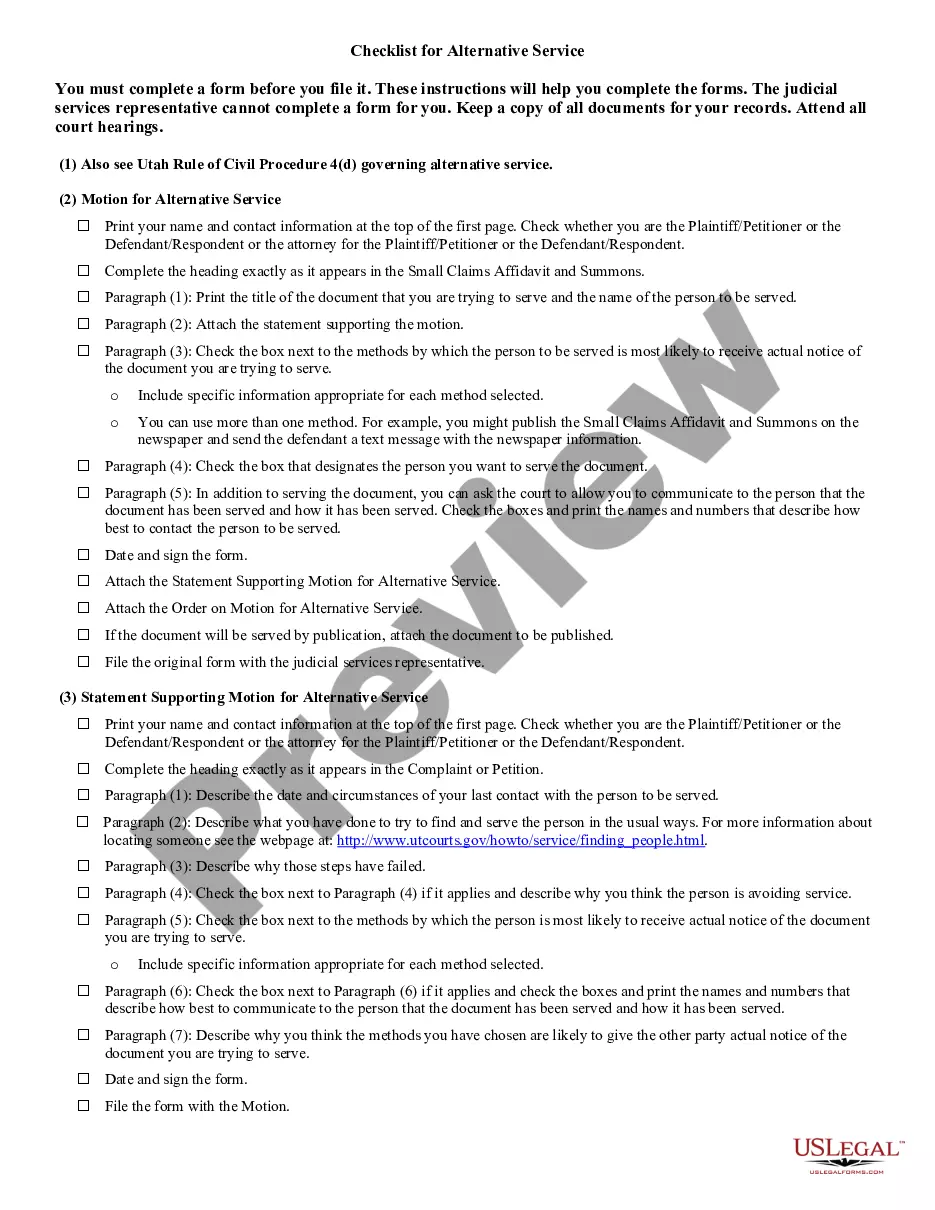

How to fill out Hawaii Articles Of Conversion?

US Legal Forms is the simplest and most budget-friendly method to discover suitable legal templates.

It is the largest online collection of business and personal legal documents prepared and validated by lawyers.

Here, you can access printable and editable templates that adhere to federal and local laws - just like your Hawaii Articles of Conversion.

Review the form details or preview the document to confirm you’ve found one that meets your needs, or search for another one using the search tab above.

Click Buy now when you’re confident of its suitability for all your requirements, then select the subscription plan that best fits your needs.

- Acquiring your template requires just a few easy steps.

- Users with an existing account and an active subscription only need to Log In to the website and download the document to their device.

- Later, they can locate it in their profile under the My documents section.

- And here’s how you can obtain a professionally prepared Hawaii Articles of Conversion if you are using US Legal Forms for the first time.

Form popularity

FAQ

Incorporating in Hawaii generally takes between 2 to 4 weeks, depending on the method you choose for submission. Online applications tend to be processed more quickly than those sent via mail. To streamline the incorporation process and ensure compliance with Hawaii Articles of Conversion, check out the user-friendly options available on USLegalForms.

Failing to file an annual report for your LLC can result in penalties, including fines and possible dissolution of your business entity. The state may take action against your LLC, making it unable to conduct business legally. To protect your interests and ensure compliance with Hawaii Articles of Conversion, utilize USLegalForms to maintain accurate records and timely filings.

To register a DBA (Doing Business As) in Hawaii, submit an application to the county clerk's office where your business operates. This process includes payment of the applicable fees and publication of your DBA in a local newspaper. For more detailed guidance on ever-evolving regulations, USLegalForms provides resources that align well with Hawaii Articles of Conversion.

You can obtain a certificate of good standing in Hawaii by submitting a request to the Department of Commerce and Consumer Affairs. This certificate verifies that your LLC is compliant with state regulations and has filed all necessary documents, including annual reports. For assistance in navigating this process and understanding Hawaii Articles of Conversion, consider using USLegalForms.

To file an annual report for your LLC in Hawaii, you must complete the required form and submit it to the Department of Commerce and Consumer Affairs. Make sure to include all necessary information regarding your business, such as its name, address, and any changes that occurred during the year. For guidance and access to the correct forms, USLegalForms offers helpful resources for Hawaii Articles of Conversion.

An annual LLC report typically outlines your business's financial status, including the revenue, expenses, and net profit or loss. It may also detail the ownership structure, registered agent information, and any changes in business operations. For Hawaii Articles of Conversion, your report must adhere to state requirements, which you can easily follow using resources available through USLegalForms.

Creating an annual report for your business involves compiling important financial information, including income statements and balance sheets, into a structured format. You should also include a summary of your business activities and any changes in ownership or management. To simplify this process, consider using USLegalForms, where you can find templates tailored for Hawaii Articles of Conversion.

Yes, a certificate of good standing is a legitimate document issued by the state. It serves as proof that your business is adhering to state requirements and is authorized to operate. When pursuing processes such as Hawaii Articles of Conversion, having this certificate can enhance your credibility and streamline transactions. You can obtain a legitimate certificate through official state channels or trusted services like US Legal Forms.

A certificate of good standing in Hawaii verifies that your business is legally registered and compliant with state regulations. It demonstrates that your entity has met all required filings and is eligible to conduct business within the state. This certificate plays a crucial role when navigating processes such as Hawaii Articles of Conversion, ensuring your business remains in good standing. You can request your certificate through the state or utilize platforms like US Legal Forms for convenience.

If you need an alternative to a certificate of good standing, a letter of status from the Secretary of State can serve this purpose. This document confirms your business's current existence and compliance. Understanding these options is vital, especially when considering Hawaii Articles of Conversion, which may require a clear status of your business. You can find these documents easily through services like US Legal Forms.