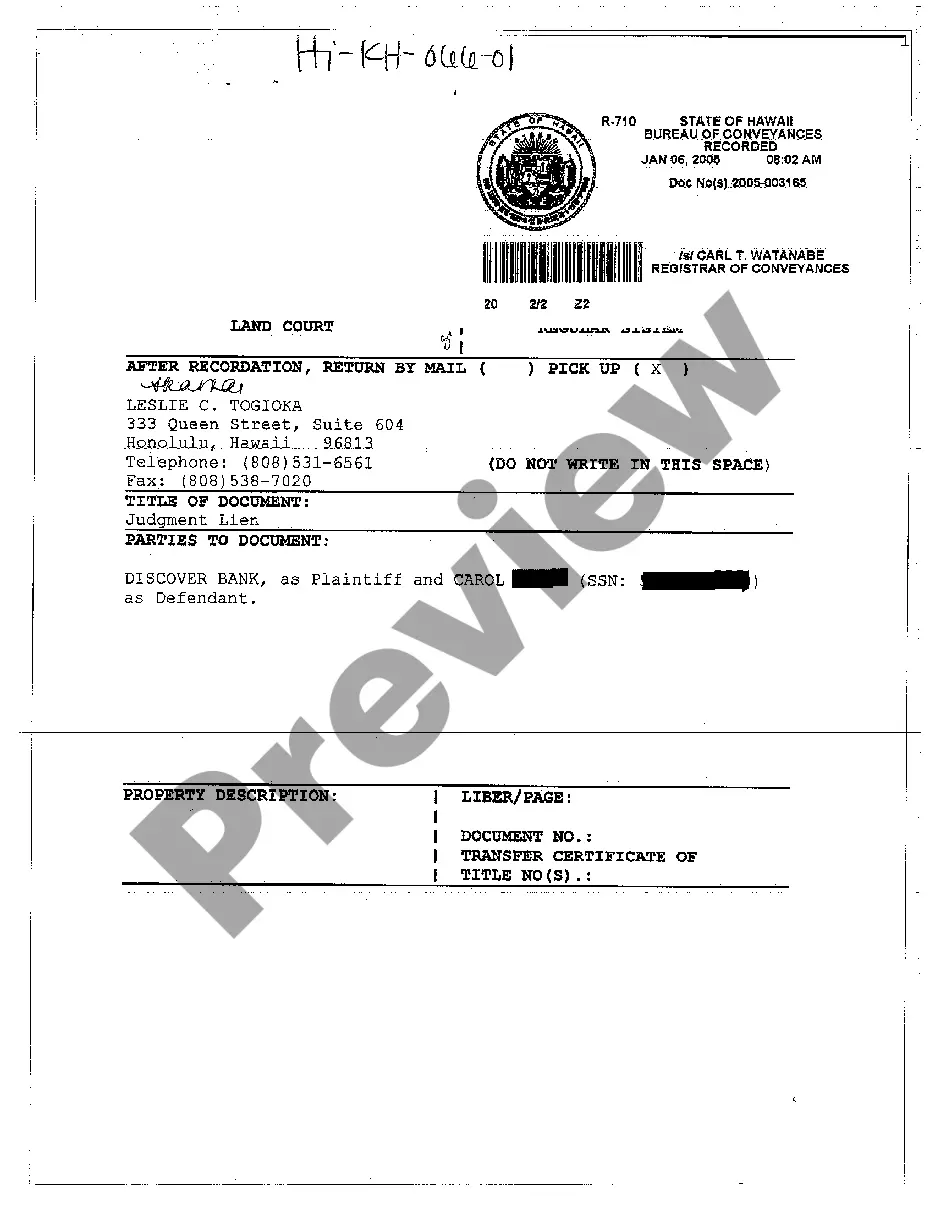

Hawaii Judgment Lien for Credit Card Debt

Description

How to fill out Hawaii Judgment Lien For Credit Card Debt?

Amidst numerous complimentary and premium examples available online, you cannot guarantee their trustworthiness.

For instance, who generated them or if they possess adequate qualifications to handle your requirements.

Stay composed and utilize US Legal Forms!

Confirm that the document you find is applicable in your residing state. View the document by checking the description using the Preview feature. Click Buy Now to commence the purchasing procedure or search for another example using the Search box located in the header. Select a payment plan and establish an account. Settle the subscription for your chosen credit/debit card or Paypal. Download the document in your desired file format. Once registered and your subscription is paid, you can utilize your Hawaii Judgment Lien for Credit Card Debt as often as required or as long as it remains valid in your state. Modify it with your preferred offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Discover Hawaii Judgment Lien for Credit Card Debt templates crafted by experienced attorneys.

- Avoid the costly and lengthy undertaking of searching for a lawyer.

- Skip the hassle of paying them to create a document that you can obtain yourself.

- If you hold a subscription, Log In to your account and locate the Download button next to the form you seek.

- You will also have access to all previously downloaded files in the My documents section.

- If you are using our website for the first time, adhere to the steps below to quickly obtain your Hawaii Judgment Lien for Credit Card Debt.

Form popularity

FAQ

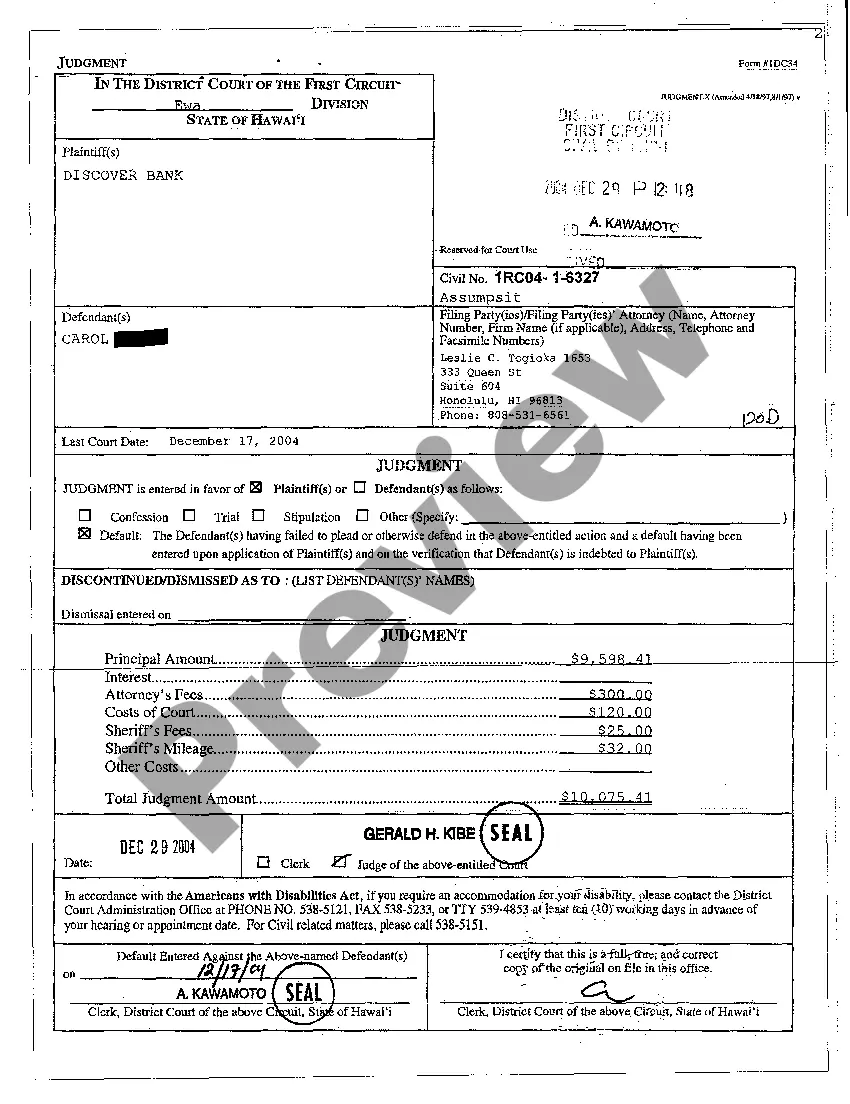

Yes, credit card debt can lead to a lien on your property under certain conditions. If the credit card company obtains a judgment against you, they may file for a Hawaii Judgment Lien for Credit Card Debt. This legal claim allows them to secure payment for the debt by attaching it to your property. To protect your assets, it's wise to understand your options and consider speaking with a legal expert who can navigate you through the process.

Responding to a court summons for credit card debt is crucial in avoiding a default judgment. First, read the summons carefully, noting any deadlines. Then, prepare your answer, which should include your personal information and a clear statement addressing the claims made against you. If you need guidance, consider using platforms like US Legal Forms, which offer resources and templates to help you effectively address issues related to a Hawaii Judgment Lien for Credit Card Debt.

Yes, a lien can indeed be placed on your house for unpaid credit card debt if a judgment is obtained. This process usually involves a court ruling, leading to a Hawaii Judgment Lien for Credit Card Debt. Such a lien can affect your ability to sell your property or refinance your mortgage. To avoid these scenarios, staying informed and managing your debts responsibly is vital, and platforms like USLegalForms can assist you in understanding your options.

Credit card debt becomes uncollectible after a set amount of time, usually six years in Hawaii, depending on specific circumstances. After this period, creditors no longer have the legal right to file a lawsuit to collect the debt. However, it's important to note that the debt may still exist, and the creditor may still pursue other ways to collect. Engaging with tools like USLegalForms can help you navigate these complexities smoothly.

In Hawaii, a debt typically becomes uncollectible after six years from the date of the last payment or communication regarding the debt. This timeframe applies to various types of unsecured debts, including credit card debt. Understanding the statute of limitations can be crucial, especially if you are considering a Hawaii Judgment Lien for Credit Card Debt. Knowing your rights can empower you during debt management.

To collect on a judgment in Hawaii, you can pursue various methods such as wage garnishment or bank levies. You may also register your judgment as a Hawaii Judgment Lien against the debtor's property. It's vital to stay organized and informed of the legal processes involved. US Legal Forms can offer you the tools and templates necessary for successfully navigating judgment collection.

In Hawaii, the statute of limitations for credit card debt is generally six years. This means creditors must file a lawsuit within this time frame to collect the debt. Knowing this timeline can empower you to manage and defend against potential credit card judgments effectively. Always keep in mind the implications of a Hawaii Judgment Lien for Credit Card Debt.

To stop a judgment for credit card debt, consider filing a motion to vacate the judgment. You will need to present valid reasons, such as proving you were not properly served with summons. Engaging with US Legal Forms can help you compile the necessary documents and understand your options to effectively address a Hawaii Judgment Lien for Credit Card Debt.

To stop a credit card judgment, you can file an appeal or negotiation for a settlement. You may also seek to vacate the judgment by showing new evidence that supports your case. Utilizing resources from US Legal Forms can guide you through procedures necessary to address a Hawaii Judgment Lien for Credit Card Debt.

When a credit card company obtains a judgment against you, they can legally pursue collection efforts on the debt. This might include garnishing your wages or placing a Hawaii Judgment Lien on your property. The judgment can also negatively impact your credit score. It's important to address the situation promptly to minimize long-term effects.