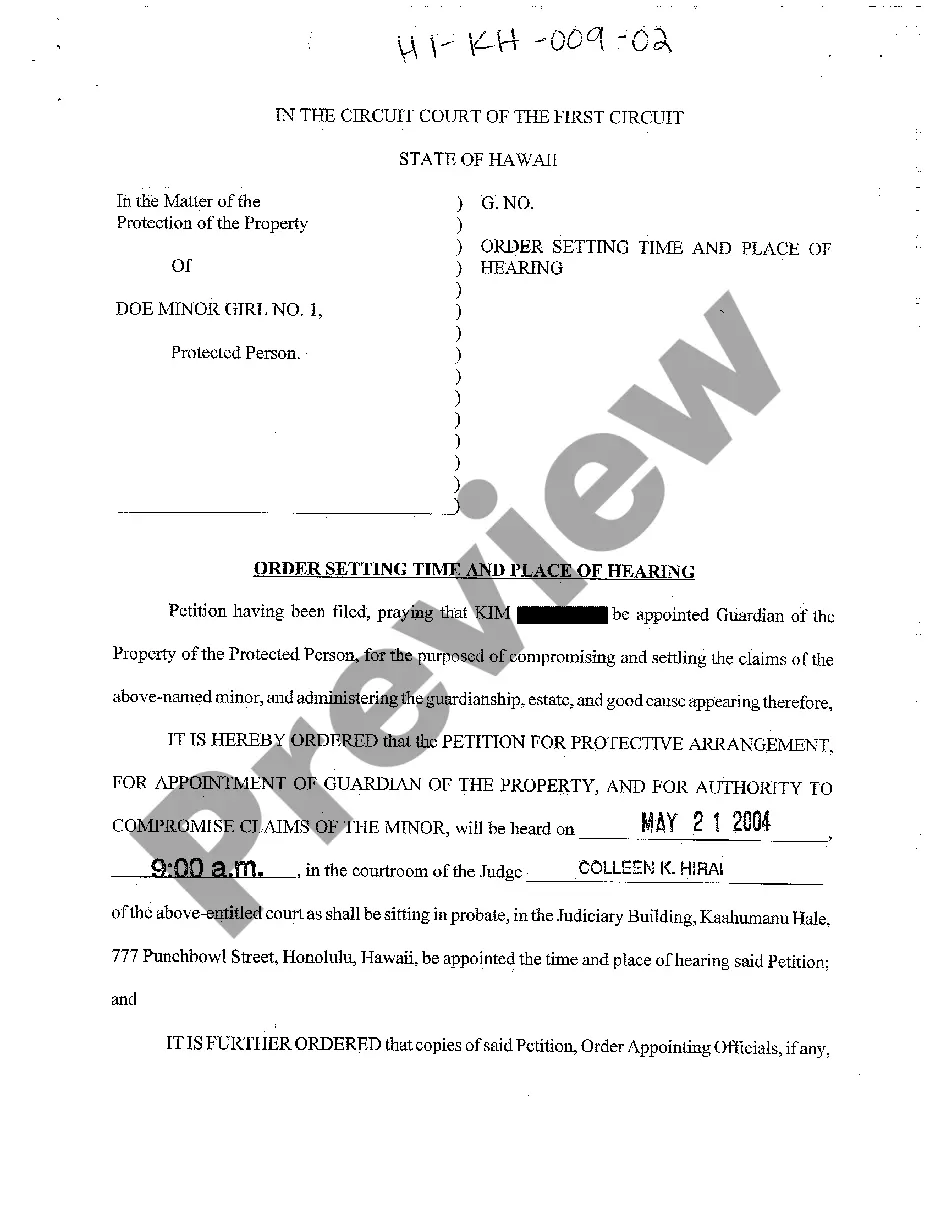

Hawaii Order Setting Time and Place of Hearing

Description

How to fill out Hawaii Order Setting Time And Place Of Hearing?

Amid various complimentary and premium templates available online, you cannot be assured of their precision.

For instance, who created them or if they possess the expertise necessary to handle your requirements.

Stay composed and utilize US Legal Forms! Uncover Hawaii Order Setting Time and Place of Hearing templates crafted by experienced lawyers and sidestep the costly and time-intensive process of searching for a lawyer and subsequently paying them to draft a document for you that you can access independently.

Choose a pricing plan and establish an account. Pay for the subscription with your credit/debit card or Paypal. Download the form in the desired format. After you have registered and paid for your subscription, you can use your Hawaii Order Setting Time and Place of Hearing as frequently as needed or for as long as it remains valid in your state. Modify it in your preferred offline or online editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- If you hold a membership, Log In to your account and locate the Download button adjacent to the form you're seeking.

- You'll have the ability to review your previously downloaded files in the My documents section.

- If this is your first time using our platform, adhere to the instructions below to obtain your Hawaii Order Setting Time and Place of Hearing with ease.

- Ensure that the document you discover is valid in your jurisdiction.

- Examine the file by perusing the details in the Preview function.

- Click Buy Now to initiate the purchasing procedure or search for another template using the Search box located in the header.

Form popularity

FAQ

Rule 42 in Hawaii probate outlines guidelines for consolidating cases in probate court. This rule simplifies proceedings, making it easier for individuals to manage estate matters efficiently. When dealing with probate, understanding how to set a Hawaii Order Setting Time and Place of Hearing can aid in streamlining the process and ensuring all parties are informed.

Rule 52 in Hawaii governs the findings of fact and conclusions of law in civil cases. It requires courts to provide a clear understanding of their decisions, ensuring all parties involved grasp the outcomes. This rule is essential when parties seek a Hawaii Order Setting Time and Place of Hearing, allowing them to prepare adequately for their case.

The number one cause of death in Hawaii is heart disease, significantly impacting the community. However, understanding these health concerns can guide families when considering estate planning and legal matters. This context becomes crucial in discussions surrounding a Hawaii Order Setting Time and Place of Hearing, especially when dealing with health-related legal issues.

Rule 9 in Hawaii pertains to the specific requirements for pleadings and motions submitted to courts. It establishes guidelines that ensure cases are presented clearly, which is vital when requesting a Hawaii Order Setting Time and Place of Hearing. By following these guidelines, you enhance the efficiency of your legal proceedings.

Title 9 in Hawaii concerns the administration of civil and criminal court procedures. It encompasses rules essential for effectively managing court processes, ensuring that all parties understand their rights and obligations. Understanding Title 9 will help you navigate situations where a Hawaii Order Setting Time and Place of Hearing is necessary, improving your knowledge of court schedules.

Rule 37 is critical for managing discovery disputes in the Hawaii legal system, influencing the Hawaii Order Setting Time and Place of Hearing. It explains how parties can resolve issues regarding document exchanges and deposition practices. Understanding this rule fosters a more effective and fair legal process, crucial for all participants.

Rule 59 of the Hawaii Family Court deals with motions for new trials and reconsideration, an essential aspect of navigating the Hawaii Order Setting Time and Place of Hearing. This rule permits parties to request a reevaluation of court decisions, ensuring that all voices are heard. Recognizing this rule can empower you in case reassessments and appeals.

Rule 35 concerns the physical and mental examinations in legal cases, relating closely to the Hawaii Order Setting Time and Place of Hearing. This rule allows for examinations of parties where their physical or mental condition is in dispute. Understanding this rule can help you prepare adequately for any examinations that may arise in your case.

Rule 7 in Hawaii pertains to the motions and what should be included in them, directly impacting the Hawaii Order Setting Time and Place of Hearing. This rule provides guidance on how to structure motions properly, ensuring that all relevant information is presented clearly. Familiarizing yourself with rule 7 can streamline your legal processes, making your case more efficient.

Rule 11 in Hawaii emphasizes the importance of verifying the validity of documents filed with the court, especially in the context of the Hawaii Order Setting Time and Place of Hearing. This rule requires attorneys and parties to affirm that their filings comply with court standards, reducing frivolous lawsuits. Understanding rule 11 can help you avoid unnecessary complications in your legal matters.