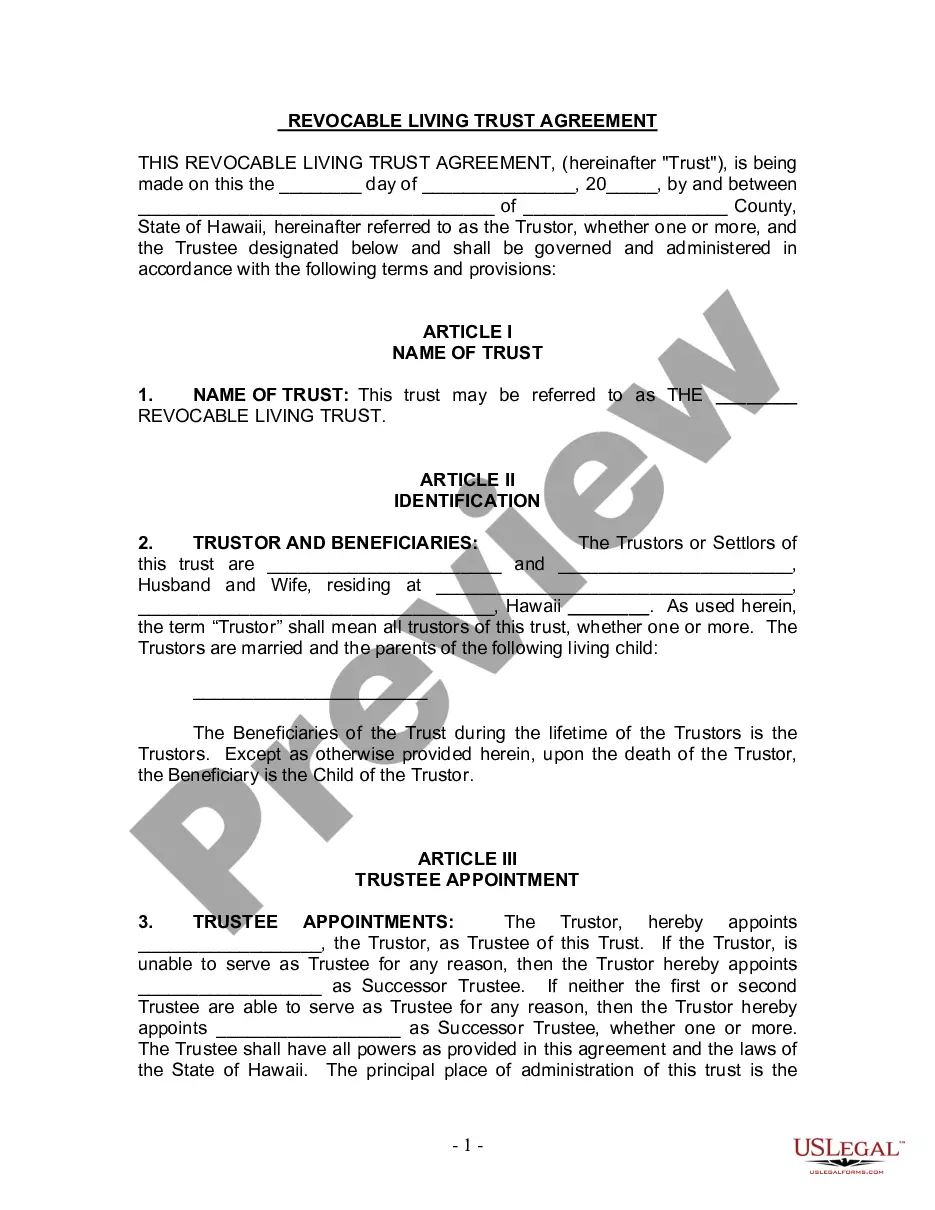

Hawaii Living Trust for Husband and Wife with One Child

Description

How to fill out Hawaii Living Trust For Husband And Wife With One Child?

Access one of the most extensive collections of legal documents.

US Legal Forms is essentially a platform to locate any state-specific paperwork in just a few clicks, including Hawaii Living Trust for Husband and Wife with One Child samples.

No need to squander hours of your time looking for a court-acceptable form.

After selecting a pricing plan, set up your account. Make a payment with a credit card or PayPal. Download the template onto your device by clicking the Download button. That's it! You should fill out the Hawaii Living Trust for Husband and Wife with One Child template and verify it. To confirm everything is accurate, consult your local legal advisor for assistance. Join and easily explore around 85,000 useful templates.

- To utilize the document library, choose a subscription and create an account.

- If you have already set it up, simply Log In and click Download.

- The Hawaii Living Trust for Husband and Wife with One Child template will be swiftly saved in the My documents section (a section for every form you store on US Legal Forms).

- To establish a new account, follow the brief instructions outlined below.

- If you plan to use a state-specific template, ensure you specify the correct state.

- If possible, review the description to grasp all the details of the form.

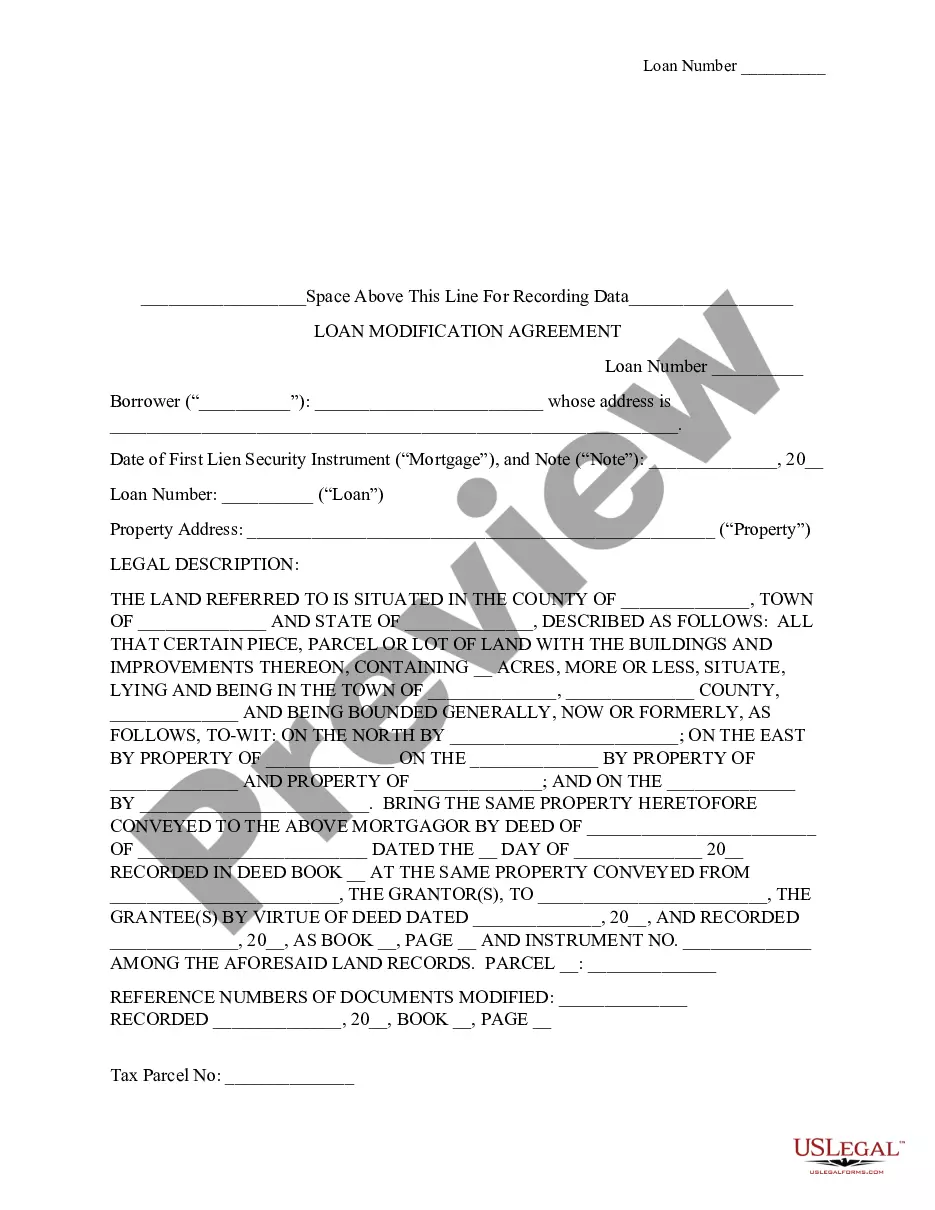

- Utilize the Preview feature if available to check the document's content.

- If everything appears to be correct, click Buy Now.

Form popularity

FAQ

Deciding whether a husband and wife should have separate living trusts often depends on individual circumstances. In many cases, a shared Hawaii Living Trust for Husband and Wife with One Child can simplify estate management and ensure a smooth transition of assets. However, separate trusts may provide greater control and flexibility, especially in cases of differing personal assets or specific estate planning goals. It's always wise to consult a legal expert to tailor a solution that best fits your family's needs.

A married couple should consider establishing a Hawaii Living Trust for Husband and Wife with One Child to protect their assets and ensure efficient estate planning. This trust can simplify the transfer of property to their child while avoiding probate, which can be a lengthy and costly process. By using a living trust, couples can maintain control over their assets while providing clear instructions for their distribution after their passing. Additionally, working with a platform like US Legal Forms can streamline the creation of this trust, making it easier to secure peace of mind for the family.

Setting up a Hawaii Living Trust for Husband and Wife with One Child involves a few key steps. First, you will need to gather important documents and information, including details about assets you wish to place into the trust. Then, you can work with an attorney or use an online platform like UsLegalForms to create the trust document, ensuring it meets Hawaii's legal requirements. Finally, you will fund the trust by transferring ownership of your assets to it, effectively safeguarding your family's future.

While a Hawaii Living Trust for Husband and Wife with One Child offers numerous benefits, there are some downsides. Setting up a trust can involve complicated legal processes and upfront costs. Additionally, if you do not properly fund the trust or neglect to update it, it may not serve its intended purpose. It's wise to consult with professionals from platforms like uslegalforms to navigate these potential challenges effectively.

A Hawaii Living Trust for Husband and Wife with One Child serves as a comprehensive estate planning tool. It allows both partners to manage their assets together while ensuring that their child is taken care of after they pass. The trust facilitates seamless asset transfer without the need for probate, which can save time and costs. This arrangement also provides flexibility and control over how and when assets are distributed.

One of the biggest mistakes parents make when establishing a trust fund is failing to properly fund it. It is essential to transfer assets into the trust so that it operates as intended. Additionally, many overlook the importance of regularly updating the trust to reflect changes in family circumstances. Avoid this common pitfall by staying proactive with your Hawaii Living Trust for Husband and Wife with One Child.

To set up a Hawaii Living Trust for Husband and Wife with One Child, start by determining your assets and beneficiaries. Next, work with an estate planning attorney to create a trust document that reflects your wishes. You will need to fund the trust by transferring ownership of your assets into it. Finally, ensure that all legal documents are signed and filed correctly to make the trust effective.