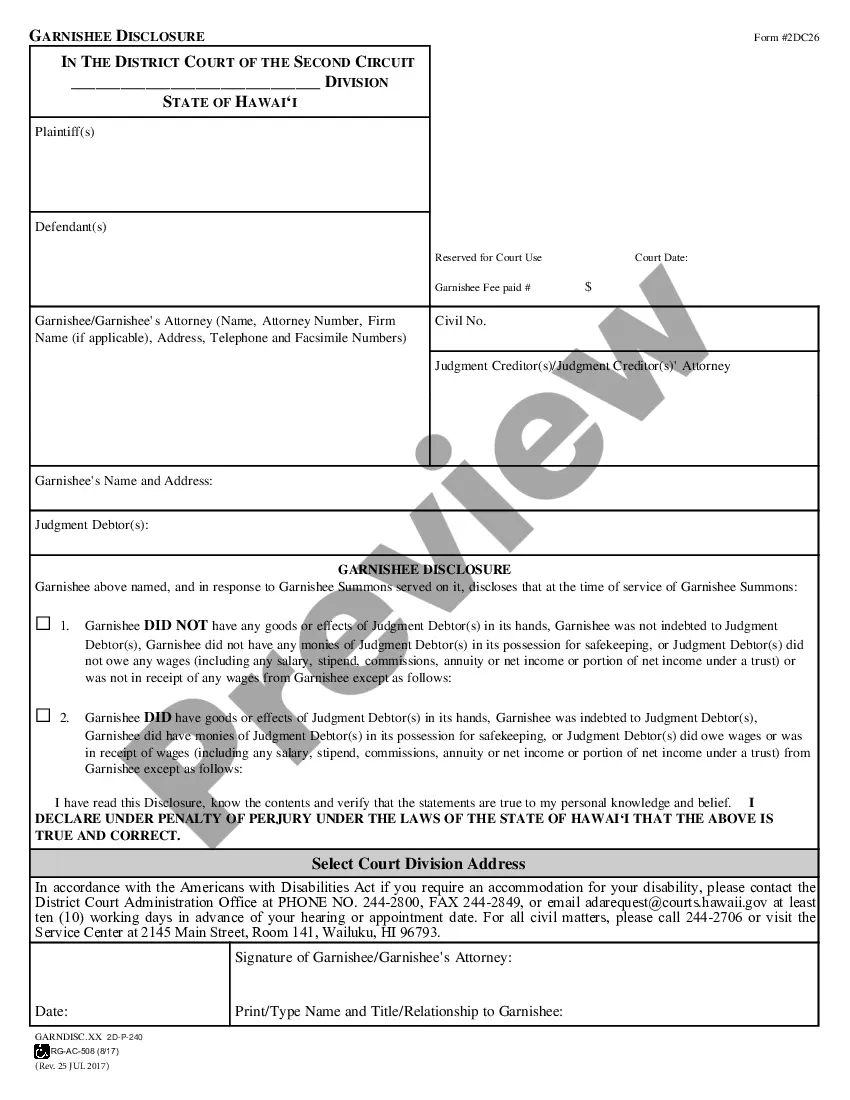

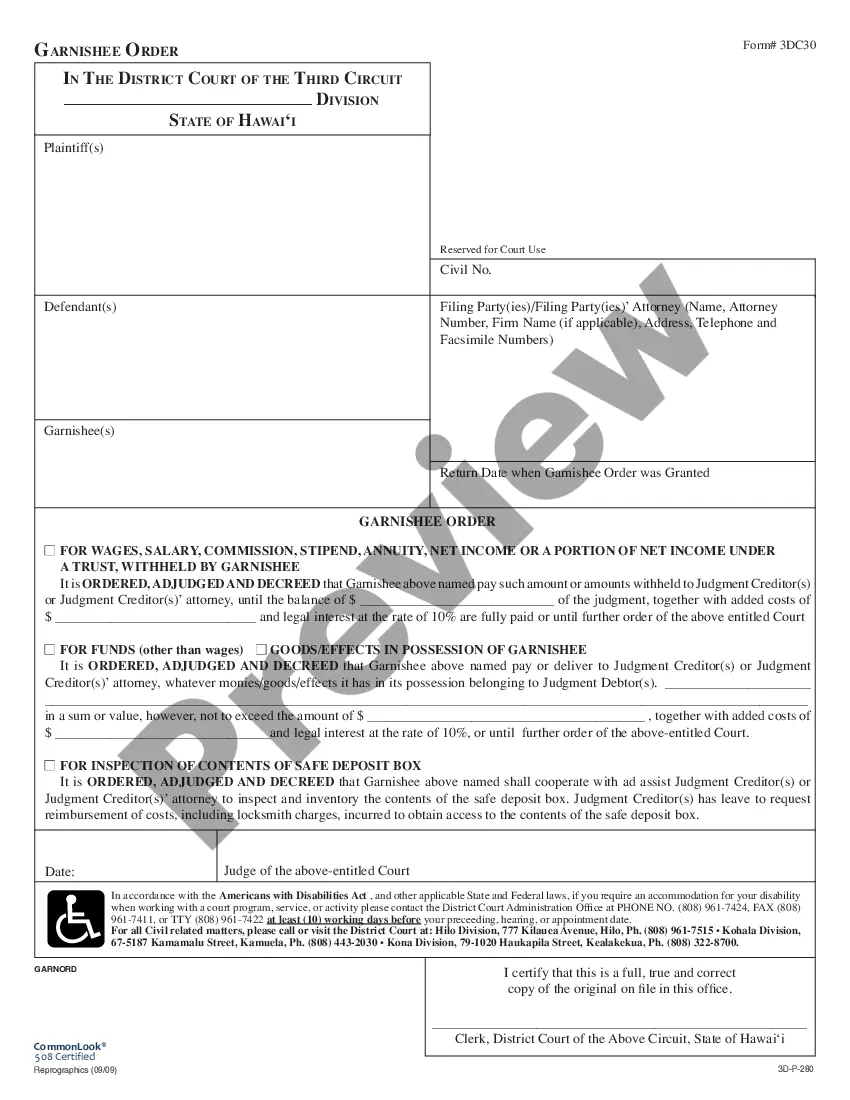

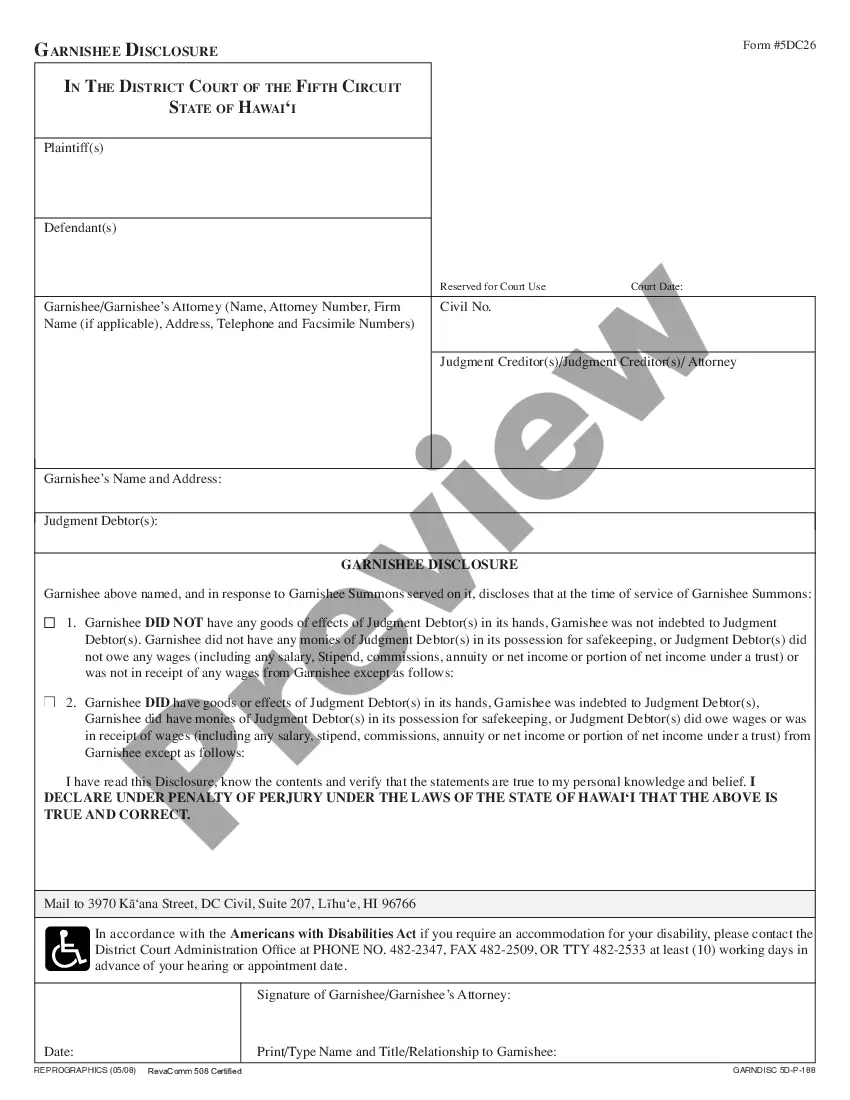

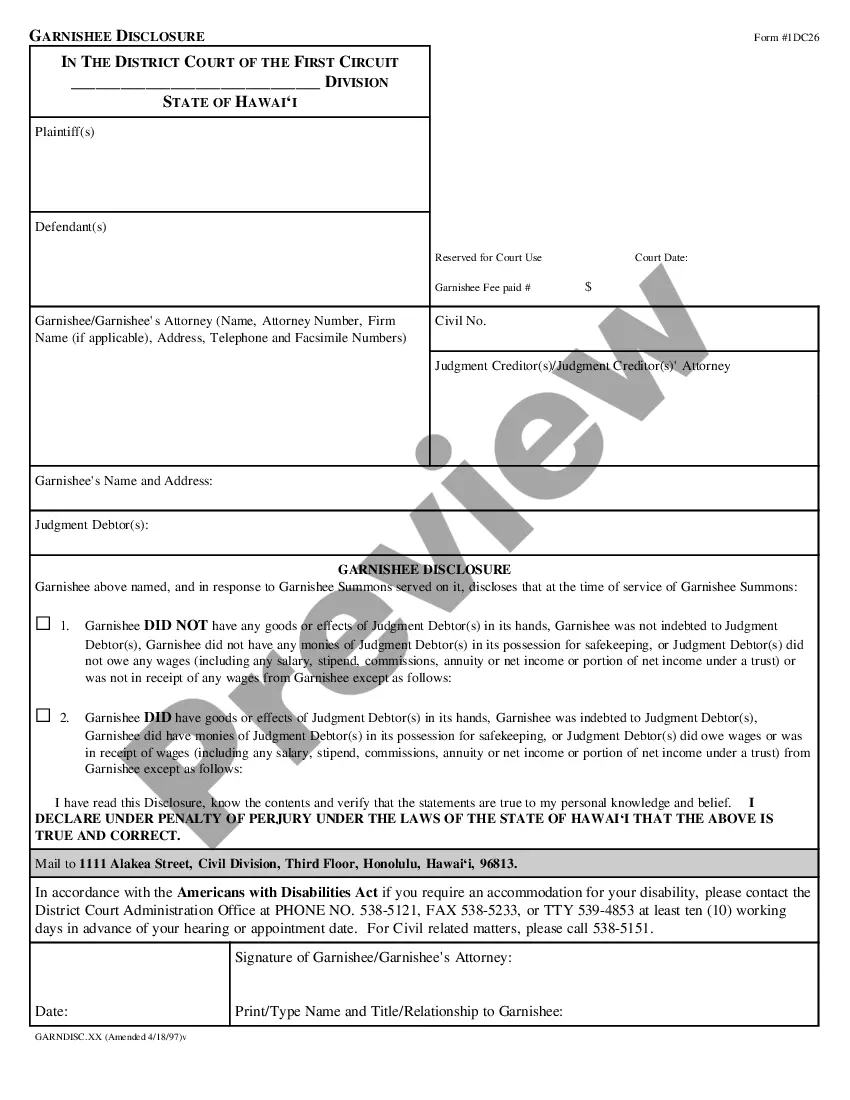

This official form is to be completed by a garnishee in response to a summons. The garnishee is to state whether garnishee was in possession of monies owed the judgment debtor at the time of the summons, and, if so, what was done with the monies.

Hawaii Garnishee Disclosure

Description

How to fill out Hawaii Garnishee Disclosure?

Obtain one of the most comprehensive directories of approved forms.

US Legal Forms is a platform where you can locate any specific form for your state with just a few clicks, including Hawaii Garnishee Disclosure documents.

There’s no need to spend numerous hours searching for a court-acceptable example.

After selecting a pricing plan, establish your account. Make your payment via card or PayPal. Download the document to your device by clicking the Download button. That’s all! You need to complete the Hawaii Garnishee Disclosure form and verify it. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and easily access over 85,000 useful templates.

- To utilize the document repository, select a subscription plan and set up an account.

- If you have already created an account, simply Log In and click the Download button.

- The Hawaii Garnishee Disclosure file will be swiftly stored in the My documents section (which contains all forms you've downloaded from US Legal Forms).

- To establish a new profile, follow the straightforward instructions provided below.

- If you plan to use a state-specific document, make sure to select the correct state.

- If possible, review the description to understand all the specifics of the document.

- Utilize the Preview option if available to examine the information of the document.

- If everything looks correct, click the Buy Now button.

Form popularity

FAQ

In Hawaii, the amount that can be garnished from your wages is capped at a specific percentage based on your disposable income. Typically, up to 25% of your weekly wages can be garnished, but there are minimum thresholds to consider as well. Being informed about the Hawaii Garnishee Disclosure can empower you to manage your finances better during challenging times. To learn more about your rights and find helpful forms, explore the offerings at US Legal Forms.

In Hawaii, the maximum amount that can be garnished depends on various factors, including your income and the type of debt. Generally, creditors can garnish up to 25% of your disposable income or the amount by which your weekly income exceeds 40 times the federal minimum wage. Understanding the Hawaii Garnishee Disclosure law is essential, as it helps you protect your earnings while ensuring that creditors receive what they are owed. To navigate these regulations effectively, consider using the resources available through US Legal Forms.

In Hawaii, the maximum amount that can be garnished from your paycheck is typically set at 25% of your disposable earnings or the amount exceeding 30 times the federal minimum wage, whichever is less. This limit ensures that debtors retain enough income to support themselves. The Hawaii Garnishee Disclosure is essential for accurately determining what amounts can be withheld from your paycheck. Knowing these limits can help you manage your finances effectively amid garnishment.

To sue someone in Hawaii, you must first gather all necessary documents and evidence supporting your claim. Filing a lawsuit involves submitting your complaint to the appropriate court and serving the defendant with the papers. Utilizing platforms like US Legal Forms can streamline this process, providing templates for necessary legal documents. Familiarize yourself with legal requirements to enhance your chances of success in your lawsuit.

A garnishment may be considered invalid for several reasons, including lack of proper court order, wrong recipient, or if it exceeds the legal limits set by Hawaii law. If the Hawaii Garnishee Disclosure is not correctly filled out or fails to represent accurate financial data, it can lead to an invalid garnishment. Moreover, improper service to the debtor also affects the garnishment's validity. Knowing these factors can help you challenge incorrect garnishments effectively.

The garnishment law in Hawaii outlines how creditors can legally collect unpaid debts from debtors. It requires a court order, and the process involves a garnishee, such as an employer or bank, who must withhold funds from the debtor. The Hawaii Garnishee Disclosure plays a vital role in this process by providing necessary financial information to determine the appropriate amount to garnish. Familiarizing yourself with these laws can empower you to make informed decisions regarding debt management.

Hawaii garnishment laws provide a framework for creditors to recover debts through court-ordered deductions from a debtor's income or bank account. The Hawaii Garnishee Disclosure is a crucial part of this process, as it informs the court and the creditor about the debtor's financial situation. This law helps protect consumers while allowing creditors to collect what they are owed. Understanding these laws helps both creditors and debtors navigate their rights and responsibilities.

An entry of default occurs when a defendant fails to respond to a legal complaint within the designated timeframe. In Hawaii, once a plaintiff files for an entry of default, the court may rule in their favor without further input from the defendant. This can lead to garnishment actions being initiated. To learn more about how the entry of default can impact your financial situation, including implications related to Hawaii Garnishee Disclosure, seek guidance through reliable platforms like US Legal Forms.

Yes, a garnishment can occur without your immediate knowledge, especially if you do not keep track of court proceedings. If a creditor obtains a court judgment against you, they can file for garnishment without notifying you beforehand. It's crucial to stay informed about any legal notices you may receive. Understanding how Hawaii Garnishee Disclosure works can help you anticipate and respond to such actions.

The amount that can be garnished from your paycheck in Hawaii is typically limited to a certain percentage of your disposable income. Specifically, creditors can take up to 25% of your disposable earnings or the amount by which your weekly income exceeds 30 times the federal minimum wage, whichever is lower. It's important to know these caps to protect your financial well-being. For detailed insights, consider looking into resources related to Hawaii Garnishee Disclosure.