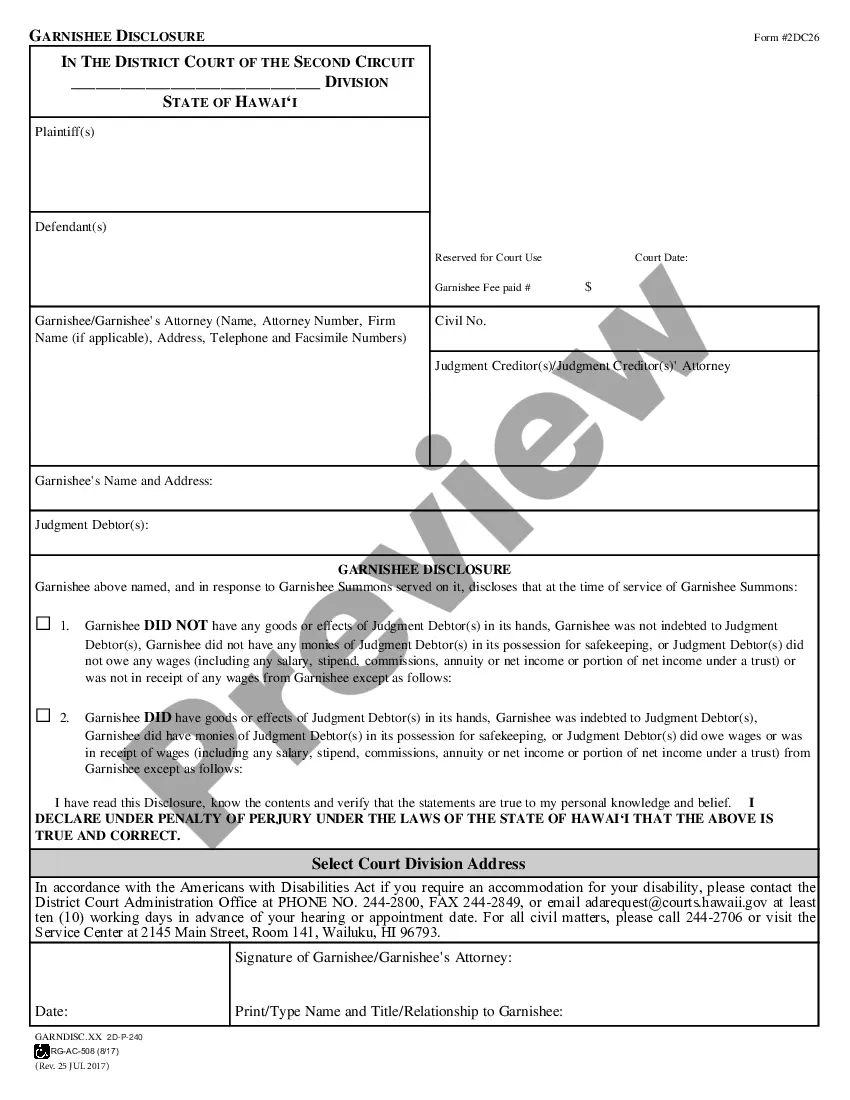

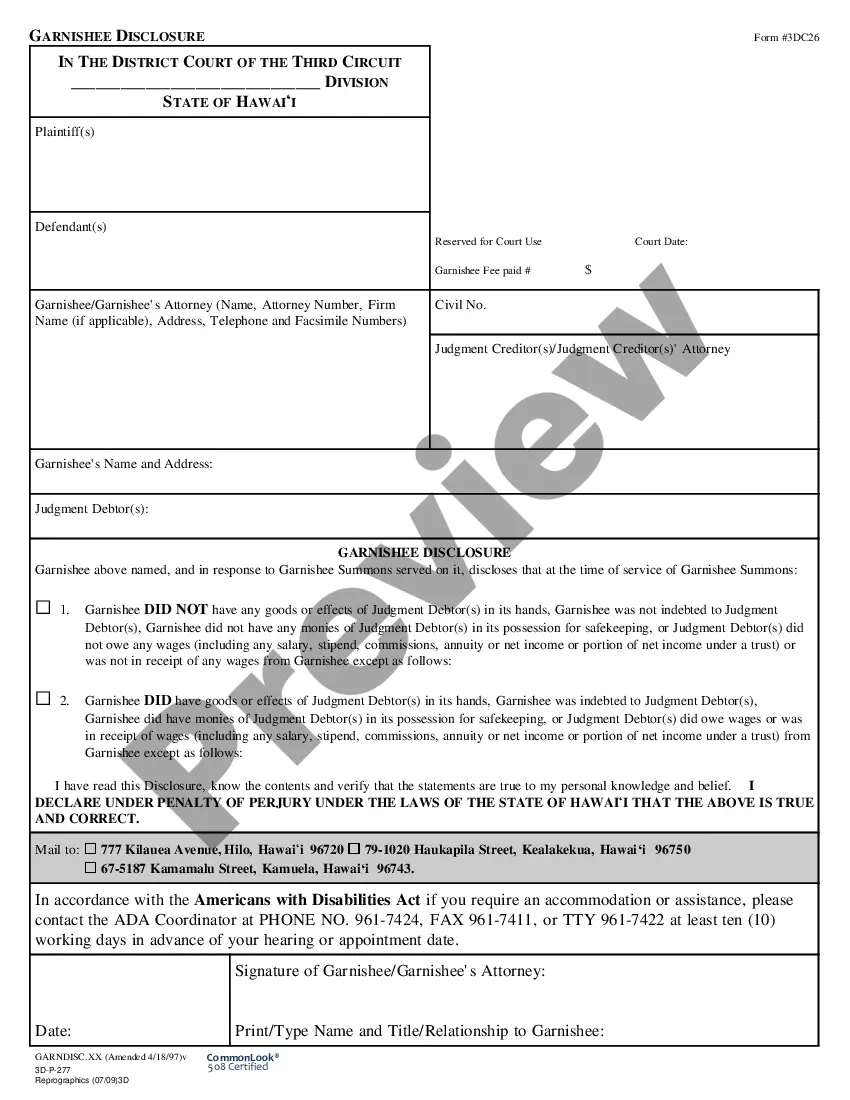

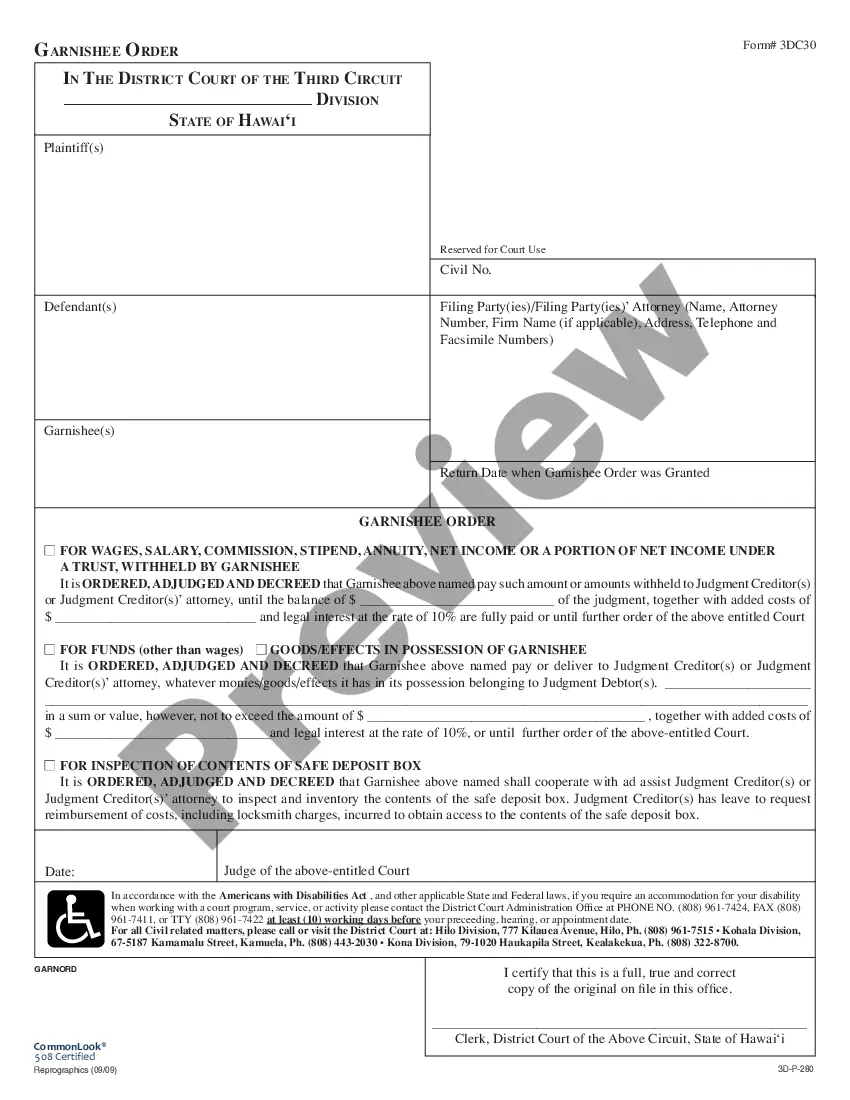

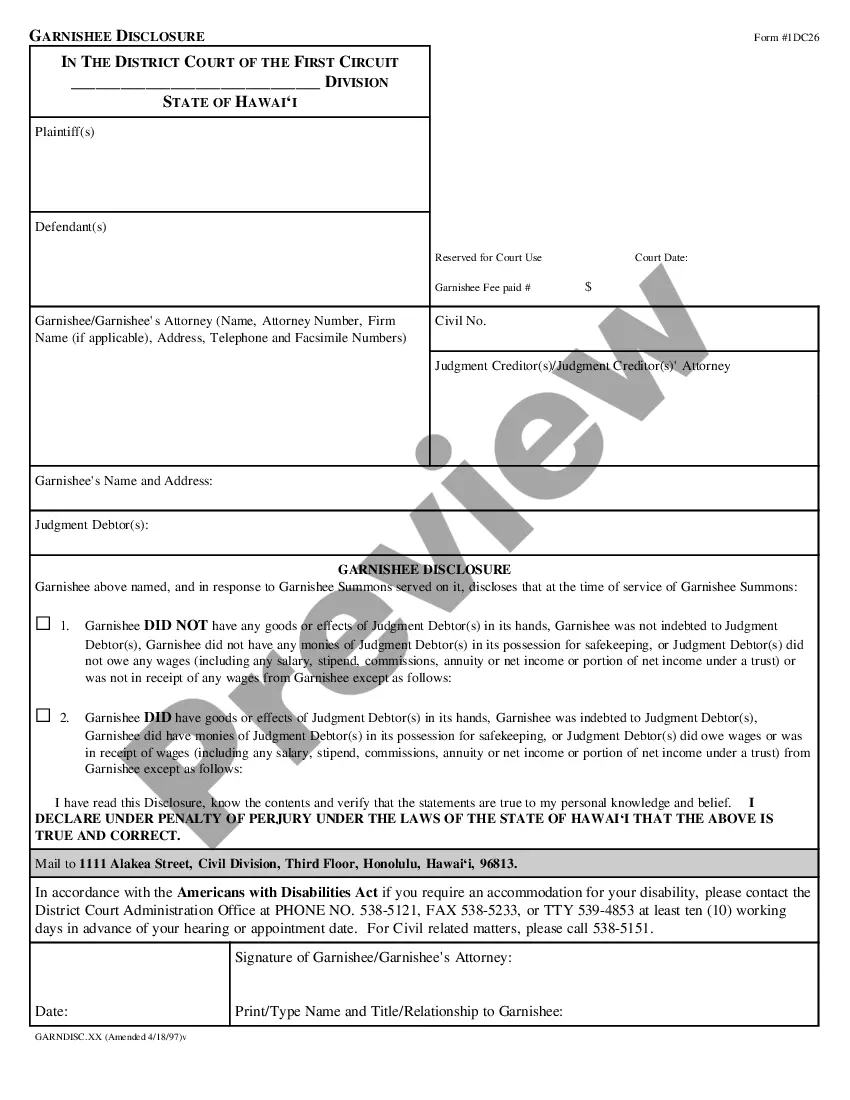

This official form is to be completed by a garnishee in response to a summons. The garnishee is to state whether garnishee was in possession of monies owed the judgment debtor at the time of the summons, and, if so, what was done with the monies.

Hawaii Garnishee Disclosure

Description

How to fill out Hawaii Garnishee Disclosure?

Obtain entry to the largest collection of sanctioned documents.

US Legal Forms serves as a means to locate any state-specific document in a few clicks, including examples of Hawaii Garnishee Disclosure.

There's no need to squander hours of your time searching for an acceptable court sample.

After selecting a pricing plan, register your account. Complete payment via card or PayPal. Download the template to your device by clicking on the Download button. That's it! Fill out the Hawaii Garnishee Disclosure form and verify it. To ensure everything is correct, consult your local legal advisor for assistance. Join and effortlessly browse through over 85,000 useful documents.

- To utilize the forms library, choose a subscription and create an account.

- If you've created an account, simply Log In and then click Download.

- The Hawaii Garnishee Disclosure template will swiftly be saved in the My documents section (a section for all forms you store on US Legal Forms).

- To create a new account, refer to the concise instructions provided below.

- If you need to use a state-specific document, ensure to specify the correct state.

- If possible, examine the description to understand all the details of the document.

- Make use of the Preview feature if it’s available to check the content of the document.

- If everything looks accurate, click on the Buy Now button.

Form popularity

FAQ

Employers generally must comply with a court order to garnish wages, but they cannot refuse if the order is valid. However, employers may have specific policies regarding the garnishment process that could impact how they handle such requests. Understanding the obligations set by the Hawaii Garnishee Disclosure can clarify your employer's role in the process. If you're seeking clarity, platforms like US Legal Forms offer valuable insights and resources to assist you.

In Hawaii, the maximum amount that can be garnished from your paycheck typically depends on your income and the type of debt. Generally, the law allows creditors to take up to 25% of your disposable income, but various exemptions may apply. To navigate this complex landscape effectively, understanding the Hawaii Garnishee Disclosure is essential. Consider resources from US Legal Forms to guide you through the nuances of wage garnishment limits.

In most cases, a court order is necessary to garnish your wages, which means you should receive notice. However, some legal processes can occur without your immediate awareness, as parties are not always required to inform you ahead of time. It's crucial to be familiar with the Hawaii Garnishee Disclosure rules to understand your rights better. Utilizing platforms like US Legal Forms can help you stay informed about these legal notices and procedures.

In Hawaii, a judgment typically lasts for ten years from the date it was entered by the court. If necessary, you can renew the judgment for another ten years before it expires. It is important to monitor the expiration date, as judgments can lose their enforceability if not renewed. For accurate information and forms, you can rely on US Legal Forms, simplifying your judgment management.

The entry of default in Hawaii occurs when a defendant fails to respond to a lawsuit within the specified time frame, resulting in the plaintiff winning by default. This legal concept streamlines the process for cases where defendants do not engage, thereby moving the case forward. Understanding this process is important for effective legal action. For further insights, consider using services related to Hawaii Garnishee Disclosure to navigate these legal waters.

Filing a lawsuit after 10 years is typically not possible due to the statute of limitations imposed on various claims. Each type of claim has a specific timeframe for filing, and exceeding this period usually bars recovery of damages. It’s essential to understand these limits to protect your rights effectively. Consulting platforms that cover Hawaii Garnishee Disclosure will help clarify how statutes could affect your specific situation.

In Hawaii, the statute of limitations for filing a civil lawsuit generally ranges from two to six years, depending on the nature of the claim. For instance, personal injury cases typically must be filed within two years, while written contract claims can take up to six years. Missing this deadline can result in losing your chance for relief, so acting promptly is crucial. Resources focusing on Hawaii Garnishee Disclosure can guide you through relevant timelines.

Deciding whether to sue for $500 involves considering the time, costs, and potential outcomes of legal action. While a financial dispute might feel significant, legal fees can outweigh the actual recovery amount. It’s essential to weigh the pros and cons. Exploring solutions related to Hawaii Garnishee Disclosure can provide additional perspectives on how to handle such disputes effectively.

Rule 37 of the Hawaii Family Court relates to the disclosure of financial information during disputes, especially concerning child support and alimony. This rule requires parties to provide transparent financial statements to ensure fair decisions. Understanding this rule is crucial for navigating family law successfully. You can learn more through platforms that specialize in Hawaii Garnishee Disclosure.

In Hawaii, the law typically allows creditors to garnish up to 25% of your disposable earnings. This means that after mandatory deductions, the remaining amount can be subject to garnishment. However, specifics can change based on your situation, so it’s wise to check recent guidelines. For detailed assistance, consider utilizing resources that address Hawaii Garnishee Disclosure.