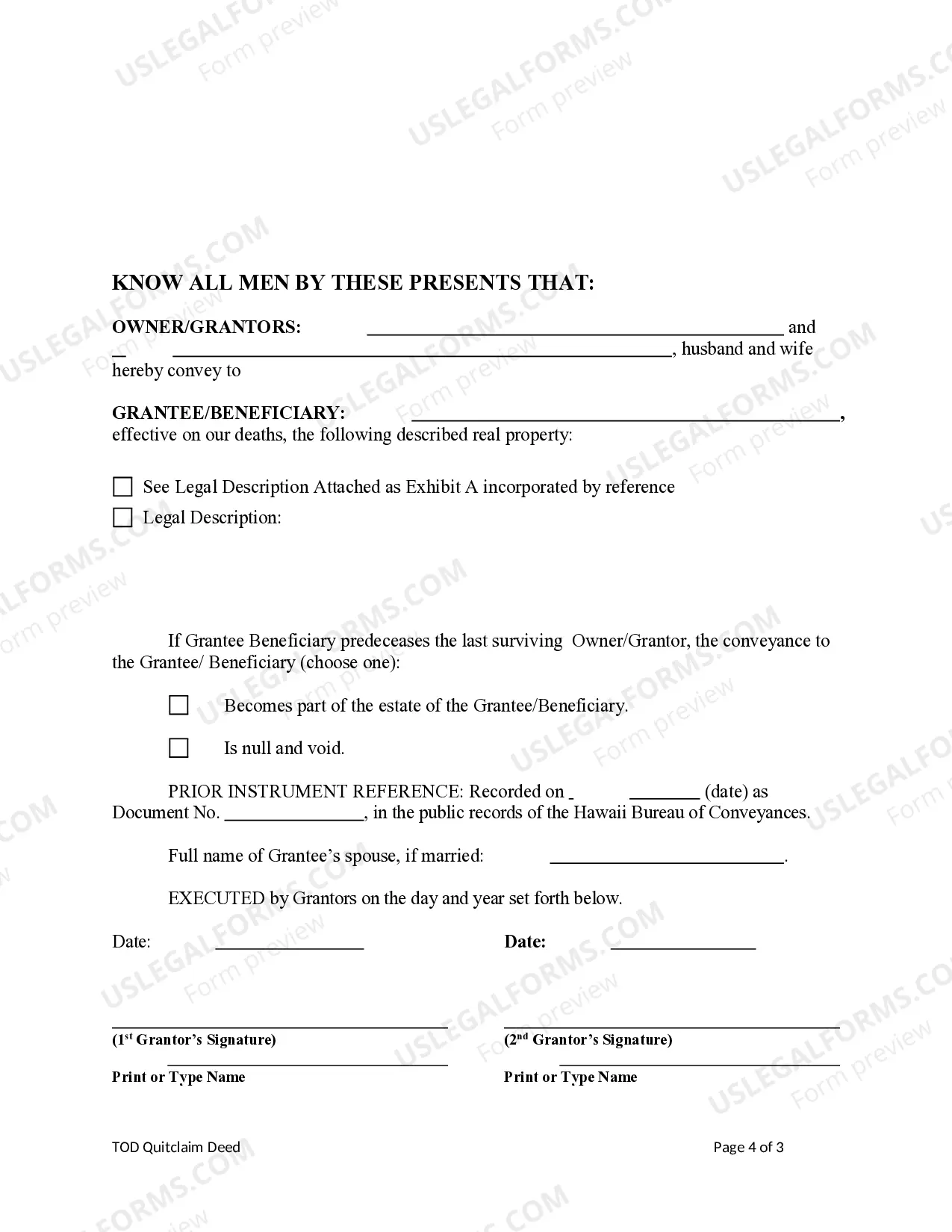

This form is a Transfer on Death Deed where the Grantor / Owners are two individuals or husband and wife and the Grantee is an individual. This transfer is revocable by Grantors until death and effective only upon the death of the last surviving Grantor. This deed complies with all state statutory laws.

Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual

Description

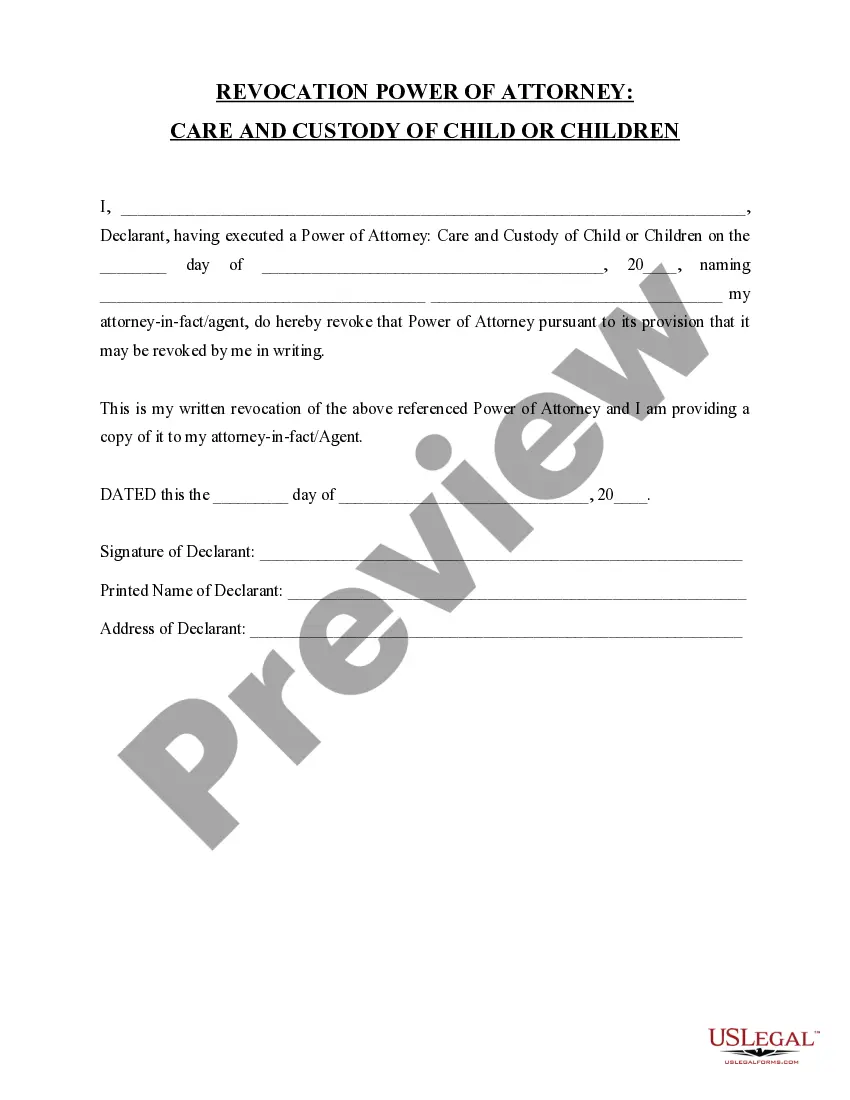

How to fill out Hawaii Transfer On Death Quitclaim Deed From Two Individuals Or Husband And Wife To An Individual?

Obtain access to one of the largest collections of legal documents. US Legal Forms serves as a resource to locate any state-specific form in just a few clicks, including the Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual templates.

There’s no need to squander your time searching for a court-admissible template. Our certified experts make sure that you receive the most current samples at all times.

To take advantage of the document library, select a subscription and create an account. If you have already created it, simply Log In and click Download. The Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual template will be immediately saved in the My documents section (a section for all forms you save on US Legal Forms).

That's it! You should file the Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual template and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and explore over 85,000 beneficial forms.

- If you plan to use a state-specific template, ensure you select the correct state.

- If possible, review the description to understand all the details of the document.

- Utilize the Preview feature if it's available to examine the document's content.

- If everything appears accurate, click on the Buy Now button.

- After selecting a pricing plan, set up your account.

- Make a payment using a credit card or PayPal.

- Download the document to your device by clicking Download.

Form popularity

FAQ

A quit claim deed in Hawaii allows one person to transfer their interest in a property to another, with minimal legal formalities. When using a Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual, the property transfers automatically upon the death of the original owners, avoiding probate. It is essential to ensure the deed is properly executed and recorded to effectively carry out this transfer. Using reliable platforms like uslegalforms can help streamline this process and ensure you meet all requirements.

One of the main disadvantages of a quit claim deed is that it provides no warranty about the ownership or condition of the property. Therefore, the recipient may inherit undisclosed debts or claims against the property. Additionally, using a Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual does not guarantee that the property will pass to the intended person if the grantors have outstanding debts at the time of death. As always, consider consulting a legal professional to explore potential risks.

While the Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual offers significant advantages, there are potential drawbacks. One concern is that it does not protect the property from creditors after death, which can affect beneficiaries. Additionally, if the grantors change their minds, they cannot revoke the deed without following specific legal steps. Understanding these aspects is critical, and using uslegalforms can provide the guidance you need on this important decision.

You do not need an attorney to execute a transfer on death deed in Hawaii. The process can be straightforward if you follow the legal requirements carefully. However, using a service like uslegalforms may streamline your efforts, ensuring you complete the Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual correctly. Sometimes, professional help brings additional clarity to your estate planning.

While it is not legally required to have a lawyer for a Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual, seeking legal advice can be beneficial. An attorney can help ensure that all aspects of the deed comply with state laws, reducing the risk of errors. Additionally, having a lawyer can provide peace of mind and clarity in terms of your estate planning. Consider reaching out to uslegalforms for resources that simplify the process.

A quitclaim deed in Hawaii allows individuals, such as two owners or a married couple, to transfer property ownership without guaranteeing the title's quality. When using a Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual, the process becomes clearer, especially for estate planning. This deed ensures that, upon the death of one or both owners, the property transfers directly to a designated person without the need for probate. Uslegalforms provides resources and templates that simplify this process, ensuring you can complete your deed accurately and confidently.

The main difference is timing. A quitclaim deed transfers ownership of property immediately, while a transfer on death deed only takes effect after the owner's death. Using the Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual allows for posthumous transfers, which can simplify estate management and avoid probate.

You do not necessarily need a lawyer to execute a transfer on death deed, but advice from one can be beneficial. Having a legal professional review your document can ensure compliance with Hawaii laws and eliminate errors. This is especially important when dealing with the Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual to protect your interests.

To fill out a quit claim deed to add a spouse, ensure you include both parties' names and specify the property being conveyed. Clearly state the intention to transfer ownership to your spouse, especially if you are using the Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual. Use clear language, and consider using a reliable platform like USLegalForms to access the right templates and guidance.

One disadvantage of a transfer on death deed is that it does not protect the property from creditors. Additionally, the transfer is automatic, which could cause issues if the beneficiary is not prepared to manage the property. Understanding these limitations is crucial when considering the Hawaii Transfer on Death Quitclaim Deed from Two Individuals or Husband and Wife to an Individual as part of your estate plan.