Guam Assignment of After Payout Interest

Description

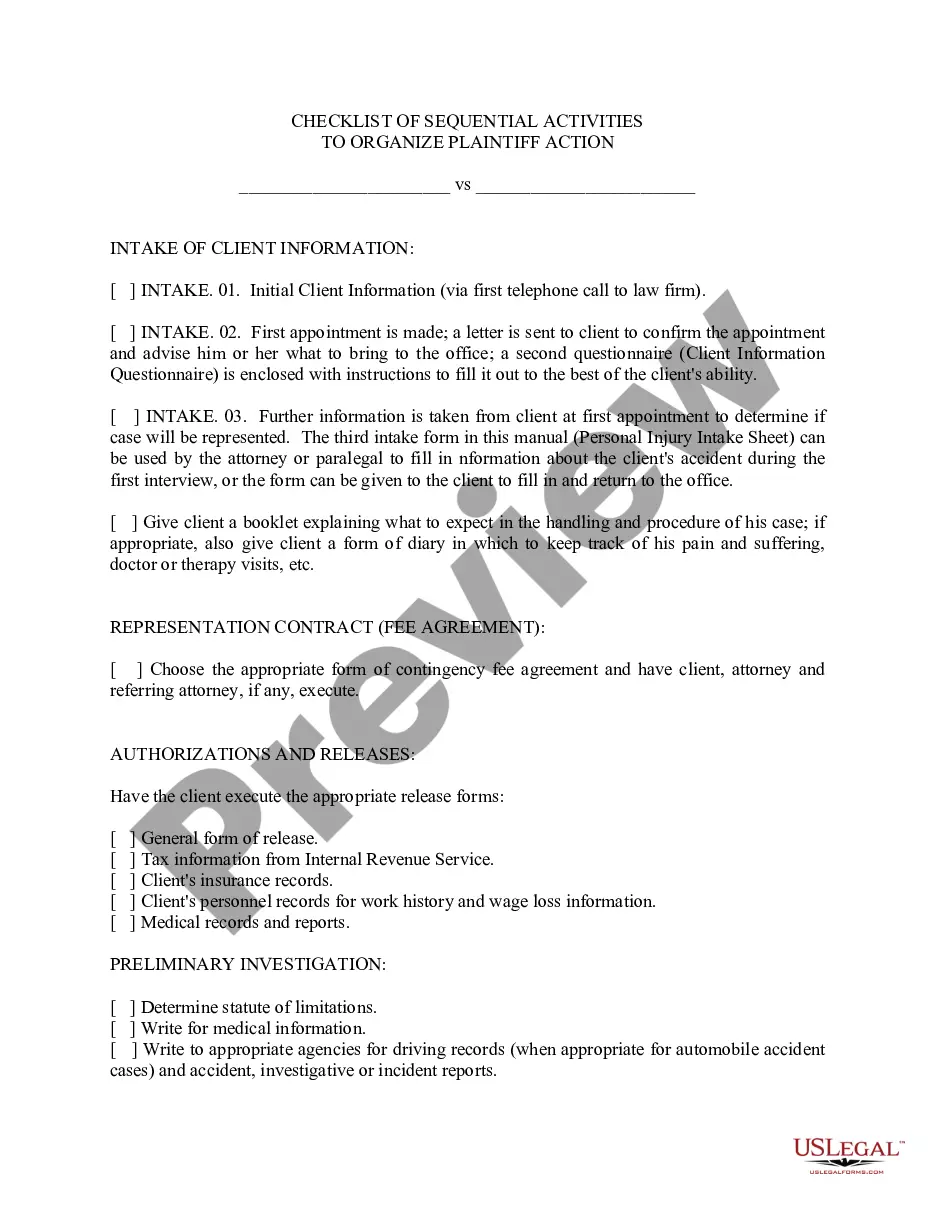

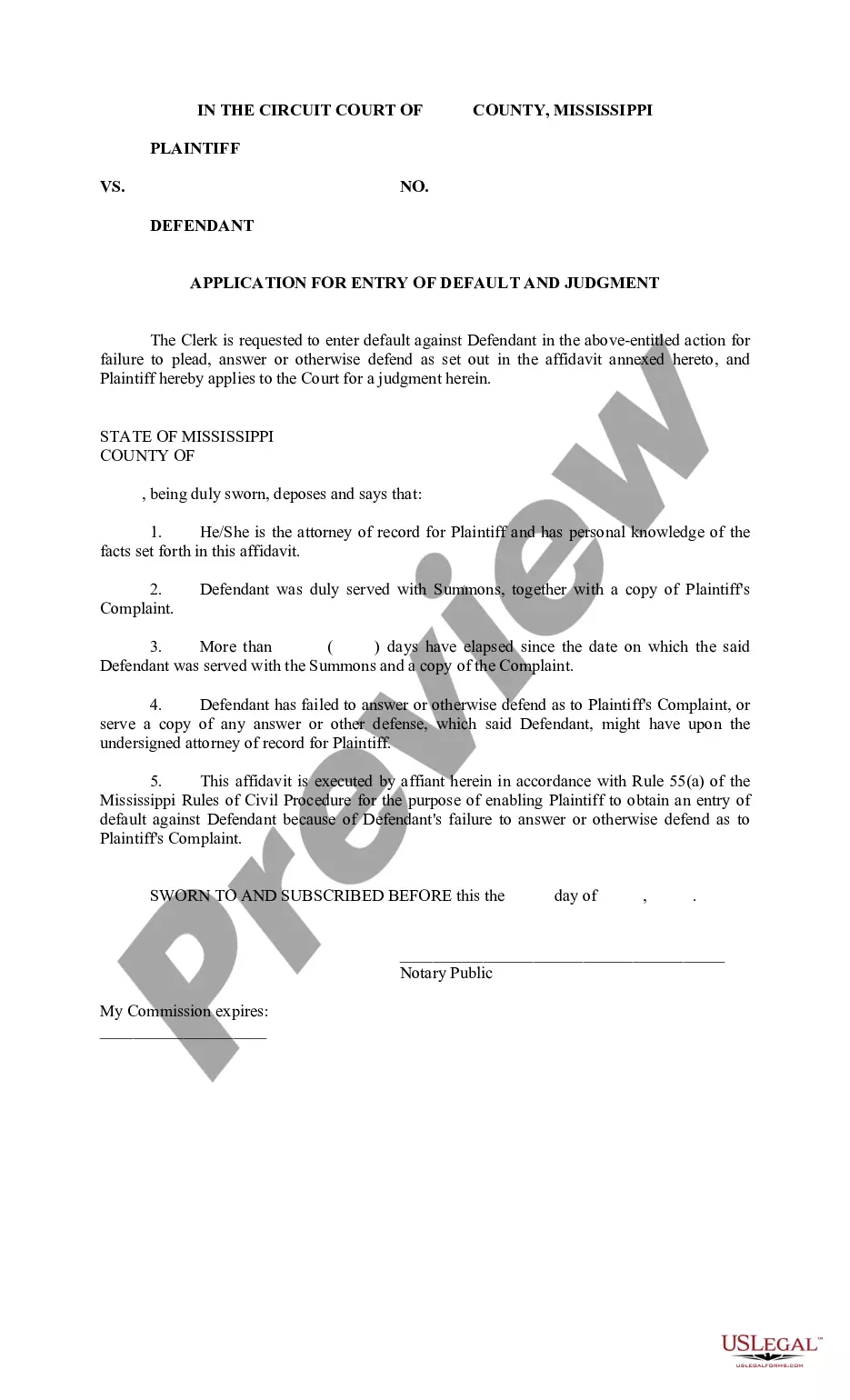

How to fill out Assignment Of After Payout Interest?

US Legal Forms - among the biggest libraries of lawful types in America - gives a variety of lawful papers templates you can acquire or print. While using website, you can find a huge number of types for organization and personal uses, categorized by groups, says, or keywords.You will discover the most up-to-date versions of types much like the Guam Assignment of After Payout Interest within minutes.

If you have a monthly subscription, log in and acquire Guam Assignment of After Payout Interest through the US Legal Forms collection. The Acquire key will show up on each and every kind you see. You have access to all previously saved types inside the My Forms tab of your own bank account.

If you would like use US Legal Forms the very first time, listed below are simple directions to obtain started out:

- Ensure you have picked the right kind for your area/county. Click on the Review key to check the form`s articles. Browse the kind information to ensure that you have selected the appropriate kind.

- In case the kind does not match your demands, take advantage of the Lookup field near the top of the monitor to discover the the one that does.

- When you are pleased with the shape, validate your choice by visiting the Acquire now key. Then, select the prices prepare you prefer and supply your references to sign up for the bank account.

- Method the purchase. Use your charge card or PayPal bank account to finish the purchase.

- Choose the structure and acquire the shape on your gadget.

- Make modifications. Fill up, change and print and indicator the saved Guam Assignment of After Payout Interest.

Each and every format you put into your money does not have an expiration time and it is your own permanently. So, if you wish to acquire or print another duplicate, just visit the My Forms area and then click about the kind you want.

Gain access to the Guam Assignment of After Payout Interest with US Legal Forms, probably the most considerable collection of lawful papers templates. Use a huge number of professional and status-particular templates that satisfy your company or personal demands and demands.

Form popularity

FAQ

Guam does not use a state withholding form because there is no personal income tax in Guam.

The Use Tax Law is outlined in Chapter 28 of Title 11 GCA and states that every person who imports into Guam, or acquires in Guam from any other person, any property for his use or consumption shall be subject to 4% Use Tax based on the landed value of such property. This is not applicable to items imported for resale.

Guam will rebate 75% of income taxes for 20 years on income from qualifying Guam businesses. If the business is conducted as an "S" corporation, the rebate is available to shareholders.

Personal and Corporate Income Tax Bona fide residents of Guam are subject to special U.S. tax rules. In general, all individuals with income from Guam will file only one return?either to Guam or the United States. If you are a bona fide resident of Guam during the entire tax year, file your return with Guam.

Sales and Use Tax If you sell taxable goods or services to customers, you'll need to register for a GuamTax.com business account and collect Guam's 2% sales tax. However, the following services are exempt from Guam sales tax: Banking and lending services. Foreign currency services.