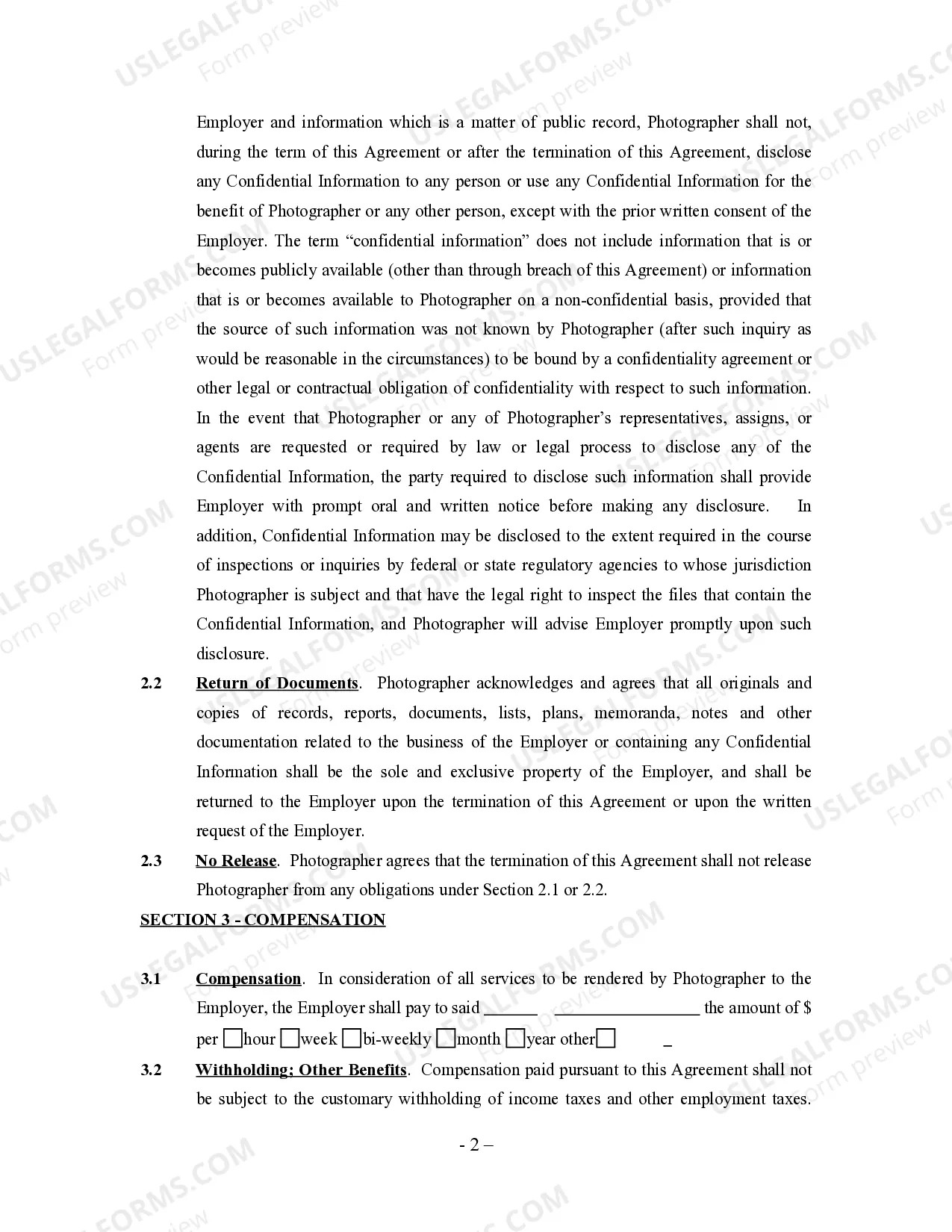

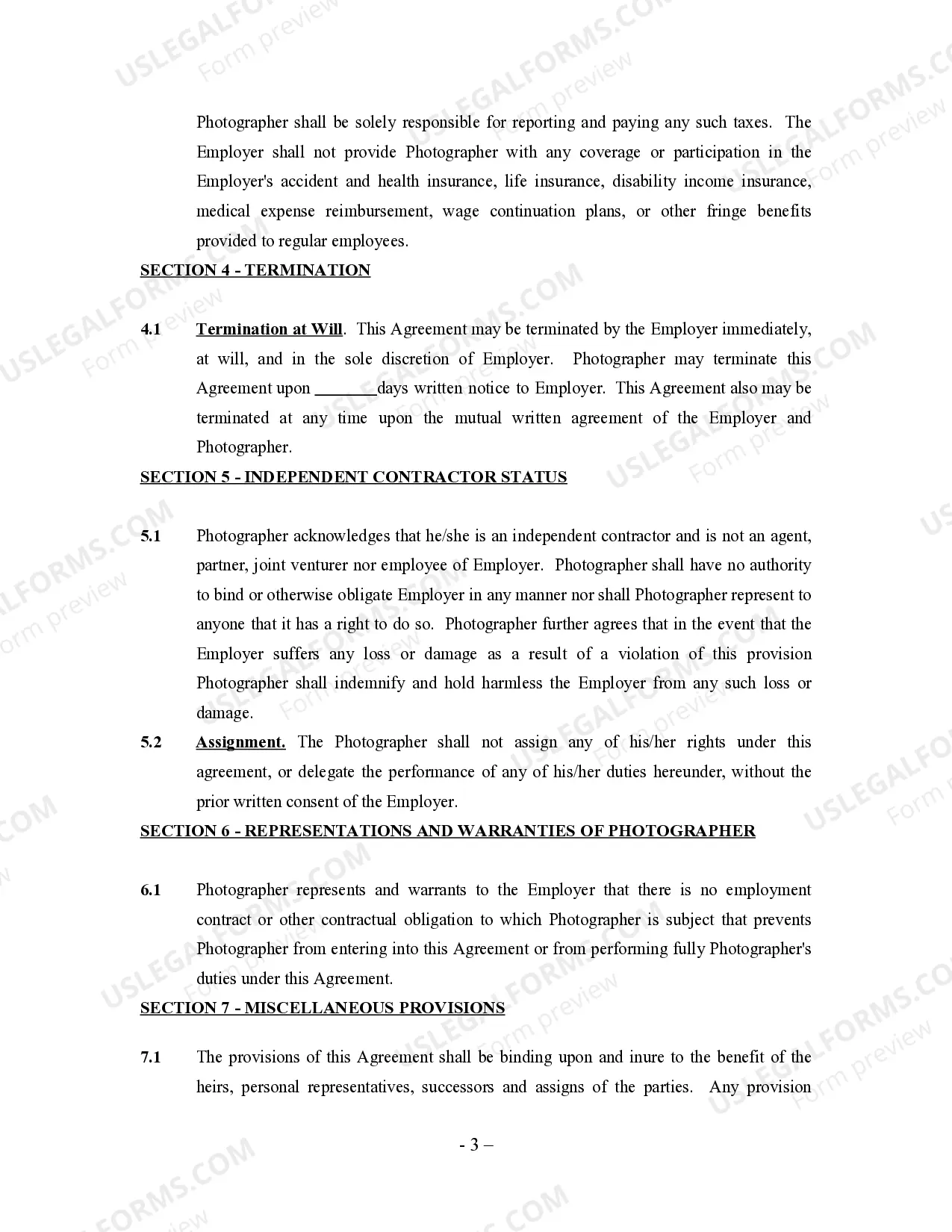

Guam Freelance Photographer Agreement - Self-Employed Independent Contractor

Description

How to fill out Freelance Photographer Agreement - Self-Employed Independent Contractor?

Are you within a position where you will need papers for both enterprise or personal functions just about every time? There are a variety of authorized papers templates available on the net, but getting ones you can rely on is not straightforward. US Legal Forms gives thousands of type templates, such as the Guam Freelance Photographer Agreement - Self-Employed Independent Contractor, that are composed in order to meet federal and state demands.

Should you be currently acquainted with US Legal Forms internet site and get a merchant account, basically log in. Next, you may obtain the Guam Freelance Photographer Agreement - Self-Employed Independent Contractor template.

If you do not offer an bank account and would like to begin using US Legal Forms, follow these steps:

- Get the type you will need and ensure it is for that correct town/state.

- Take advantage of the Preview key to examine the form.

- See the explanation to actually have selected the correct type.

- In the event the type is not what you`re seeking, utilize the Search area to obtain the type that meets your requirements and demands.

- When you find the correct type, click on Acquire now.

- Select the costs program you desire, fill out the specified information to create your account, and buy an order utilizing your PayPal or bank card.

- Select a convenient file file format and obtain your backup.

Locate every one of the papers templates you may have purchased in the My Forms food list. You can get a further backup of Guam Freelance Photographer Agreement - Self-Employed Independent Contractor whenever, if necessary. Just click the needed type to obtain or print the papers template.

Use US Legal Forms, by far the most substantial selection of authorized types, in order to save time and steer clear of blunders. The support gives expertly made authorized papers templates that can be used for a variety of functions. Generate a merchant account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

Professional photographers have their own photo studio and darkroom that can cater to all their clients' needs, unlike freelancers who don't have unlimited access to professional equipment, and often have to rent space, and rent equipment. Of course, freelancers have no fixed income.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

A freelancer is similar to an independent contractor, but they tend to work on a project-to-project basis and have multiple employers at the same time. Independent contractors will be on long-term contracts, where freelancers are usually hired on short-term contracts.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Since they own their own limited company, you would be dealing with the individual directly, rather than liaising with an agency. Freelancers on the other hand, always work on their own. As an employer, you reach out to them directly, you do not have to go via an agency or a vendor to hire a freelancer.

An independent contractor often functions as a freelancer, but typically will work with one client for a longer time frame. In many cases, independent contractors work for an hourly rate. Furthermore, they might work through a third party or agency but can also work on their own.

An independent contractor often functions as a freelancer, but typically will work with one client for a longer time frame. In many cases, independent contractors work for an hourly rate. Furthermore, they might work through a third party or agency but can also work on their own.

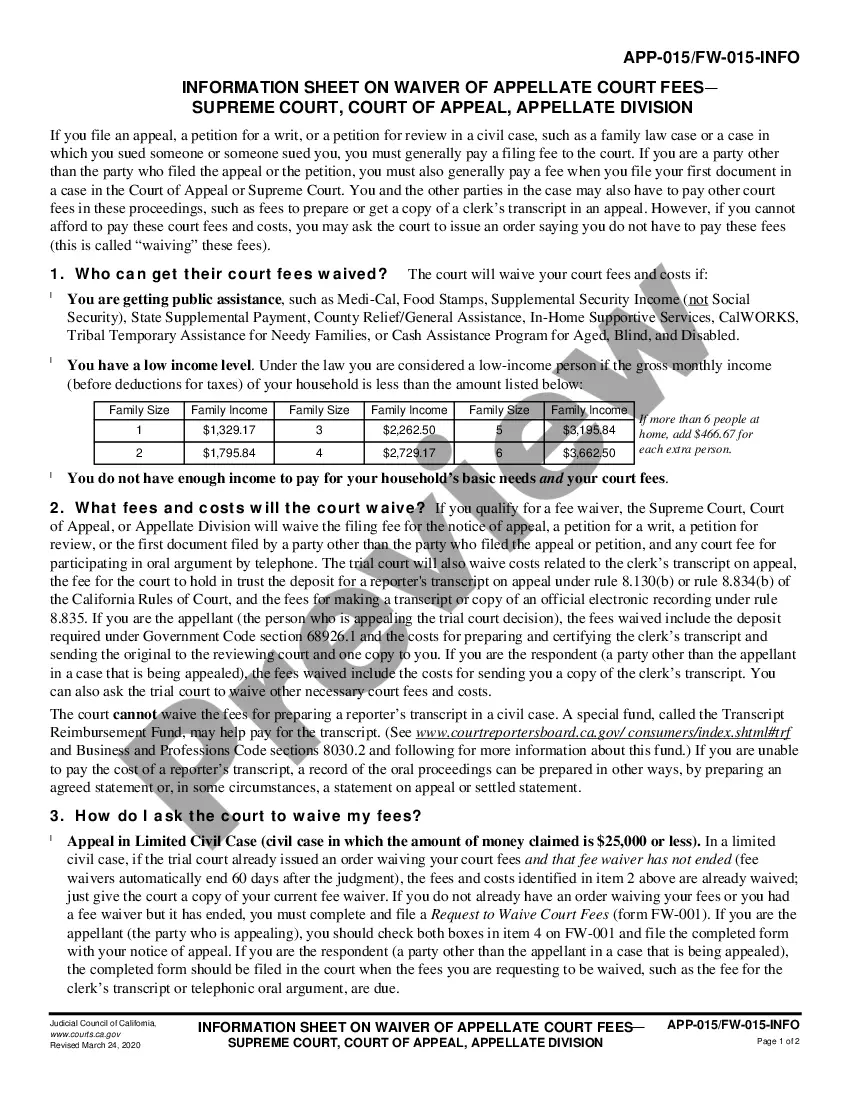

California Governor Gavin Newsom has quietly signed a new law that exempts freelance photographers and some other types of independent contractors from the controversial AB 5 law that forced a huge range of freelancers to become employees.