Guam Employer Training Memo - Payroll Deductions

Description

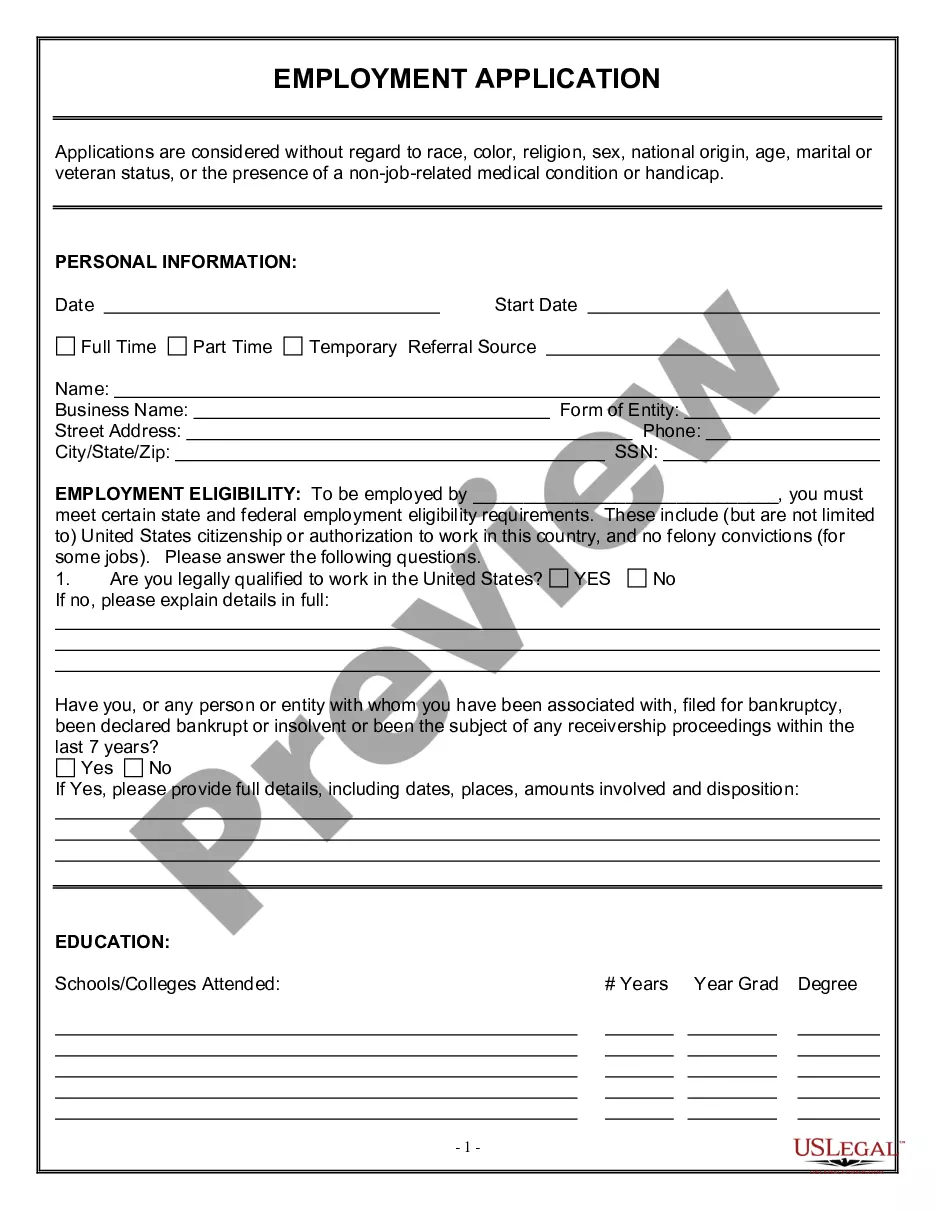

How to fill out Employer Training Memo - Payroll Deductions?

US Legal Forms - one of several most significant libraries of legitimate types in the States - offers an array of legitimate record layouts you can download or produce. Using the internet site, you can find a large number of types for organization and specific functions, sorted by types, states, or key phrases.You will discover the latest variations of types such as the Guam Employer Training Memo - Payroll Deductions in seconds.

If you currently have a subscription, log in and download Guam Employer Training Memo - Payroll Deductions through the US Legal Forms catalogue. The Down load button can look on every develop you look at. You have accessibility to all formerly acquired types within the My Forms tab of your own accounts.

In order to use US Legal Forms initially, listed here are straightforward recommendations to help you get started out:

- Make sure you have picked the right develop for the town/area. Click on the Review button to check the form`s content material. Browse the develop explanation to ensure that you have chosen the correct develop.

- In case the develop does not fit your specifications, utilize the Search industry on top of the screen to find the one that does.

- When you are happy with the shape, confirm your choice by clicking on the Get now button. Then, choose the prices plan you like and supply your references to sign up for an accounts.

- Approach the transaction. Make use of your bank card or PayPal accounts to complete the transaction.

- Choose the formatting and download the shape on the gadget.

- Make modifications. Complete, modify and produce and indication the acquired Guam Employer Training Memo - Payroll Deductions.

Each and every design you included with your bank account lacks an expiry particular date and is your own forever. So, if you want to download or produce yet another version, just check out the My Forms portion and click on in the develop you need.

Obtain access to the Guam Employer Training Memo - Payroll Deductions with US Legal Forms, probably the most comprehensive catalogue of legitimate record layouts. Use a large number of expert and condition-certain layouts that meet your organization or specific demands and specifications.

Form popularity

FAQ

Mandatory payroll deductionsFICA tax. Federal Insurance Contributions Act (FICA) tax is made up of Social Security and Medicare taxes.Federal income tax.State and local taxes.Garnishments.Health insurance premiums.Retirement plans.Life insurance premiums.Job-related expenses.

Mandatory Payroll Tax DeductionsFederal income tax withholding.Social Security & Medicare taxes also known as FICA taxes.State income tax withholding.Local tax withholdings such as city or county taxes, state disability or unemployment insurance.Court ordered child support payments.

There are three basic categories of deductions employers make from pay: legally required deductions, deductions for the employer's convenience and deductions for the employee's benefit.

You can deduct up to $5,250 (or an unlimited amount if the education is job related) of education reimbursements as an employee benefit expense. And you don't have to withhold income tax or pay payroll taxes on these reimbursements.

Some mandatory payroll tax deductions that employers are required by law to withhold from an employee's paycheck include:Federal income tax withholding.Social Security & Medicare taxes also known as FICA taxes.State income tax withholding.More items...?

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments.Child support payments.

There are two types of payroll deductions: mandatory and voluntary.Mandatory payroll deductions are required by law, like federal and state income taxes.Voluntary payroll deductions, on the other hand, are payroll deductions your employees can elect to have, such as insurance or retirement plans.

Pre-tax deductions: Medical and dental benefits, 401(k) retirement plans (for federal and most state income taxes) and group-term life insurance. Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations.

Common itemized deductions include interest on a mortgage loan, unreimbursed healthcare costs, charitable contributions, and state and local taxes. Please consult a tax professional to determine whether a standard deduction or itemizing works for your financial situation.

Mandatory payroll deductionsFICA tax. Federal Insurance Contributions Act (FICA) tax is made up of Social Security and Medicare taxes.Federal income tax.State and local taxes.Garnishments.Health insurance premiums.Retirement plans.Life insurance premiums.Job-related expenses.