Guam Certificate of Accredited Investor Status

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

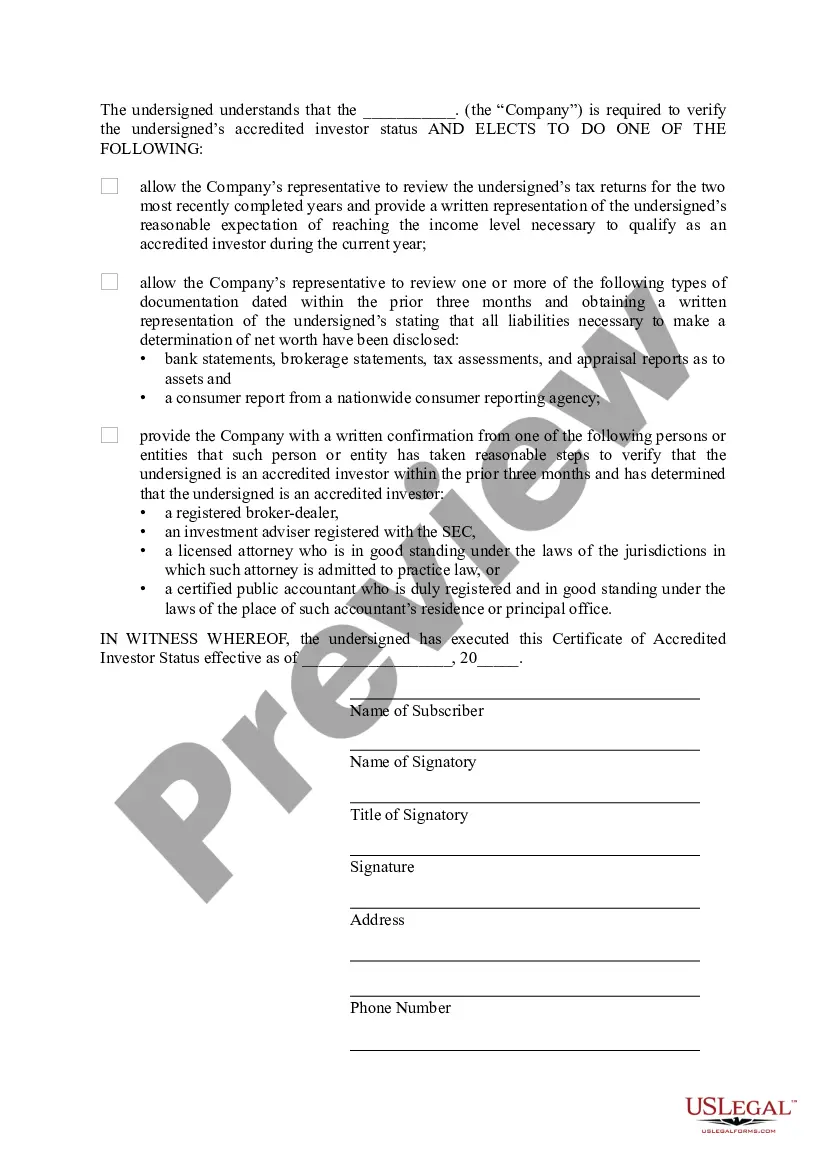

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Certificate Of Accredited Investor Status?

You may spend time on the Internet searching for the lawful papers web template that suits the state and federal needs you will need. US Legal Forms supplies a huge number of lawful varieties which are analyzed by professionals. You can easily obtain or produce the Guam Certificate of Accredited Investor Status from your service.

If you already possess a US Legal Forms bank account, it is possible to log in and click on the Acquire button. After that, it is possible to complete, modify, produce, or sign the Guam Certificate of Accredited Investor Status. Each and every lawful papers web template you acquire is yours eternally. To get one more copy for any obtained form, proceed to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms site initially, keep to the simple instructions under:

- Very first, ensure that you have selected the right papers web template for your area/town of your choice. See the form explanation to ensure you have picked out the appropriate form. If available, use the Preview button to appear through the papers web template too.

- If you would like find one more edition of the form, use the Search discipline to find the web template that fits your needs and needs.

- Upon having found the web template you desire, click on Get now to carry on.

- Pick the pricing plan you desire, type your accreditations, and sign up for your account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal bank account to fund the lawful form.

- Pick the formatting of the papers and obtain it in your gadget.

- Make alterations in your papers if possible. You may complete, modify and sign and produce Guam Certificate of Accredited Investor Status.

Acquire and produce a huge number of papers web templates using the US Legal Forms Internet site, that provides the largest selection of lawful varieties. Use skilled and express-specific web templates to handle your company or individual requirements.

Form popularity

FAQ

Being a non-accredited investor does not mean that the individual cannot invest; however, investment opportunities for them are different from accredited investors. The options available for non-accredited investors include certain types of bonds, real estate, equities, and other securities.

Non-accredited investors can invest in public company stock (those traded on public stock exchanges), as well as other publicly available assets like bonds, real estate, and art.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

In the U.S., an accredited investor is anyone who meets one of the below criteria: Individuals who have an income greater than $200,000 in each of the past two years or whose joint income with a spouse is greater than $300,000 for those years, and a reasonable expectation of the same income level in the current year.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

When raising money from foreign investors, the company can take advantage of a US federal securities law exemption called Regulation S that does require the foreign investors to be ? accredited investors .? There are other requirements of Regulation S, some of which are somewhat complicated.

No, you do not have to be accredited, but we do require all foreign investors to use a US bank account and complete either a W-8BEN or W-8BEN-E form. The minimum investment criteria differs for foreign investors, as well.

Reviewing bank statements, brokerage statements, and other similar reports to determine net worth. Obtaining written confirmation of the investor's accredited investor status from one of the following persons: a registered broker-dealer, an investment adviser registered with the SEC, a licensed attorney, or a CPA.