Guam Form of Revolving Promissory Note

Description

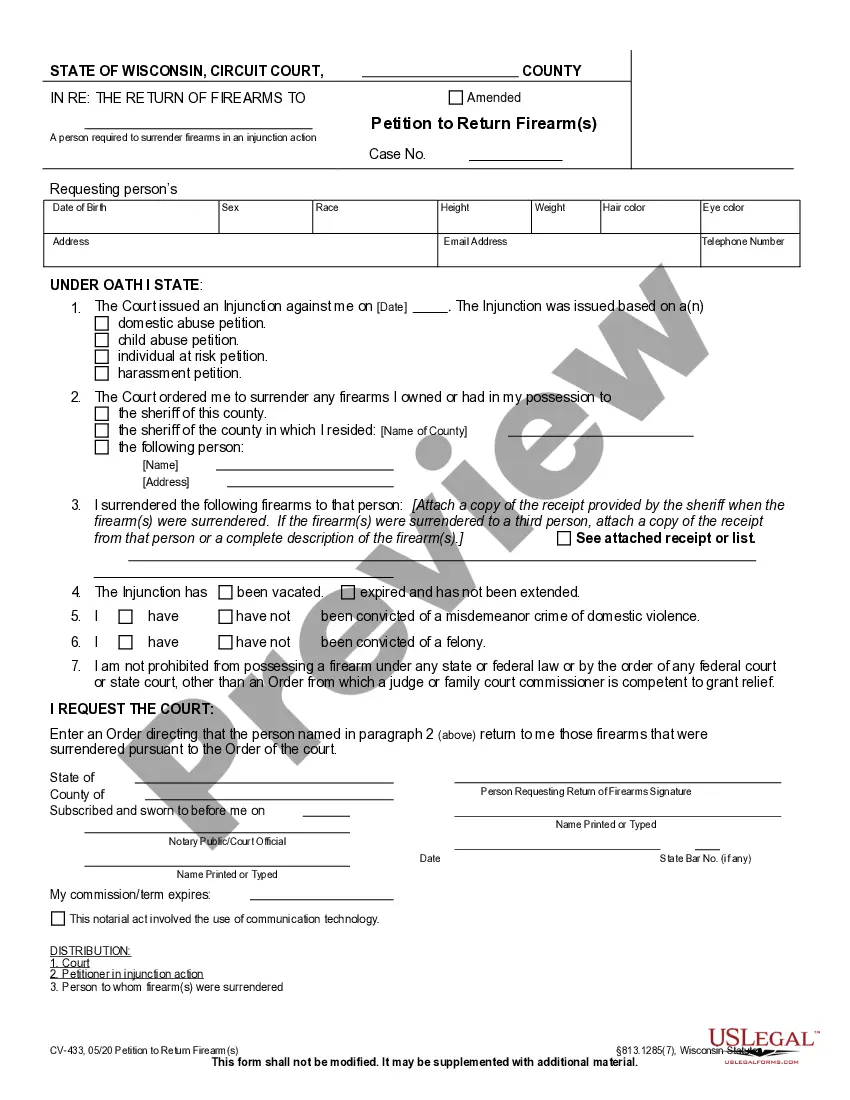

How to fill out Form Of Revolving Promissory Note?

Finding the right lawful document web template can be quite a have difficulties. Of course, there are a lot of layouts available on the net, but how do you find the lawful kind you will need? Make use of the US Legal Forms site. The support offers a large number of layouts, including the Guam Form of Revolving Promissory Note, that can be used for company and personal demands. Each of the forms are checked out by specialists and fulfill state and federal demands.

If you are currently authorized, log in for your profile and then click the Obtain option to find the Guam Form of Revolving Promissory Note. Make use of your profile to appear throughout the lawful forms you have acquired previously. Go to the My Forms tab of your profile and get an additional backup of your document you will need.

If you are a brand new user of US Legal Forms, listed below are basic recommendations for you to stick to:

- Initial, ensure you have selected the proper kind for your town/county. You can check out the form using the Review option and study the form information to make sure this is basically the best for you.

- If the kind is not going to fulfill your preferences, use the Seach discipline to discover the proper kind.

- When you are certain the form is acceptable, go through the Get now option to find the kind.

- Choose the rates strategy you want and type in the necessary info. Create your profile and purchase an order using your PayPal profile or bank card.

- Pick the submit structure and obtain the lawful document web template for your device.

- Comprehensive, change and print and sign the received Guam Form of Revolving Promissory Note.

US Legal Forms is definitely the biggest collection of lawful forms that you can see various document layouts. Make use of the service to obtain skillfully-created documents that stick to state demands.

Form popularity

FAQ

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

Also commonly known as loan stock, loan notes constitute a particular type of debt security called debentures.

Loan notes issues are better suited where the amount borrowed can increase as new lenders come on board. Loan agreements are more cumbersome where the total commitments under the loan are not fixed. If there are to be no obligations on the lender other than to advance the initial money.

A loan note can offer greater flexibility than a simple loan agreement, while still being legally actionable should it need to be upheld in court. They are also much easier to enforce than an informal IOU because the legal terms of the agreement are much more clearly defined.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

What is a loan note? A loan note is a legal agreement between a company and a lender (bank or financial institution). The lender agrees to make a loan to the company, and the company agrees to repay the loan (with interest) by a specified date.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.