Guam Form of Convertible Promissory Note, Common Stock

Description

How to fill out Form Of Convertible Promissory Note, Common Stock?

Discovering the right lawful papers web template might be a have a problem. Needless to say, there are tons of themes available on the Internet, but how do you get the lawful form you want? Take advantage of the US Legal Forms site. The support gives thousands of themes, including the Guam Form of Convertible Promissory Note, Common Stock, which you can use for company and private demands. Every one of the kinds are inspected by experts and satisfy state and federal demands.

If you are previously signed up, log in to your profile and click on the Obtain key to have the Guam Form of Convertible Promissory Note, Common Stock. Utilize your profile to appear with the lawful kinds you possess ordered in the past. Go to the My Forms tab of the profile and get one more duplicate in the papers you want.

If you are a brand new end user of US Legal Forms, here are easy recommendations so that you can stick to:

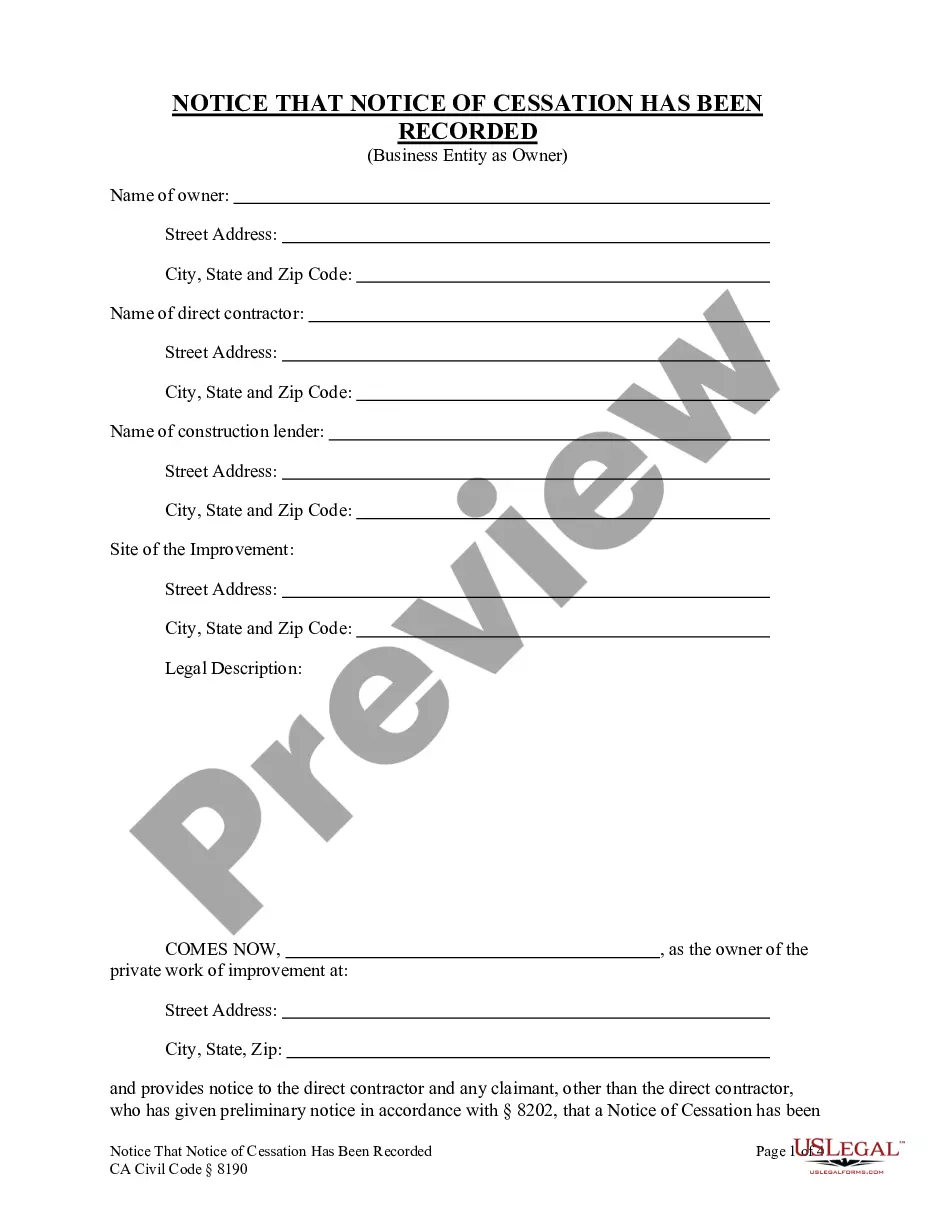

- Very first, ensure you have chosen the right form to your area/state. You are able to look through the form while using Preview key and browse the form explanation to guarantee it is the best for you.

- In case the form does not satisfy your requirements, take advantage of the Seach industry to find the correct form.

- When you are certain the form would work, click the Acquire now key to have the form.

- Select the pricing plan you desire and enter in the essential details. Create your profile and pay money for the order utilizing your PayPal profile or charge card.

- Choose the document format and obtain the lawful papers web template to your device.

- Total, change and print and indication the attained Guam Form of Convertible Promissory Note, Common Stock.

US Legal Forms is definitely the greatest catalogue of lawful kinds where you can find different papers themes. Take advantage of the company to obtain skillfully-produced files that stick to status demands.

Form popularity

FAQ

Convertible promissory notes can be attractive investment instruments for a variety of reasons. Unlike equity financings, note financings do not require companies and investors to negotiate a company valuation and resulting price per share.

A promissory note is simply a form of debt - like a loan or an IOU - that a company may issue to raise money. An investor typically agrees to loan money to a company in exchange for the company's promise that it will pay back the amount, plus interest, over a specific time period.

Convertible loan notes can lead to dilution of existing shareholders' equity when the notes convert. This can be a disadvantage for start-ups that want to maintain control over their company.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

High Risk: Convertible notes can be very risky investments. This is because if the firm does not find another investor who can give them a good valuation, then they will be bound to repay the notes with cash.

Typically, promissory notes are securities. They must be registered with the SEC, a state securities regulator, or be exempt from registration.

In addition to getting the benefit of the accrued interest, which buys the convertible note holders more shares than they would have if they had waited and invested the same amount of money in the equity round of financing, they often get several additional perks in exchange for investing earlier.

The main disadvantages of convertible note offerings are equity dilution and near?term stock price impact and, if the stock price fails to appreciate above the conversion price, potential refinancing risk.