Guam Amendment to the articles of incorporation to eliminate par value

Description

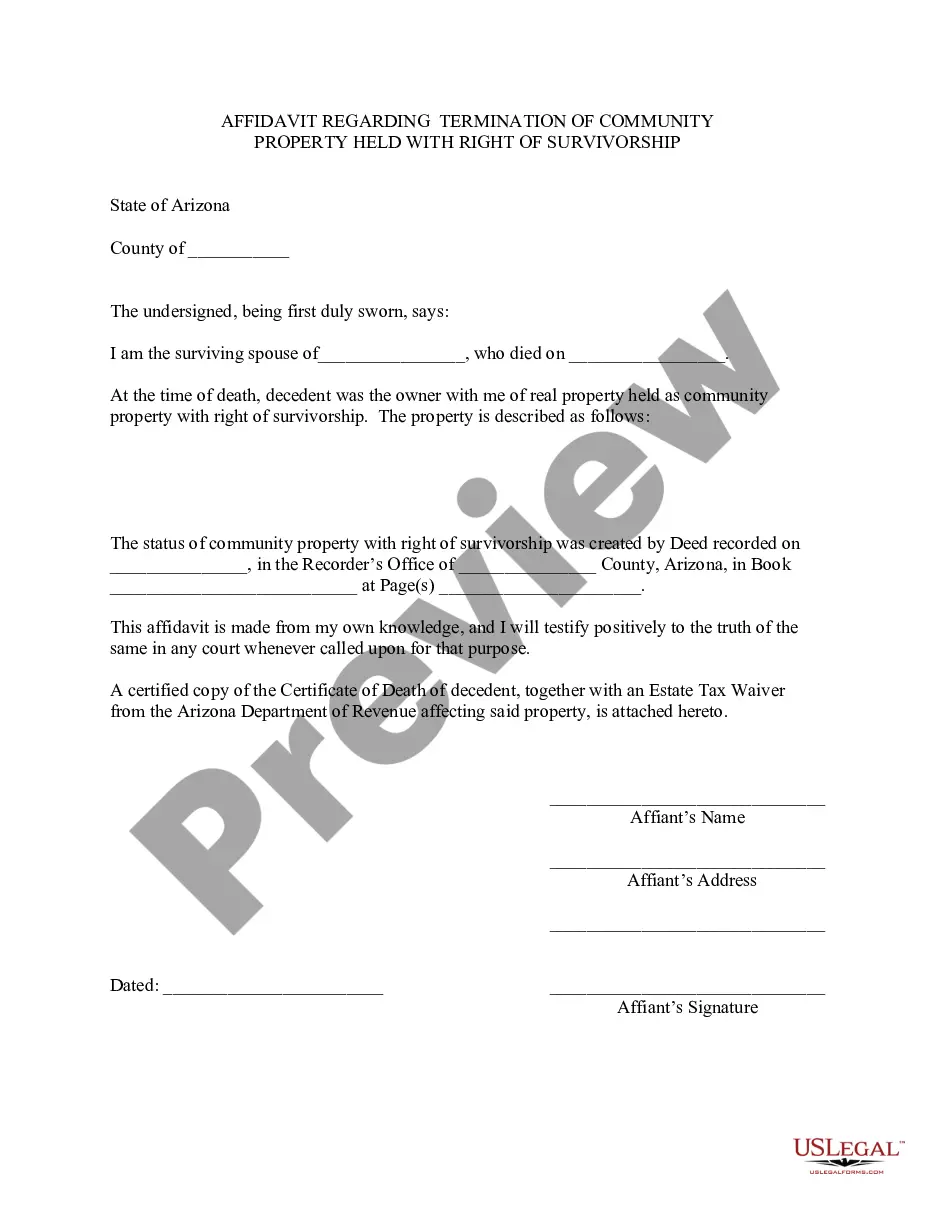

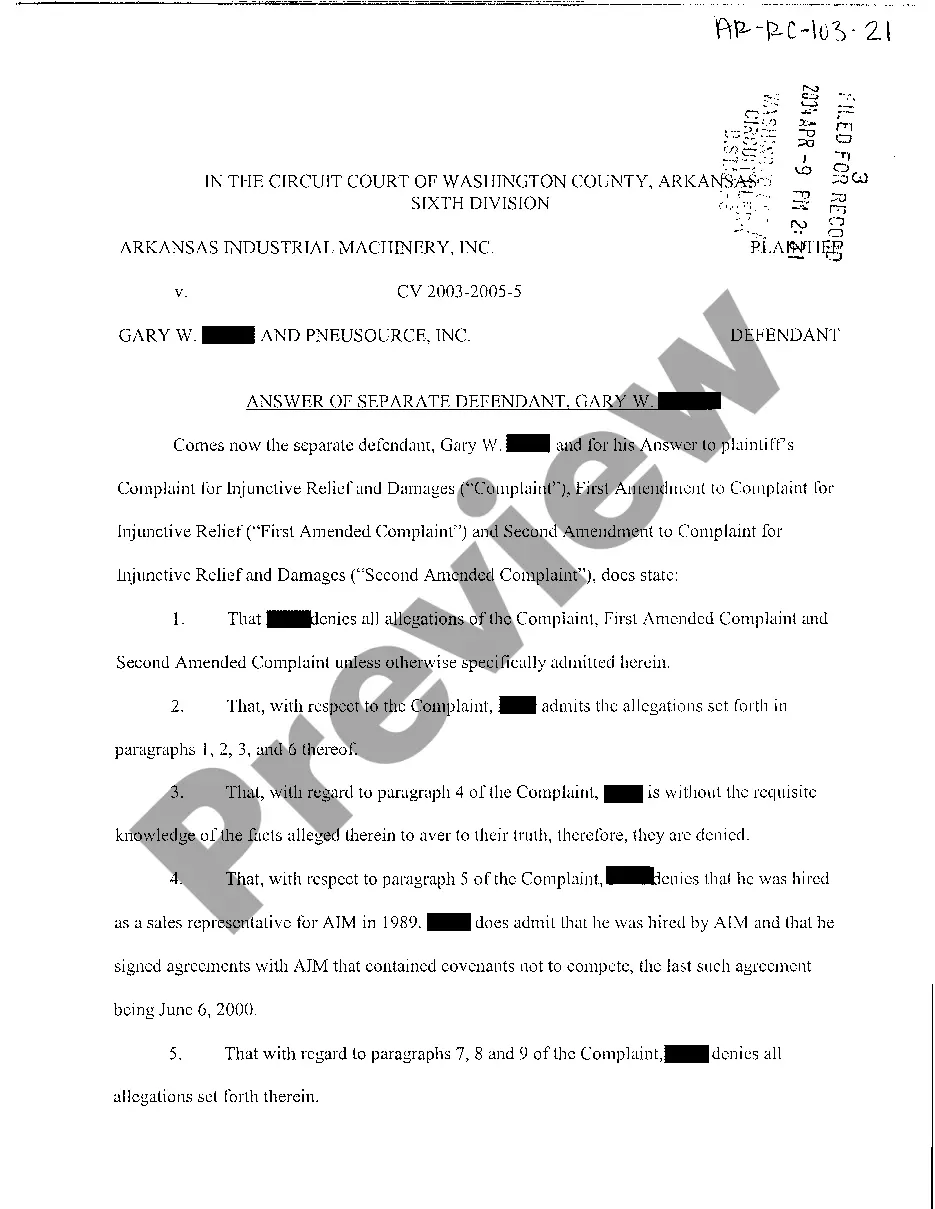

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

If you want to total, acquire, or print out legal record web templates, use US Legal Forms, the largest selection of legal varieties, which can be found on the Internet. Utilize the site`s simple and convenient lookup to obtain the paperwork you require. Different web templates for business and specific purposes are sorted by types and suggests, or search phrases. Use US Legal Forms to obtain the Guam Amendment to the articles of incorporation to eliminate par value with a few clicks.

When you are previously a US Legal Forms customer, log in for your account and click the Download option to have the Guam Amendment to the articles of incorporation to eliminate par value. You can even gain access to varieties you in the past saved within the My Forms tab of your respective account.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for that proper area/country.

- Step 2. Take advantage of the Review option to look over the form`s content material. Never forget to see the outline.

- Step 3. When you are unhappy using the type, make use of the Research area on top of the monitor to find other types of your legal type template.

- Step 4. After you have located the form you require, go through the Buy now option. Choose the rates plan you favor and add your credentials to register to have an account.

- Step 5. Procedure the financial transaction. You should use your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the formatting of your legal type and acquire it on your system.

- Step 7. Complete, modify and print out or signal the Guam Amendment to the articles of incorporation to eliminate par value.

Each and every legal record template you acquire is the one you have permanently. You have acces to each and every type you saved inside your acccount. Click on the My Forms area and choose a type to print out or acquire yet again.

Be competitive and acquire, and print out the Guam Amendment to the articles of incorporation to eliminate par value with US Legal Forms. There are many skilled and express-certain varieties you can use for your personal business or specific requirements.

Form popularity

FAQ

This legal document contains general information about the corporation, that includes its business name, address and other essential information. It is the primary document of authentication of the company, and the Registrar of Companies (ROC) issues this document.

An entrepreneur needs to submit the following documents for the incorporation of a company. (a) Memorandum of association. (b) Articles of association. (c) Written approval of the proposed directors to function as directors and an undertaking to buy the qualification shares.

A corporation, sometimes called a C corp, is a legal entity that's separate from its owners. Corporations can make a profit, be taxed, and can be held legally liable. Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures.

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

Incorporators and Board of Directors in the Philippines Where the capital stock consists of no-par value shares, the subscriptions must be paid in full. The minimum paid-up capital is P5,000.

The Guam Business Corporation Act (the "Guam Act") updates Guam's general corporation laws, creating uniformity with the corporate laws of other jurisdictions, while tailoring certain statutes to accomplish Guam's long-standing objective to attract off-island interest and facilitate investment in local businesses.

The Articles of Incorporation states the name, purpose, place of office, incorporators, capital stock, and term of the Company upon its establishment. The By-Laws outline the rules on annual and special meetings, voting, quorum, notice of meeting and auditors and inspectors of election.