Guam Proposal Approval of Nonqualified Stock Option Plan

Description

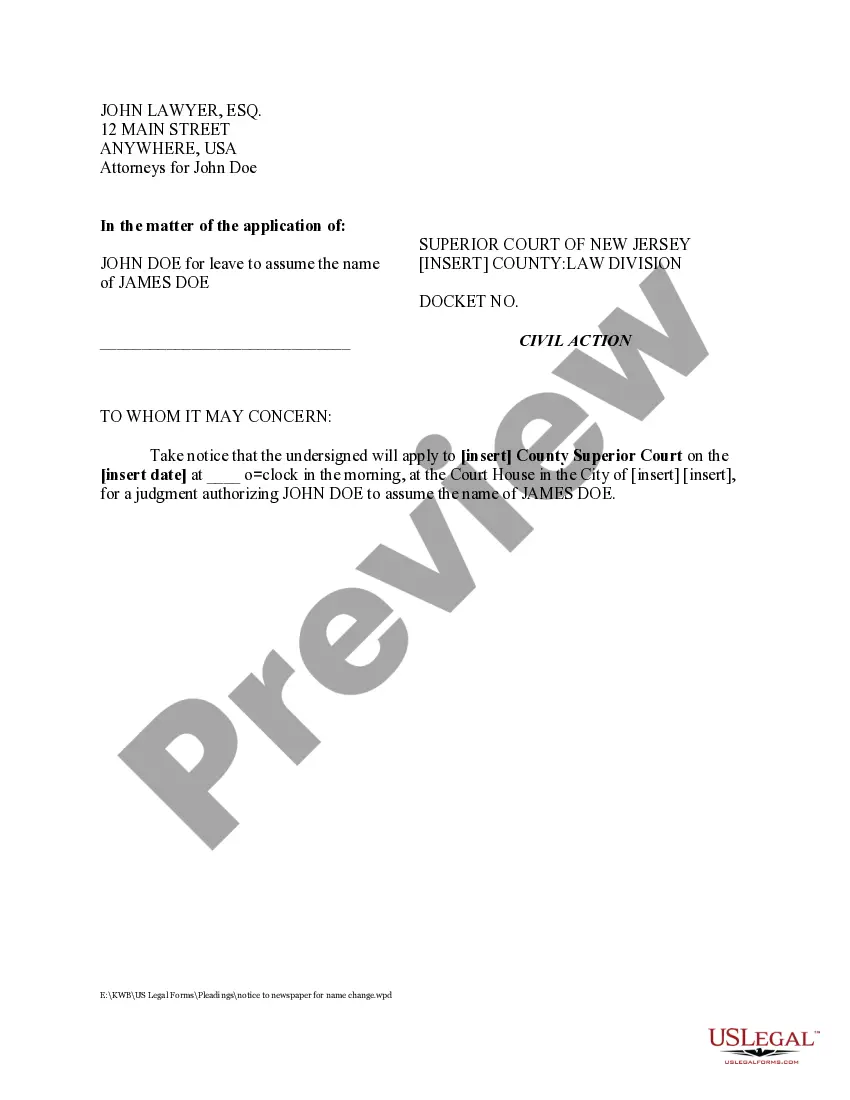

How to fill out Proposal Approval Of Nonqualified Stock Option Plan?

If you wish to total, download, or printing legal file templates, use US Legal Forms, the greatest selection of legal varieties, that can be found online. Utilize the site`s simple and hassle-free search to get the documents you require. A variety of templates for enterprise and individual purposes are sorted by groups and suggests, or key phrases. Use US Legal Forms to get the Guam Proposal Approval of Nonqualified Stock Option Plan in just a couple of mouse clicks.

In case you are currently a US Legal Forms customer, log in to your account and then click the Down load option to find the Guam Proposal Approval of Nonqualified Stock Option Plan. Also you can entry varieties you earlier acquired inside the My Forms tab of your account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that appropriate town/nation.

- Step 2. Utilize the Review choice to look over the form`s articles. Never neglect to learn the description.

- Step 3. In case you are unhappy together with the develop, take advantage of the Look for area towards the top of the screen to find other models of your legal develop design.

- Step 4. When you have located the form you require, select the Get now option. Pick the prices program you choose and add your qualifications to register on an account.

- Step 5. Procedure the transaction. You may use your bank card or PayPal account to perform the transaction.

- Step 6. Choose the file format of your legal develop and download it in your device.

- Step 7. Complete, modify and printing or indicator the Guam Proposal Approval of Nonqualified Stock Option Plan.

Each legal file design you get is yours permanently. You might have acces to each develop you acquired in your acccount. Select the My Forms area and decide on a develop to printing or download again.

Be competitive and download, and printing the Guam Proposal Approval of Nonqualified Stock Option Plan with US Legal Forms. There are millions of professional and status-specific varieties you can use for your enterprise or individual requires.

Form popularity

FAQ

A stock option plan must be adopted by the company's directors and, in some cases, approved by the company's shareholders.

Once you have a plan in place, you can simply make amendments to increase the number of shares in the option pool on an as-needed basis. The initial plan and any expansions must be approved by your board of directors and then by shareholders.

Failure to get board approval Let's start with an obvious one that founders routinely miss in the early days: Stock option grants must be approved by the board. If the board doesn't approve (either at a board meeting or by unanimous written consent), the stock options haven't actually been granted. Avoid These Common Pitfalls When Granting Stock Options vanguardlawmag.com ? blog ? avoid-these-... vanguardlawmag.com ? blog ? avoid-these-...

Key Points: The day you receive non-qualified stock options is known as the grant date. The value of the shares on this date is the exercise price, the price at which the employee may purchase the shares of stock. Non-qualified stock options are issued with a vesting schedule. The Basics of Non Qualified Stock Options - Zajac Group zajacgrp.com ? insights ? non-qualified-stock-opti... zajacgrp.com ? insights ? non-qualified-stock-opti...

Corporate actions include stock splits, dividends, mergers and acquisitions, rights issues and spin-offs. All of these are major decisions that typically need to be approved by the company's board of directors and authorized by its shareholders.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan. Who Can Approve Equity Awards? | Foley & Lardner LLP foley.com ? insights ? publications ? 2023/06 foley.com ? insights ? publications ? 2023/06

For example, if you're based in the US, you can offer ISOs to your domestic employees. However, as you cannot use an EOR to offer ISOs to foreign employees, you would need to offer an alternative, such as NSOs, RSUs, or VSOs. How to offer stock options (ESOP) to foreign employees - Remote remote.com ? blog ? how-to-offer-esop-to-foreig... remote.com ? blog ? how-to-offer-esop-to-foreig...