Guam Nonqualified Stock Option Agreement of N(2)H(2), Inc.

Description

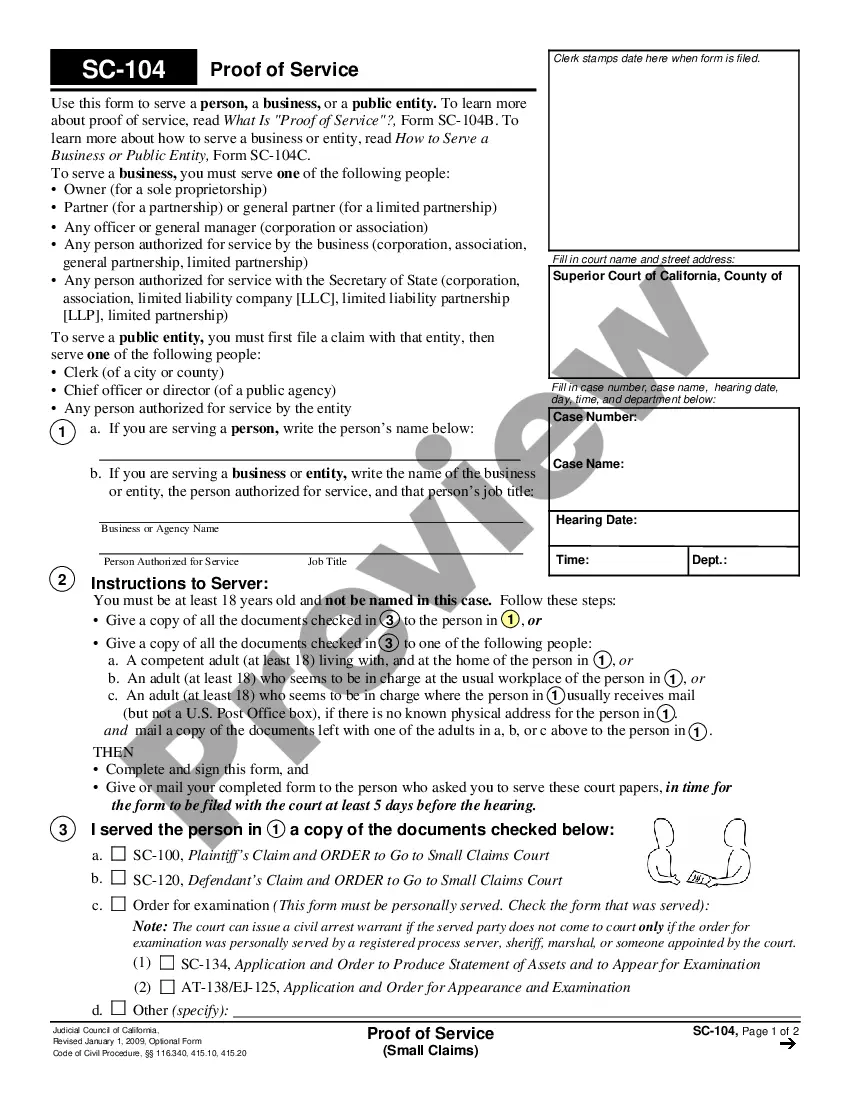

How to fill out Nonqualified Stock Option Agreement Of N(2)H(2), Inc.?

Are you currently within a placement that you need to have paperwork for possibly enterprise or personal reasons virtually every time? There are a lot of legal papers templates available on the net, but finding kinds you can rely on isn`t straightforward. US Legal Forms provides thousands of form templates, just like the Guam Nonqualified Stock Option Agreement of N(2)H(2), Inc., that are published in order to meet federal and state needs.

If you are presently knowledgeable about US Legal Forms website and also have an account, merely log in. Next, it is possible to download the Guam Nonqualified Stock Option Agreement of N(2)H(2), Inc. design.

If you do not offer an profile and would like to start using US Legal Forms, follow these steps:

- Obtain the form you will need and ensure it is for the correct city/state.

- Utilize the Review button to check the form.

- Read the information to ensure that you have chosen the right form.

- In case the form isn`t what you are seeking, utilize the Lookup industry to get the form that meets your needs and needs.

- Whenever you find the correct form, just click Get now.

- Select the rates program you need, complete the required details to create your account, and purchase your order making use of your PayPal or credit card.

- Select a practical file format and download your duplicate.

Locate each of the papers templates you possess purchased in the My Forms menus. You can obtain a extra duplicate of Guam Nonqualified Stock Option Agreement of N(2)H(2), Inc. anytime, if required. Just select the necessary form to download or print out the papers design.

Use US Legal Forms, probably the most comprehensive assortment of legal varieties, to save time and stay away from errors. The assistance provides professionally produced legal papers templates which can be used for a range of reasons. Generate an account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.

In this situation, you exercise your option to purchase the shares but you do not sell the shares. Your compensation element is the difference between the exercise price ($25) and the market price ($45) on the day you exercised the option and purchased the stock, times the number of shares you purchased.

However, when you sell an option?or the stock you acquired by exercising the option?you must report the profit or loss on Schedule D of your Form 1040. If you've held the stock or option for one year or less, your sale will result in a short-term gain or loss, which will either add to or reduce your ordinary income.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

If you exercise one of these NSOs, you'll pay your company $3 to buy a share. But the IRS views that share to be worth $35. The difference between the $3 and the $35 counts as a $32 phantom gain (also called the spread). The phantom gain is taxed at ordinary income rates.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation. Box 3: Social Security wages (up to the income ceiling)