Guam Request for Maintenance

Description

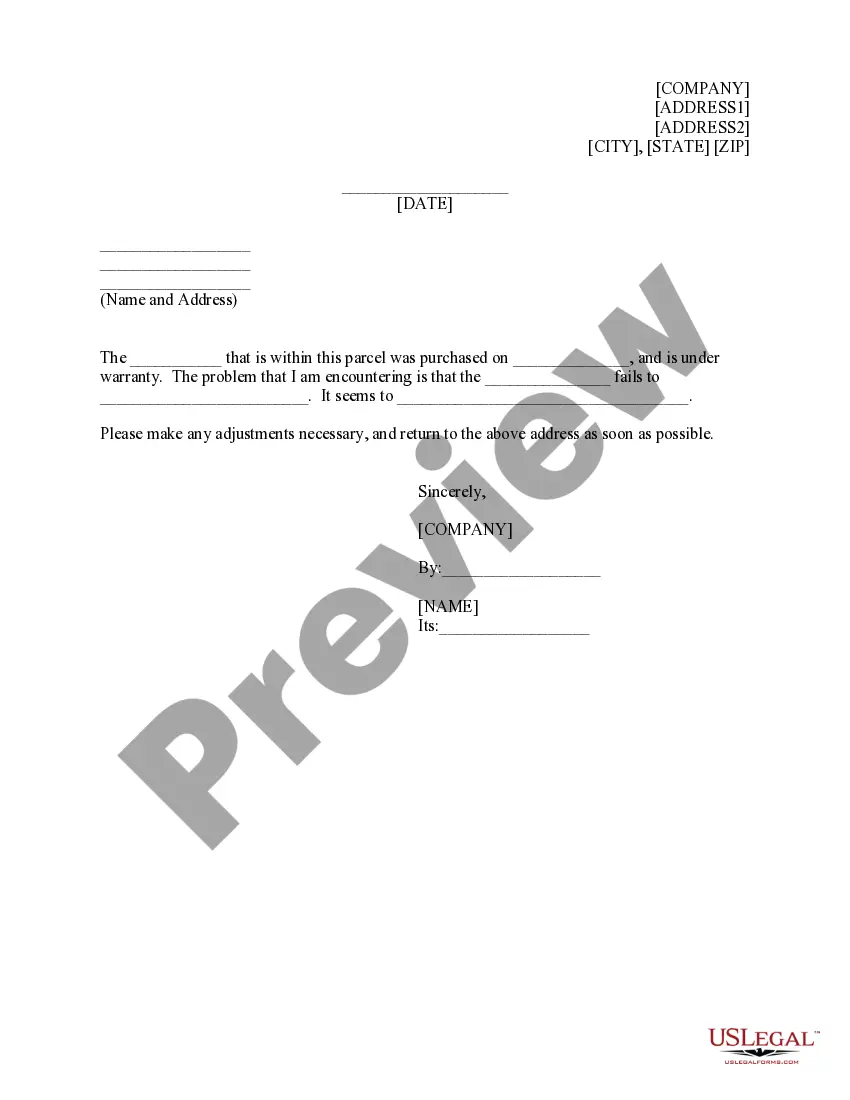

How to fill out Request For Maintenance?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal document templates that you can download or print.

By utilizing the website, you can obtain thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent versions of forms, such as the Guam Request for Maintenance, within minutes.

If you already hold a membership, Log In to download Guam Request for Maintenance from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms within the My documents section of your profile.

Select the format and download the form to your device.

Make edits. Complete, modify, print, and sign the downloaded Guam Request for Maintenance.

- Ensure you have selected the correct form for your area/region. Click the Preview button to review the form's content.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

Where to File Forms 2848 and 8821. Practitioners must mail or fax their authorization forms to the applicable CAF unit (Ogden, Utah; Memphis, Tenn.; or Philadelphia) unless they check the box on line 4 of Form 2848 or 8821 (specific use not recorded on the CAF).

Walk in to the Department of Revenue and Taxation, Collection branch. Make sure to bring a copy of your e-filed return with the watermark "E-Filed" shown across the page. Mail in your payment. Mail your check payable to "Treasurer of Guam" to the Department of Revenue and Taxation, P.O. Box 23607, GMF, Guam 96921.

Or you can send your comments to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Don't send Form 8821 to this office. Instead, see How To File, earlier.

Electronic signatures are not allowed. Most Forms 2848 and 8821 are recorded on the IRS's Centralized Authorization File (CAF). Authorization forms uploaded through this tool will be worked on a first-in, first-out basis along with mailed or faxed forms.

Visit or call 877-777-4778. Complete this form, and mail or fax it to us within 30 days from the date of this notice. If you use the enclosed envelope, be sure our address shows through the window.

See GRT E-Filing Help.Email grt@revtax.gov.gu.Call 671-635-1835/1836.Write to Department of Revenue and Taxation, BPTB, P.O. Box 23607, GMF, Guam, 96921.

Employers file this form to report Guam wages. Do not use this form to report wages subject to U.S. income tax withholding.

You can file your 1040EZ online using MyGuamTax.com, an official service of the Guam Department of Revenue and Taxation. You will need to create a separate user account on MyGuamTax to file your 1040EZ online.

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.

SBA requires you to complete the IRS Form 8821 as a part of your disaster loan application submission. The form authorizes the IRS to provide federal income tax information directly to SBA. Although the form is available online, it cannot be transmitted electronically.