Guam Maintenance Request

Description

How to fill out Maintenance Request?

Are you presently in a situation where you need documents for business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the Guam Maintenance Request, designed to meet state and federal requirements.

Once you find the suitable form, click Get now.

Select the pricing plan you want, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Guam Maintenance Request template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it corresponds to the correct city/state.

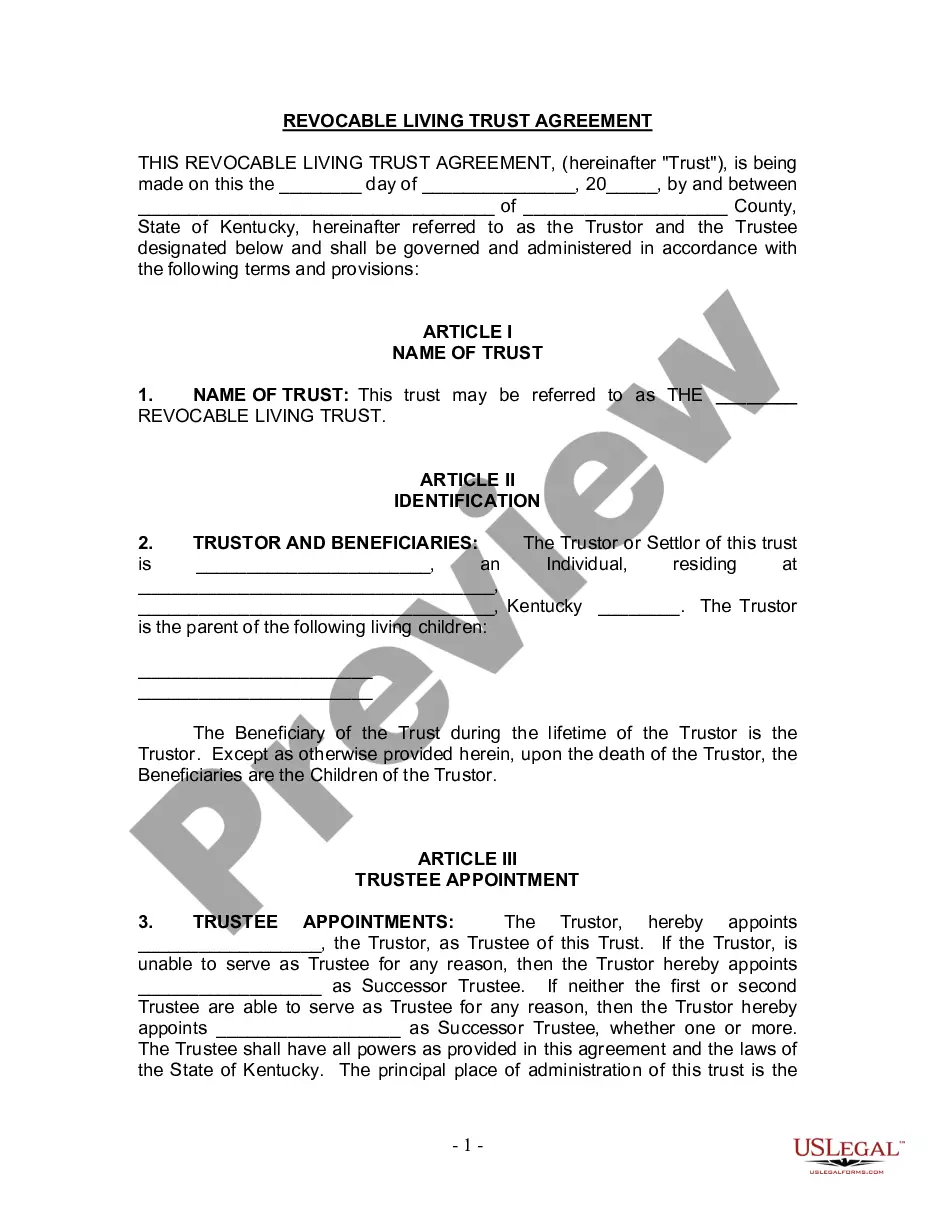

- Use the Preview button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form does not meet your needs, utilize the Search field to locate the form you require.

Form popularity

FAQ

2GU form is used to report wage and salary information for employees earning Guam wages. Example use: Those with one or more employees use this form to report Guam wages and salary with U.S. income tax withheld.

To cover housing expenses on Guam, military personnel receive Overseas Housing Allowance (OHA). OHA is different from state-side Basic Allowance for Housing (BAH), in that you don't get to keep what's left of your allowance that you don't spend on rent.

You are paid OHA in the exact amount of your rent, plus an amount determined by DoD to cover the utility and recurring maintenance expenses for their location. The amount is determined based on location, rank, and dependency status.

See GRT E-Filing Help.Email grt@revtax.gov.gu.Call 671-635-1835/1836.Write to Department of Revenue and Taxation, BPTB, P.O. Box 23607, GMF, Guam, 96921.

Overseas Housing Allowance (OHA) The Overseas Housing Allowance Program is a reimbursement system that takes into consideration the amount Service members spend on rent, utilities and associated move-in costs. Rental allowances are computed using actual rent payments as reported through the local finance systems.

The Overseas Housing Program enables military members assigned overseas to privately lease housing on the economy. This program encompasses a reimbursement system designed to partially defray housing costs when on-base or government leased housing is not available.

GuamTax.comGuamTax.com. The Official Web Site of the Guam Department of Revenue and Taxation.MyGuamtax.com. An official service of GuamTax.com that provides online services for individual taxpayers.Pay.Guam.Gov. Make Treasurer of Guam payments online using your Visa, MasterCard, or check. .

Employers file this form to report Guam wages. Do not use this form to report wages subject to U.S. income tax withholding.

You can file your 1040EZ online using MyGuamTax.com, an official service of the Guam Department of Revenue and Taxation. You will need to create a separate user account on MyGuamTax to file your 1040EZ online.

BAH is needed for Guam in order to ensure military housing allowance equities for service members and cost savings for the government.