Nebraska Subcontract for Construction of Portion of or Materials to go into Building

Description

How to fill out Subcontract For Construction Of Portion Of Or Materials To Go Into Building?

If you wish to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest repository of legal forms accessible online.

Leverage the website's straightforward and user-friendly search to locate the documents you require.

A range of templates for business and personal purposes are arranged by categories and states, or keywords.

Step 4. Once you have found the necessary form, click the Get Now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Nebraska Subcontract for Construction of Part of or Materials to be Incorporated into Building with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to get the Nebraska Subcontract for Construction of Part of or Materials to be Incorporated into Building.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for your correct region/state.

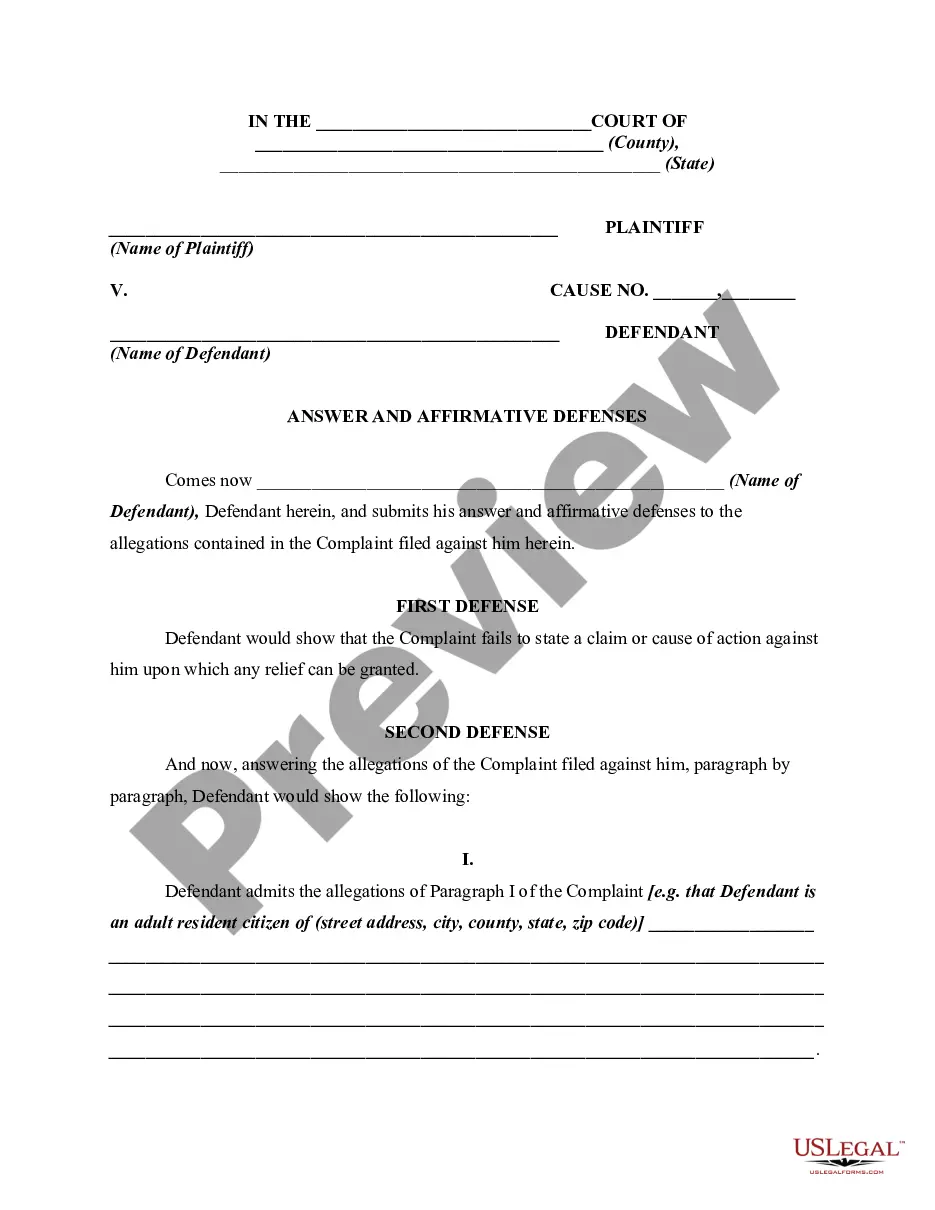

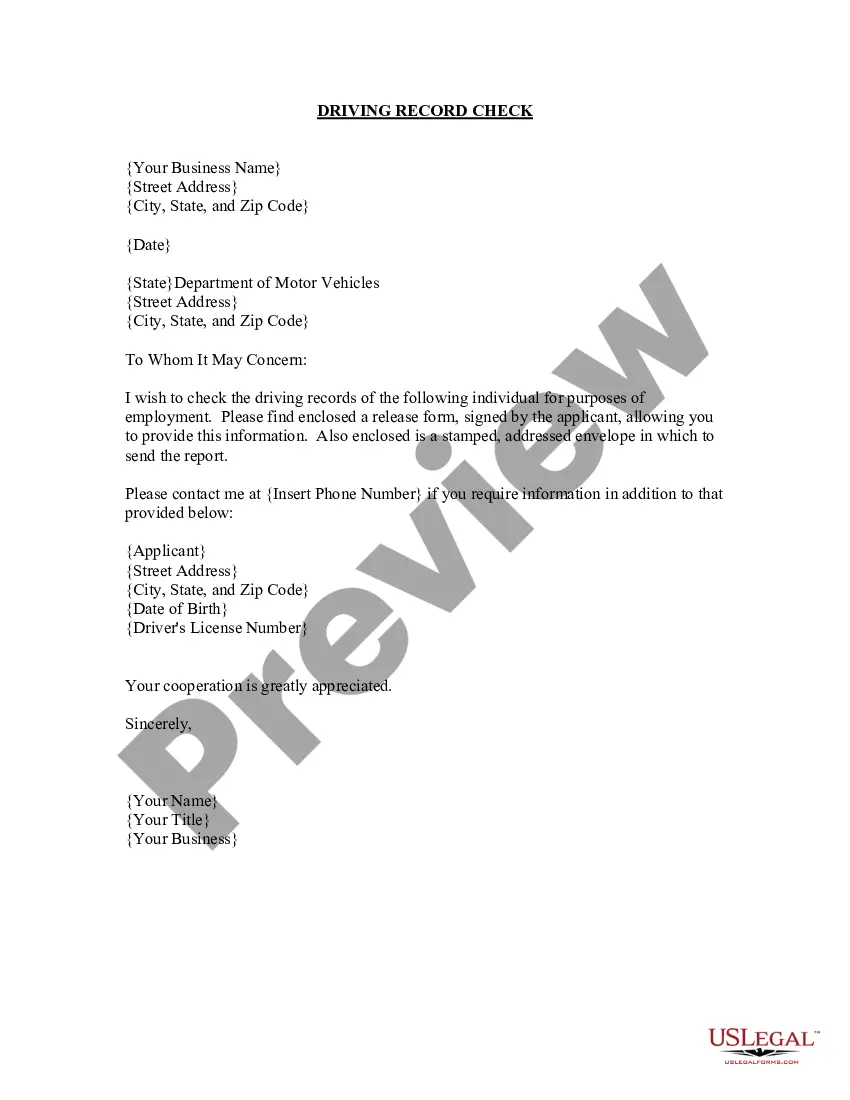

- Step 2. Take advantage of the Preview option to examine the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative forms in the legal form repository.

Form popularity

FAQ

A subcontractor agreement is a contract between a contractor and a subcontractor to perform a portion of work that is part of a larger construction project. A subcontractor doesn't have an agreement with the property owner directly.

Traditional Goods or Services Goods that are subject to sales tax in Nebraska include physical property, like furniture, home appliances, and motor vehicles. Medicine, groceries, and gasoline are all tax-exempt.

Services in Nebraska are generally not taxable.

Option 2 contractor labor charges are not taxable. Option 2 contractors will not be required to obtain a Nebraska Resale or Exempt Sale Certificate, Form 13, when billing other contractors for contractor labor charges.

Charges for production and assembly labor are taxable. Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable. See Sales and Use Tax Regulation 1-082, Labor Charges.

However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers. Generally, if you perform taxable labor in California, you must obtain a seller's permit and report and pay tax on your taxable sales.

No. Contractors and third party installers who install parts that remain tangible personal property after installation are required to collect sales tax on the total amount charged for the parts and installation labor.

Option 3 contractors are consumers of all manufacturing machinery and equipment purchased and annexed by them. Option 3 contractors must pay tax on purchases of machinery and equipment even if the machinery and equipment will be used by a manufacturer.

Charges for production and assembly labor are taxable. Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable.