Guam Sales Prospect File

Description

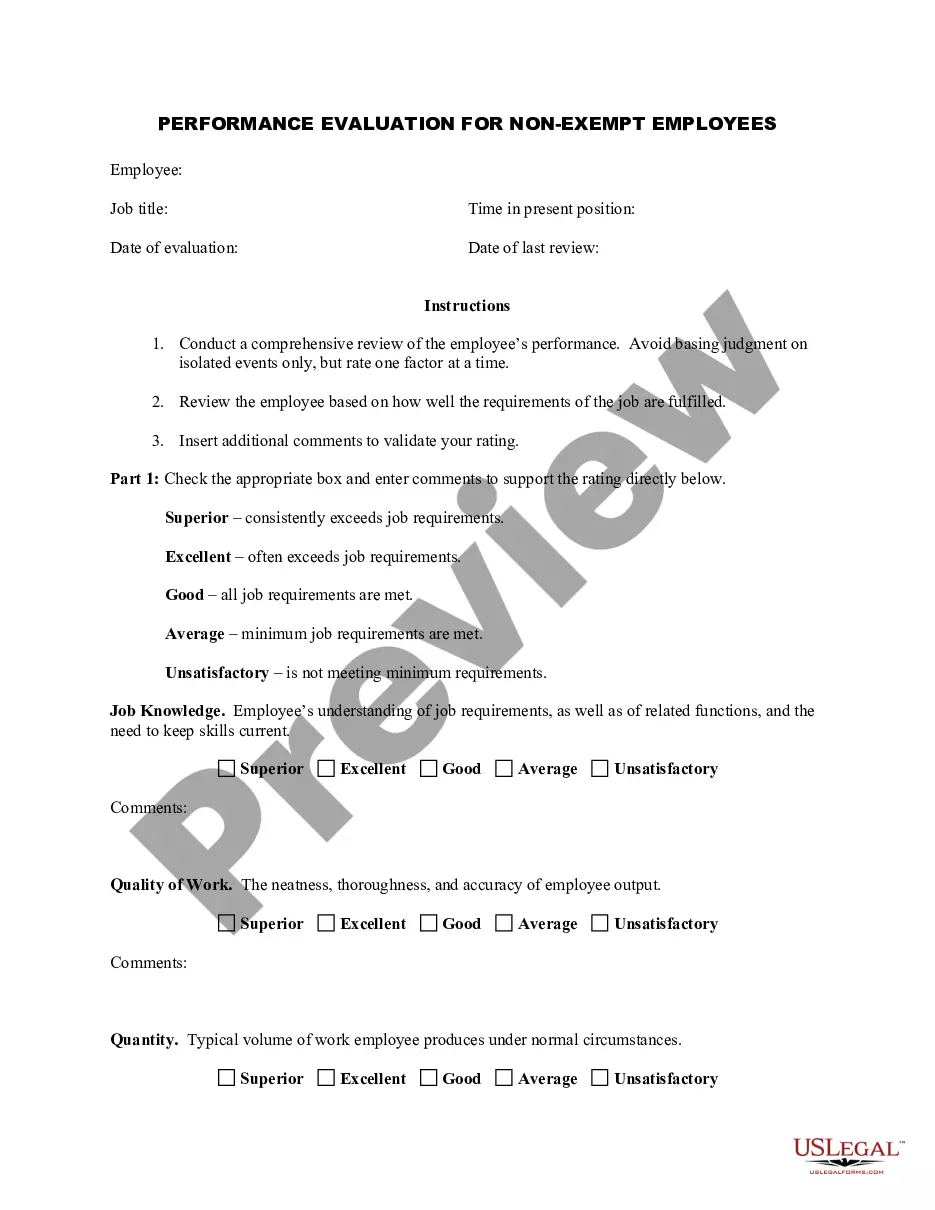

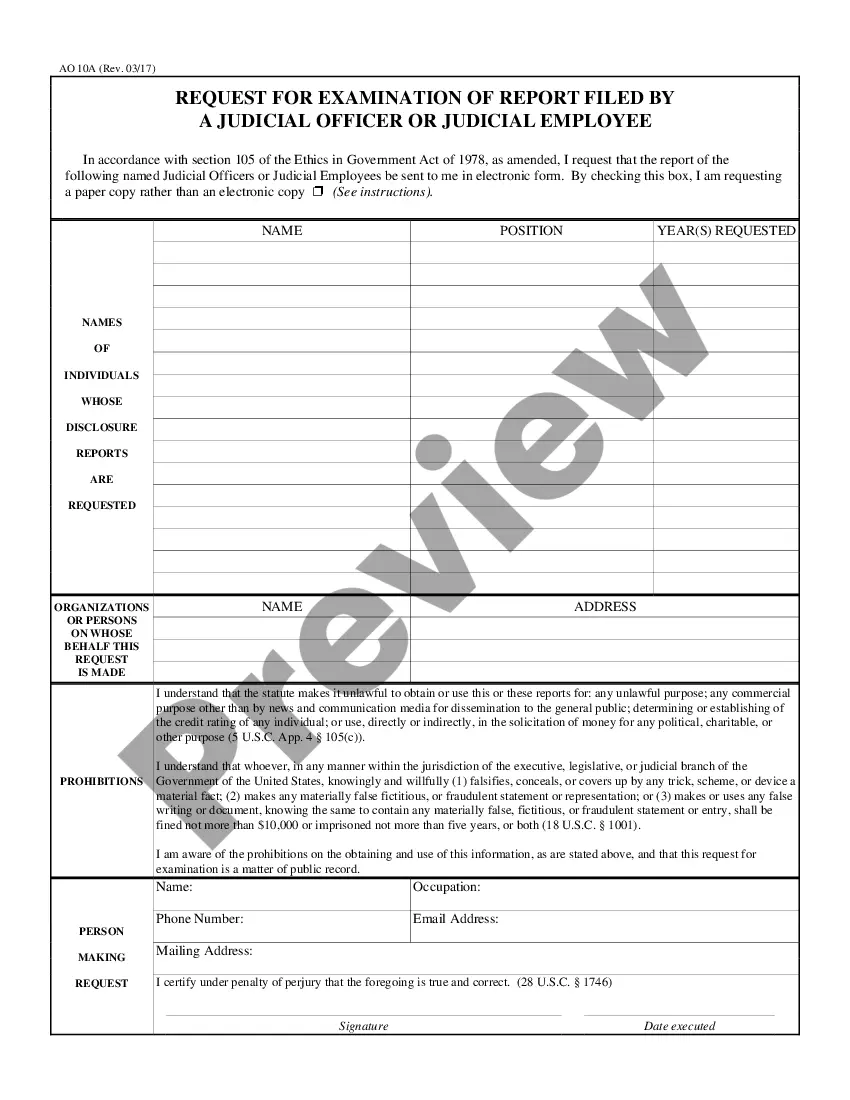

How to fill out Sales Prospect File?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent versions of forms such as the Guam Sales Prospect Document in just seconds.

If the form does not meet your requirements, use the Search field at the top of the screen to find a more suitable one.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Next, select the pricing plan you want and provide your information to register for an account.

- If you have a subscription, sign in and download the Guam Sales Prospect Document from the US Legal Forms collection.

- The Download button will be visible on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If this is your first time using US Legal Forms, here are easy steps to get started.

- Ensure you have selected the correct form for your locality/county.

- Click the Review button to examine the form's details.

Form popularity

FAQ

Yes, if you are a resident of Guam or earn income there, you are required to file Guam taxes. This process is similar to filing a federal tax return in the mainland US, but you will need to submit your forms to the Guam Department of Revenue and Taxation. Filing accurately ensures compliance and can aid in maintaining your Guam Sales Prospect File effectively. Utilizing uslegalforms can simplify this process for you.

Yes, you can file your Guam taxes online through the Guam Department of Revenue and Taxation's electronic filing options. This method simplifies the filing process by allowing you to submit documents securely. Additionally, using tools like the Guam Sales Prospect File can keep your financial records organized, making online filing more efficient.

Yes, Guam is classified as a US possession, officially designated as an unincorporated territory. This status means it is governed by US laws, but it retains certain local governance powers. Understanding this status is crucial, and using resources like the Guam Sales Prospect File can facilitate better management of business operations within this territory.

Guam operates under a unique tax structure; it is recognized as a US territory but has its own tax rules. Therefore, residents filing taxes must adhere to Guam tax laws while also complying with federal regulations. By utilizing the Guam Sales Prospect File, individuals can ensure they track their income accurately and meet all tax obligations.

Yes, Guam is considered a US address since it is an unincorporated territory of the United States. Residents of Guam can use a Guam address for mailing and legal purposes. For businesses, using the Guam Sales Prospect File can help manage sales prospects effectively within this US territory.

A US national for tax purposes includes individuals who were born in the United States, as well as those born in Guam, Puerto Rico, or the US Virgin Islands. These individuals have the same rights and responsibilities regarding federal taxes as citizens. If you have questions about your status, consider using the Guam Sales Prospect File to keep track of all necessary documentation for tax compliance.

Filing GRT tax in Guam requires you to gather sales records and complete the GRT tax return form. You can file the form either online or in paper format, ensuring you meet deadlines specified by the Guam Department of Revenue and Taxation. Platforms like US Legal Forms offer templates to help you navigate this filing process efficiently.

The GRT rate in Guam varies depending on the type of goods or services provided. Typically, the rate is set by local government regulations and may differ for various industries. For accurate and updated information regarding the rates, refer to the Guam Sales Prospect File as a valuable resource.

The sales tax rate in Guam is determined by the gross receipts tax regulations. This tax applies to most sales of goods and services. Staying informed about the current rates and regulations can help you comply with tax laws and optimize your business operations. Check out the Guam Sales Prospect File for detailed insights.

Filing GRT in Guam involves completing the appropriate tax forms and submitting them either online or by mail. It's crucial to keep precise records of your sales and transactions. Resources like US Legal Forms can provide templates and support, making the GRT filing process smoother for you.