Guam Expense Account Form

Description

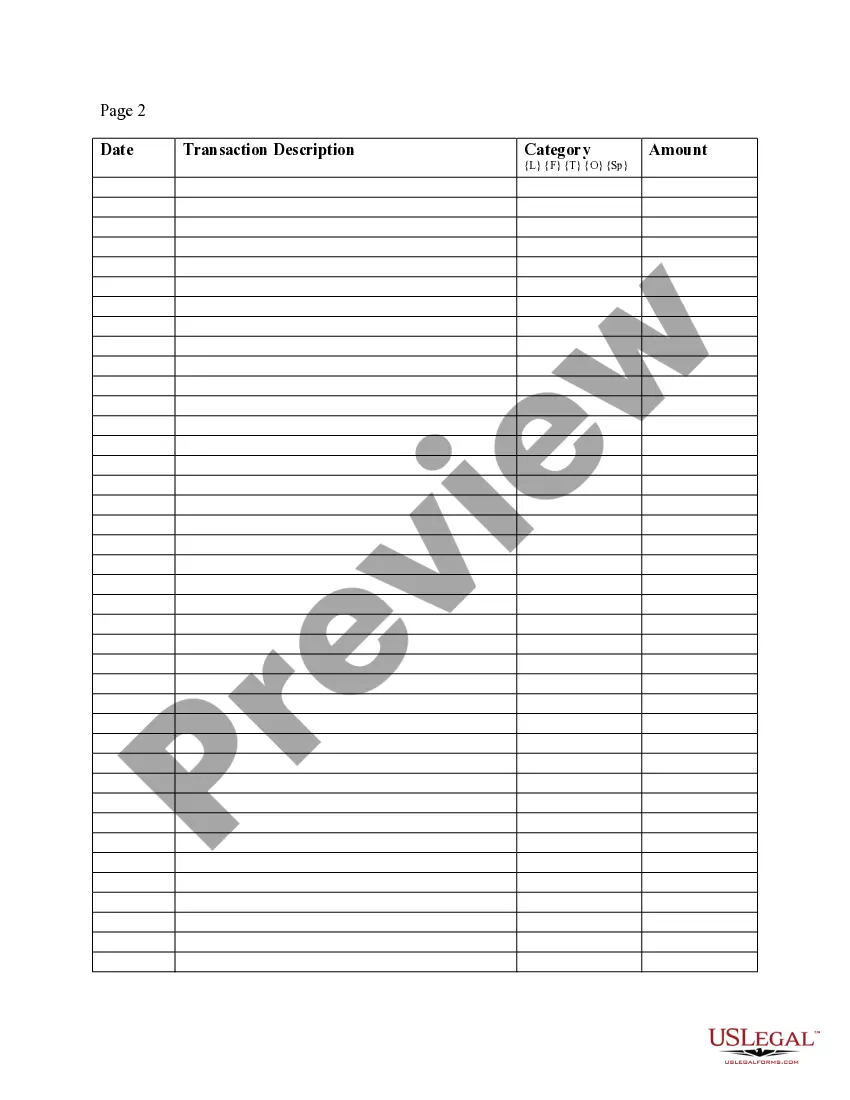

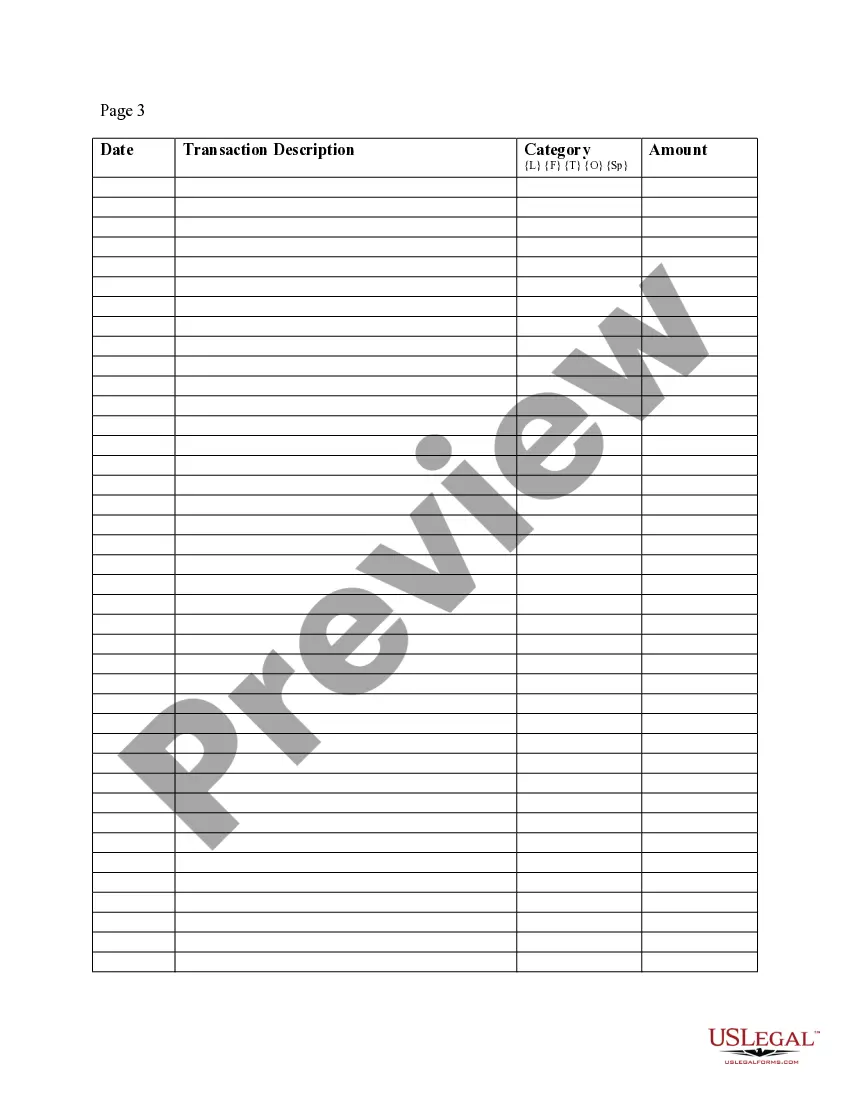

How to fill out Expense Account Form?

Have you ever been in a situation where you need documentation for business or personal activities almost every day? There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of template options, such as the Guam Expense Account Form, which are designed to comply with both state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Guam Expense Account Form template.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Guam Expense Account Form at any time if needed. Just click on the desired form to download or print the document template.

Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service provides properly designed legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- Obtain the form you need and confirm it is for your correct city/state.

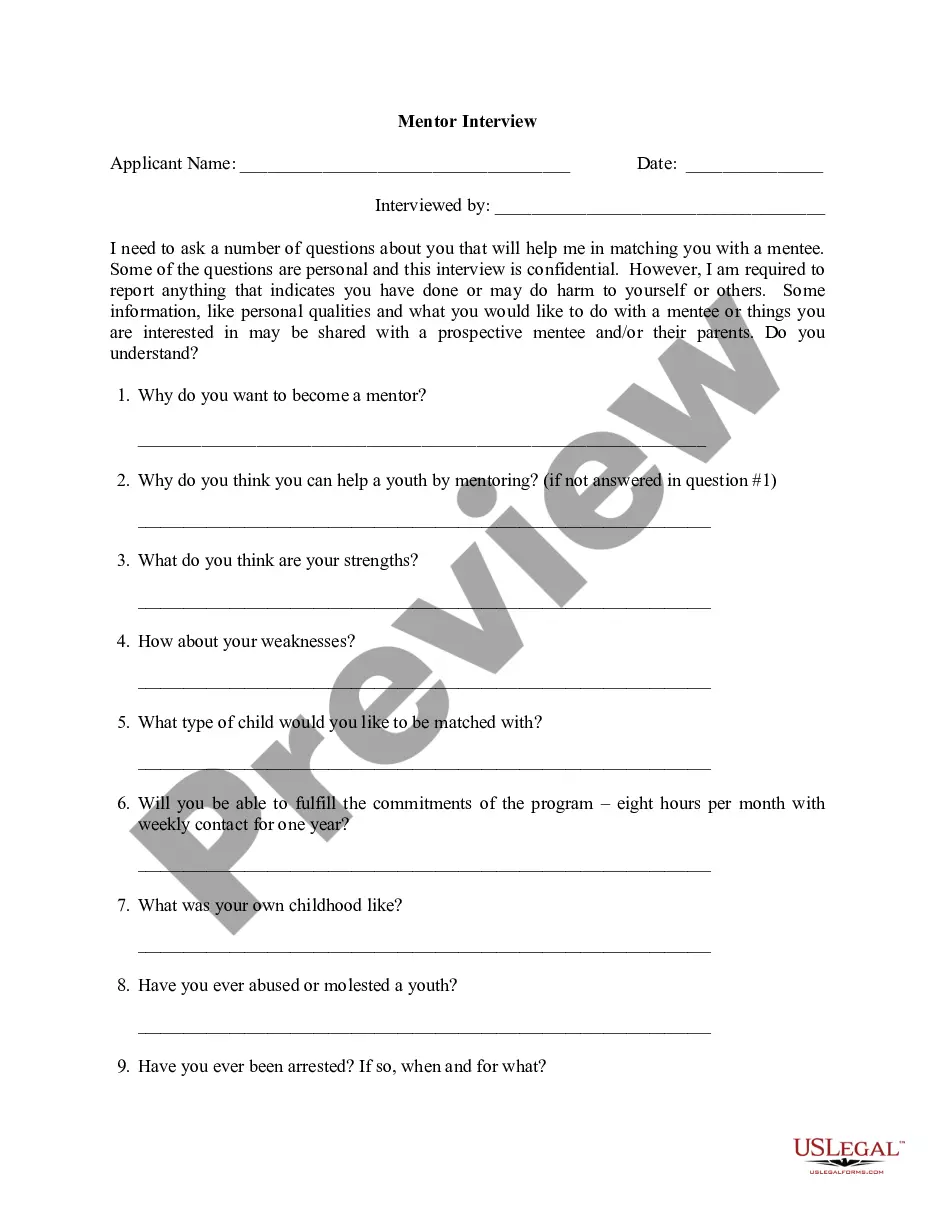

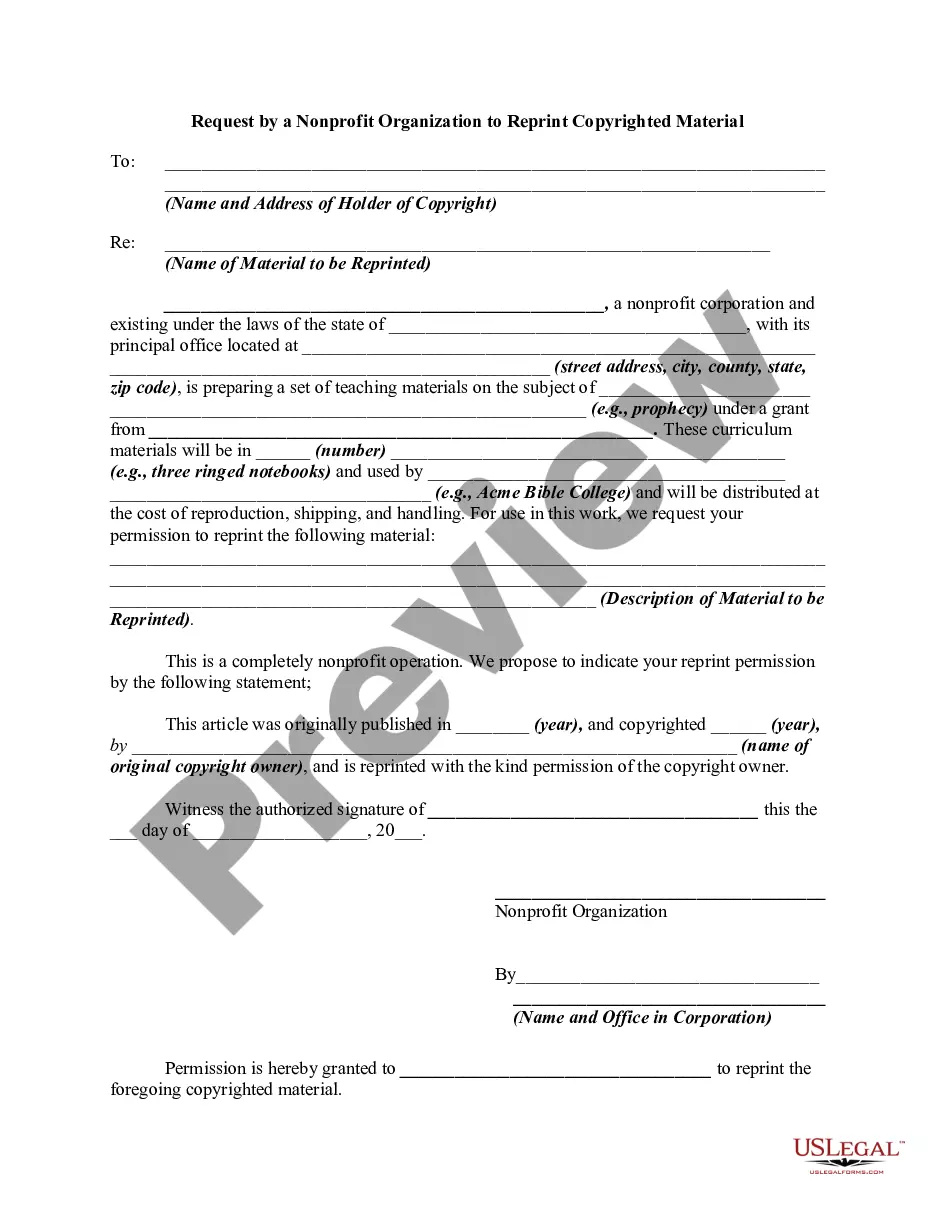

- Use the Preview button to review the form.

- Read the information to ensure that you have chosen the correct document.

- If the document is not what you are looking for, use the Search field to find the form that meets your requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you want, complete the necessary information to create your account, and purchase your order using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

The amount of tax withheld from your paycheck in Guam will depend on your income and the number of exemptions you're claiming. Generally, employers are required to withhold income taxes regularly. For clarity on how to estimate these withholdings, complete the Guam Expense Account Form. This proactive step helps you manage your financial planning and ensures you meet legal obligations.

Bona fide residents of Guam are subject to special U.S. tax rules. In general, all individuals with income from Guam will file only one returneither to Guam or the United States. If you are a bona fide resident of Guam during the entire tax year, file your return with Guam.

All businesses with sales over $500,000 per year must file monthly GRT reports and pay 4% GRT on all sales to the Treasurer of Guam. All businesses with sales less than or equal to $500,000 per year must file monthly GRT rep01is and pay 4% GRT on all sales over $50,000 to the Treasurer of Guam.

An individual who has income from American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), Guam, Puerto Rico or the U.S. Virgin Islands will usually have to file a tax return with the tax department of one of these territories.

If you don't qualify, leave the line blank. Finish the Tax and Credits section. Simply add up all of your totals in the Tax and Credits section. If the result is less than 0, enter 0 (zero).

More In Forms and InstructionsEmployers file this form to report Guam wages. Do not use this form to report wages subject to U.S. income tax withholding. Instead, use Form W-2 to show U.S. income tax withheld.

Walk in to the Department of Revenue and Taxation, Collection branch. Make sure to bring a copy of your e-filed return with the watermark "E-Filed" shown across the page. Mail in your payment. Mail your check payable to "Treasurer of Guam" to the Department of Revenue and Taxation, P.O. Box 23607, GMF, Guam 96921.

Title 11, Chapter 26, of the Guam Code Annotated provides the authority for imposing gross receipts taxes, and Section 26202(a) of Chapter 26 states that businesses (referred to in this report as taxpayers) selling goods and services will be taxed at a rate of 4 percent on the gross proceeds of sales.

You can file your 1040EZ online using MyGuamTax.com, an official service of the Guam Department of Revenue and Taxation. You will need to create a separate user account on MyGuamTax to file your 1040EZ online.

See GRT E-Filing Help.Email grt@revtax.gov.gu.Call 671-635-1835/1836.Write to Department of Revenue and Taxation, BPTB, P.O. Box 23607, GMF, Guam, 96921.