Guam Release from Liability under Guaranty

Description

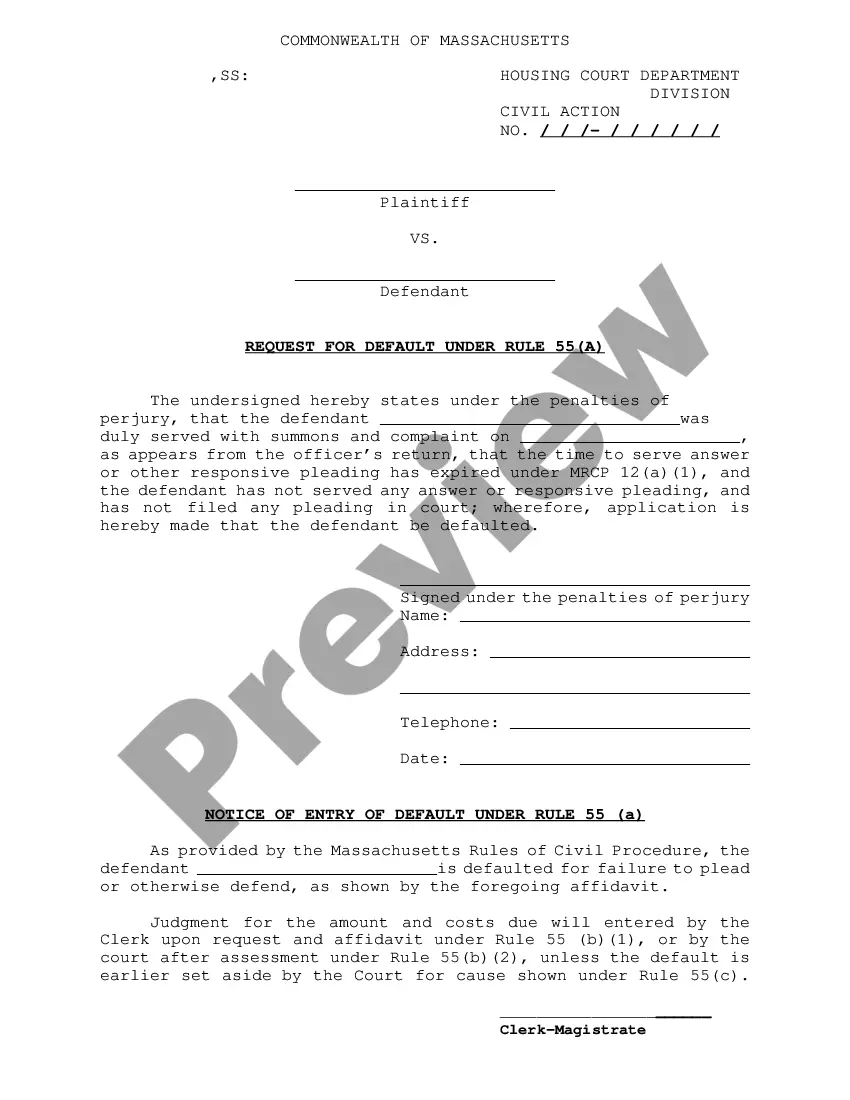

How to fill out Release From Liability Under Guaranty?

US Legal Forms - one of the biggest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by type, state, or keywords. You can find the most recent editions of forms like the Guam Release from Liability under Guaranty in minutes.

If you have a monthly subscription, Log In and retrieve the Guam Release from Liability under Guaranty from your US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Select the format and download the document onto your device.

Make modifications. Fill out, edit, and print the downloaded Guam Release from Liability under Guaranty.

- Ensure you have selected the correct form for your specific municipality/county. Click the Preview button to review the contents of the form.

- Examine the form description to confirm that you have chosen the right document.

- If the document does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your details to sign up for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

A surety is primarily liable as though there is joint and several liabilities with the principal. The exact moment that a guarantor becomes liable for the debt of the principal is less certain.

If the creditor does any act which is inconsistent with the rights of the surety, or omits to do any act which his duty to the surety requires him to do, and the eventual remedy of the surety himself against the principal debtor is thereby impaired, the surety is discharged.

Liability of surety is same as that of the principal debtor. A creditor can directly proceed against the surety. A creditor can sue the surety directly without sueing principal debtor. Surety becomes liable to make payment immediately when the principal debtor makes default in such payment.

The surety is discharged by any contract between the creditor and the principal debtor, by which the principal debtor is released, or by any act or omission of the creditor, the legal consequence of which is the discharge of the principal debtor.

Guaranteed Liability means any agreement, undertaking or arrangement by which any Person guarantees, endorses or otherwise becomes or is contingently liable upon (by direct or indirect agreement, contingent or otherwise, to provide funds for payment, to supply funds to, or otherwise to invest in, a debtor, or otherwise

The person who gives the guarantee is called the 'surety'; the person in respect of whose default the guarantee is given is called the 'principal debtor', and the person to whom the guarantee is given is called the 'creditor'. A guarantee may be either oral or written.

''The surety is discharged as soon as the original contract is altered without his consent''. Discharge of surety by release or discharge of principal debtor (Section 134) A surety can be discharged if there is any contract between principal debtor and the creditor, which releases the principal debtor.

Liability of surety is same as that of the principal debtor. A creditor can directly proceed against the surety. A creditor can sue the surety directly without sueing principal debtor. Surety becomes liable to make payment immediately when the principal debtor makes default in such payment.

The liability of the surety is co-extensive with that of the principal debtor, unless it is otherwise provided by the contract. The provision that the surety's liability is coextensive with that of the principal debtor means that his liability is exactly the same as that of the principal debtor.

Surety not discharged when agreement made with third person to give time to principal debtor. Where a contract to give time to the principal debtor is made by the creditor with a third person, and not with the principal debtor, the surety is not discharged.