Guam Sample Letter for Notice of Intent to File a Fee Petition

Description

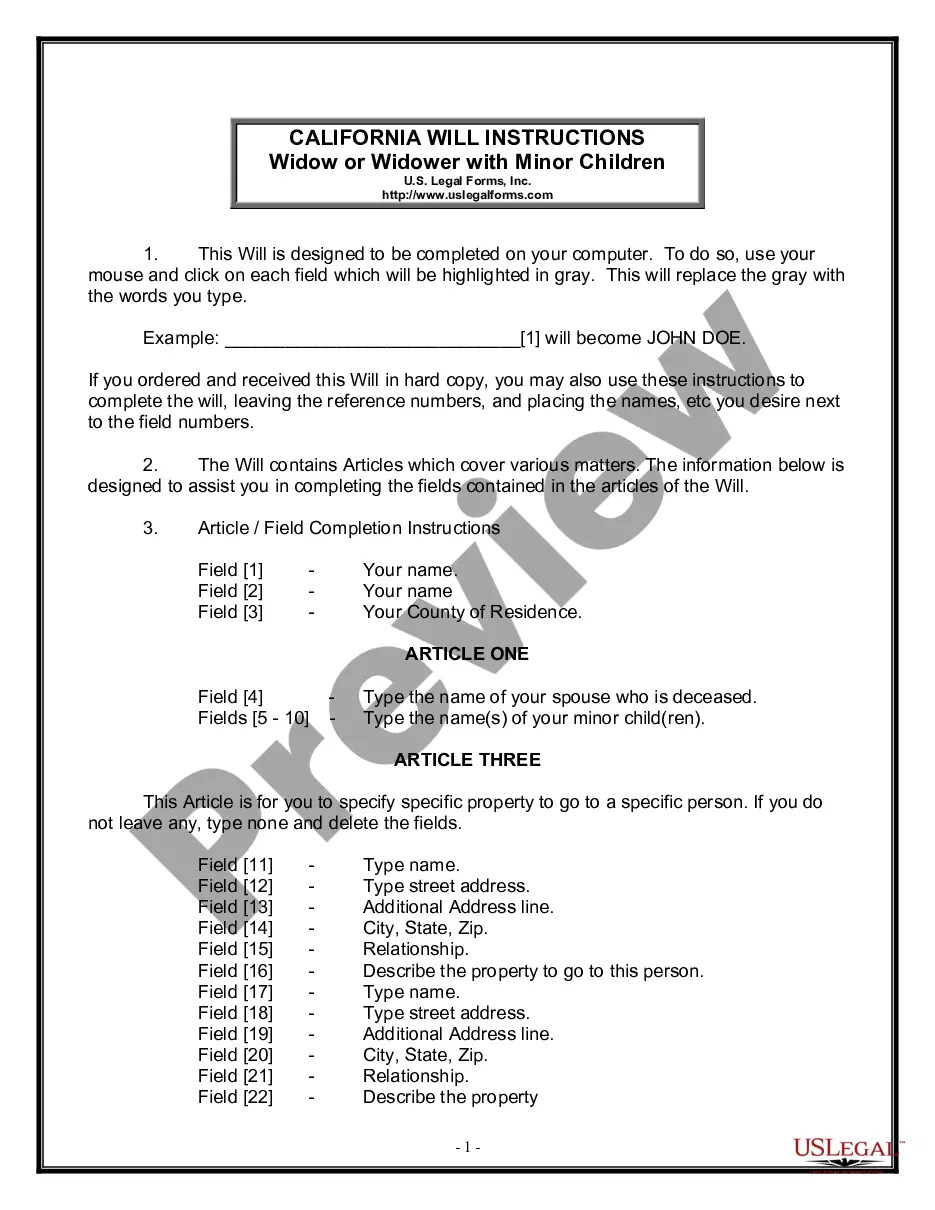

How to fill out Sample Letter For Notice Of Intent To File A Fee Petition?

Finding the right legal record design can be a battle. Needless to say, there are a variety of layouts accessible on the Internet, but how can you obtain the legal develop you require? Use the US Legal Forms internet site. The assistance provides 1000s of layouts, such as the Guam Sample Letter for Notice of Intent to File a Fee Petition, which you can use for business and personal demands. All of the varieties are checked by professionals and meet up with federal and state demands.

Should you be currently registered, log in for your bank account and click on the Acquire button to find the Guam Sample Letter for Notice of Intent to File a Fee Petition. Make use of bank account to search with the legal varieties you have acquired in the past. Go to the My Forms tab of your own bank account and obtain another duplicate of the record you require.

Should you be a new consumer of US Legal Forms, listed here are easy instructions for you to follow:

- First, make certain you have chosen the right develop for the city/area. It is possible to look through the shape using the Preview button and read the shape outline to guarantee this is the best for you.

- In the event the develop does not meet up with your requirements, use the Seach field to discover the proper develop.

- When you are sure that the shape is proper, go through the Acquire now button to find the develop.

- Opt for the pricing strategy you would like and type in the necessary details. Design your bank account and pay money for your order utilizing your PayPal bank account or charge card.

- Select the document file format and download the legal record design for your device.

- Complete, modify and print out and indication the obtained Guam Sample Letter for Notice of Intent to File a Fee Petition.

US Legal Forms is the most significant collection of legal varieties for which you can discover a variety of record layouts. Use the service to download professionally-produced documents that follow status demands.

Form popularity

FAQ

Other than admissions, use, and hotel occupancy taxes, there is no general sales tax imposed directly on the consumer. Foreign Sales Corporation (FSCs) which are licensed to do business on Guam may qualify for certain exemptions or rebates of income, real property, gross receipts and use taxes.

The income tax is the major tax in Guam, providing 60 percent of its locally collected tax revenues. These revenues are supplemented by the transfer from the Federal treasury to the Guam treasury of Federal income taxes withheld from U.S. military and civilian personnel stationed in Guam.

Dafne Shimizu - Director - Guam Department of Revenue and Taxation | LinkedIn.

Contact Information: Website: Phone Number: 671-635-1778. Email Address: legal@revtax.guam.gov. Office Address: 1240 Army Drive Barrigada GU USA 96921.

Refunds continue to be paid weekly except for the setback of one week caused by Typhoon Mawar. Due to the surge in the volume of returns filed for Tax Year 2022 through the deadline of April 18, 2023, and the setback caused by Typhoon Mawar on March 24, 2023, turnaround time now fluctuates between 3 to 8 WEEKS.

Refunds continue to be paid weekly. Due to the surge in the volume of returns filed daily ahead of the filing deadline of April 18, 2023, for Tax Year 2022, turnaround time will continue to fluctuate between 3 weeks to just over 6 weeks.