Guam General Journal

Description

How to fill out General Journal?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a range of legal document templates that you can download or print.

By using the site, you can access numerous forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Guam General Journal in just a few minutes.

Examine the form details to make sure you have selected the right form.

If the form doesn't meet your needs, take advantage of the Search box at the top of the page to find one that does.

- If you already have an account, Log In and download the Guam General Journal from the US Legal Forms directory.

- The Download button will show up on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have chosen the correct form for your area/region.

- Click on the Preview button to review the form's content.

Form popularity

FAQ

Yes, you can file your Guam tax online through the Guam Department of Revenue and Taxation's website. This option simplifies the filing process and allows you to submit your documents conveniently. Additionally, the Guam General Journal can guide you through the online filing process, making it easier to understand the requirements and track your submission. Embracing online services enhances your filing experience.

You should mail your Guam tax return to the Guam Department of Revenue and Taxation. The exact mailing address may vary depending on the type of return you are filing, so it's essential to verify this before sending. Using a service like the Guam General Journal can help ensure that your return is filled out correctly and directed to the right location. This can save you time and avoid delays.

To file an annual report in Guam, you need your business identification number, financial statements, and any supporting documents that confirm your business status. It is crucial to prepare these materials ahead of time to ensure a smooth filing process. Utilizing the Guam General Journal can help you organize your data efficiently. For businesses, accuracy in documentation is key to maintaining compliance.

Yes, Guam is treated as a U.S. territory for tax purposes, but it has distinct tax laws and regulations. Residents of Guam typically file their taxes under the Guam tax code, not the federal U.S. tax code. This means using the Guam General Journal can assist you in navigating these differences, ensuring compliance with local laws. Understanding this distinction can help you avoid potential pitfalls.

Individuals residing or earning income in Guam are typically required to file a Guam tax return. This includes residents, non-residents, and those who earn income from sources within the territory. It's important to review your specific situation, as the Guam General Journal can help you understand your obligations. If you're unsure, consider consulting with a tax professional.

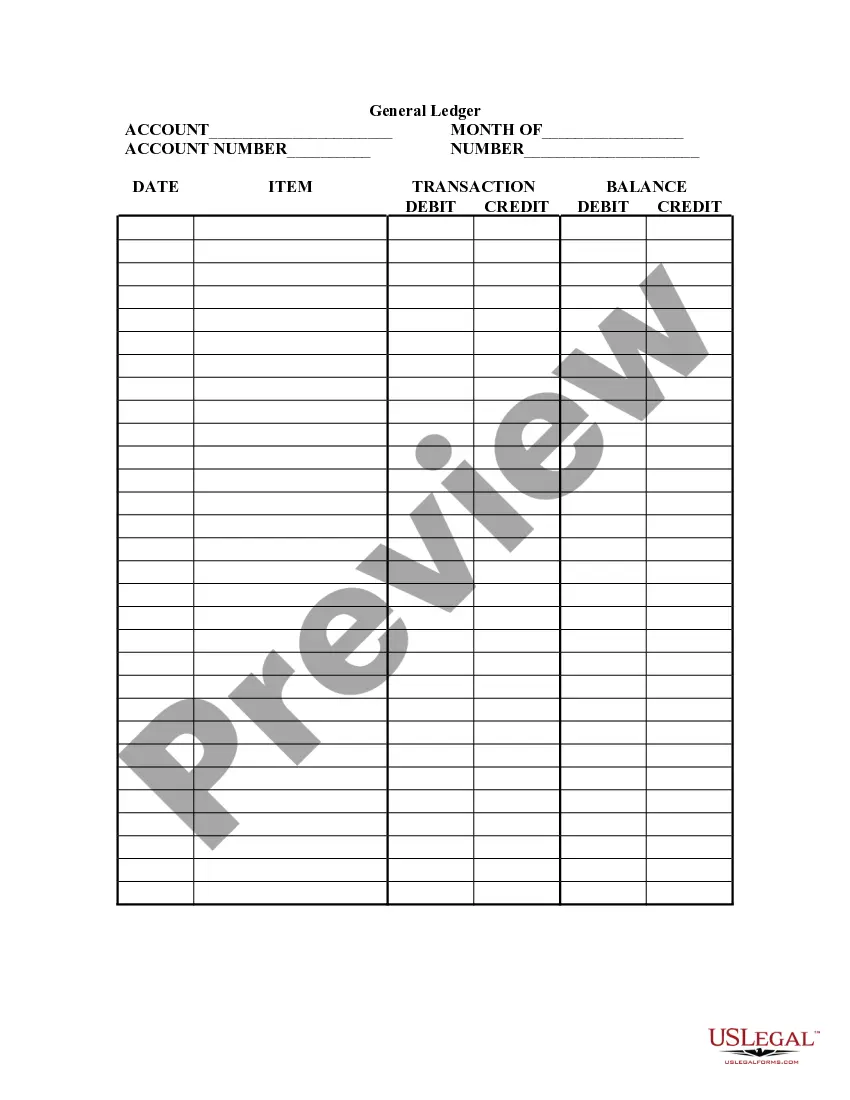

To fill out a general ledger, start by listing each account you wish to record entries for, derived from your Guam General Journal. Input the date, description, debit, and credit amounts under their respective columns. This methodical approach ensures each account maintains accurate balances, reflecting your overall financial position.

To fill out a journal entry, begin with the transaction date and follow with the affected accounts from the Guam General Journal. Identify whether each account is debited or credited, clearly indicating the amounts. A succinct description of the transaction adds context and aids in future reference.

When formatting a general ledger, create distinct columns for the date, description, debit, credit, and balance. Each account in your Guam General Journal should correspond to a separate section in the ledger. Using clear headings and consistent spacing will enhance readability, making it easier to track financial activities.

Completing a general ledger involves summarizing all transactions recorded in your Guam General Journal. Begin by transferring individual journal entries into the appropriate accounts in the ledger. Ensure each entry includes the date, description, and balance. This organized format provides a clear overview of your financial status.

To complete a Guam General Journal, start by identifying the transaction date and the accounts involved. Next, record the debit and credit amounts for each account, ensuring they balance. Include a brief description of the transaction for clarity. This structured approach helps maintain accurate financial records.