If you have to comprehensive, down load, or produce legitimate record web templates, use US Legal Forms, the greatest selection of legitimate varieties, that can be found on the web. Use the site`s basic and handy research to find the paperwork you will need. Numerous web templates for company and individual purposes are categorized by types and says, or key phrases. Use US Legal Forms to find the Guam Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company within a couple of mouse clicks.

In case you are already a US Legal Forms customer, log in to the accounts and click the Download option to obtain the Guam Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company. You may also gain access to varieties you previously acquired within the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

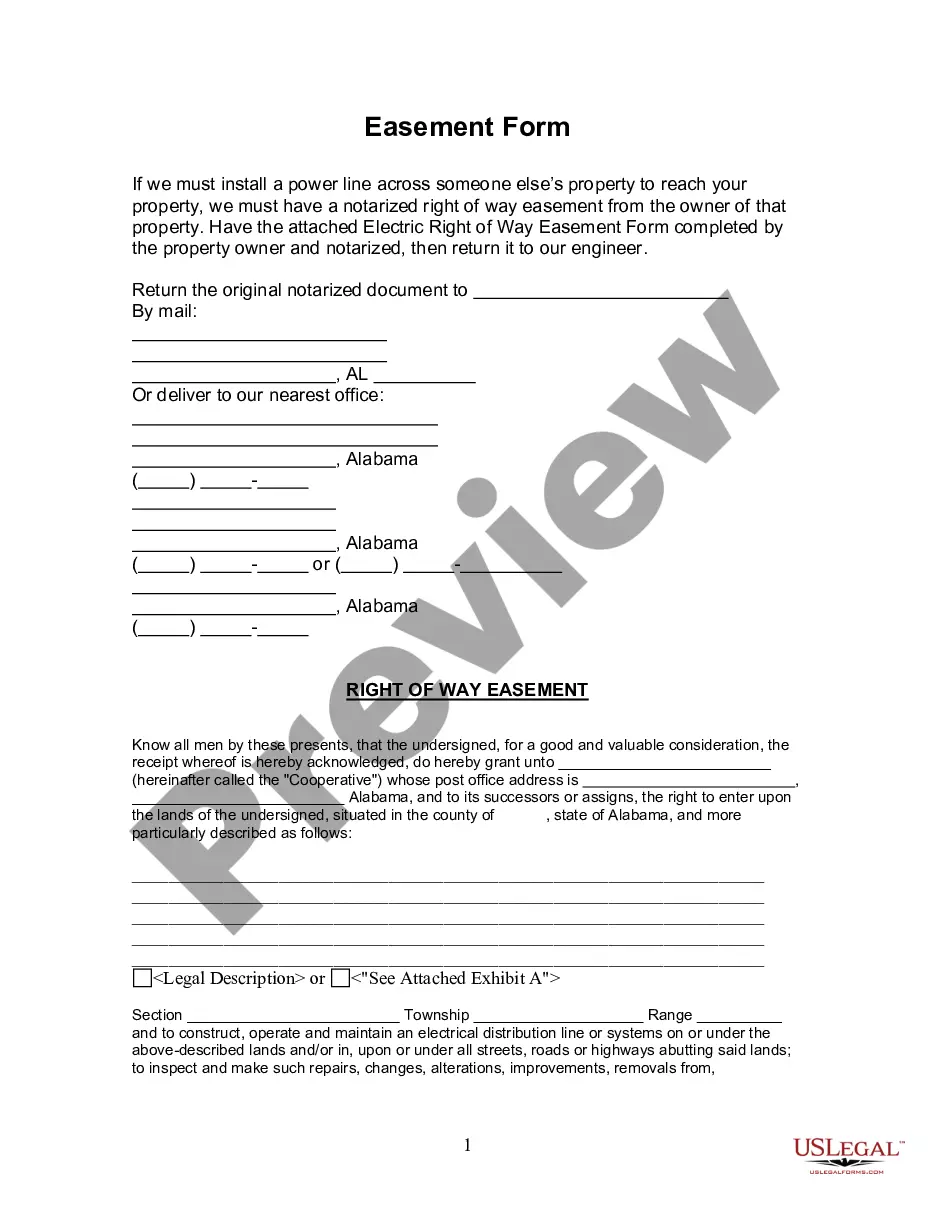

- Step 1. Ensure you have chosen the shape for your correct metropolis/country.

- Step 2. Make use of the Preview option to examine the form`s information. Never neglect to see the explanation.

- Step 3. In case you are not satisfied using the form, use the Search field at the top of the screen to discover other models of your legitimate form format.

- Step 4. When you have discovered the shape you will need, click the Acquire now option. Choose the pricing plan you choose and put your credentials to register for an accounts.

- Step 5. Method the deal. You can utilize your credit card or PayPal accounts to complete the deal.

- Step 6. Find the structure of your legitimate form and down load it on your own gadget.

- Step 7. Complete, edit and produce or indicator the Guam Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company.

Each legitimate record format you get is yours eternally. You have acces to each and every form you acquired within your acccount. Click the My Forms area and pick a form to produce or down load once again.

Compete and down load, and produce the Guam Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company with US Legal Forms. There are millions of professional and state-distinct varieties you may use to your company or individual needs.