Guam Owner Financing Contract for Land

Description

How to fill out Owner Financing Contract For Land?

You might spend time online searching for the legal document template that fulfills the state and federal requirements you have.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

It is easy to download or print the Guam Owner Financing Contract for Land from our service.

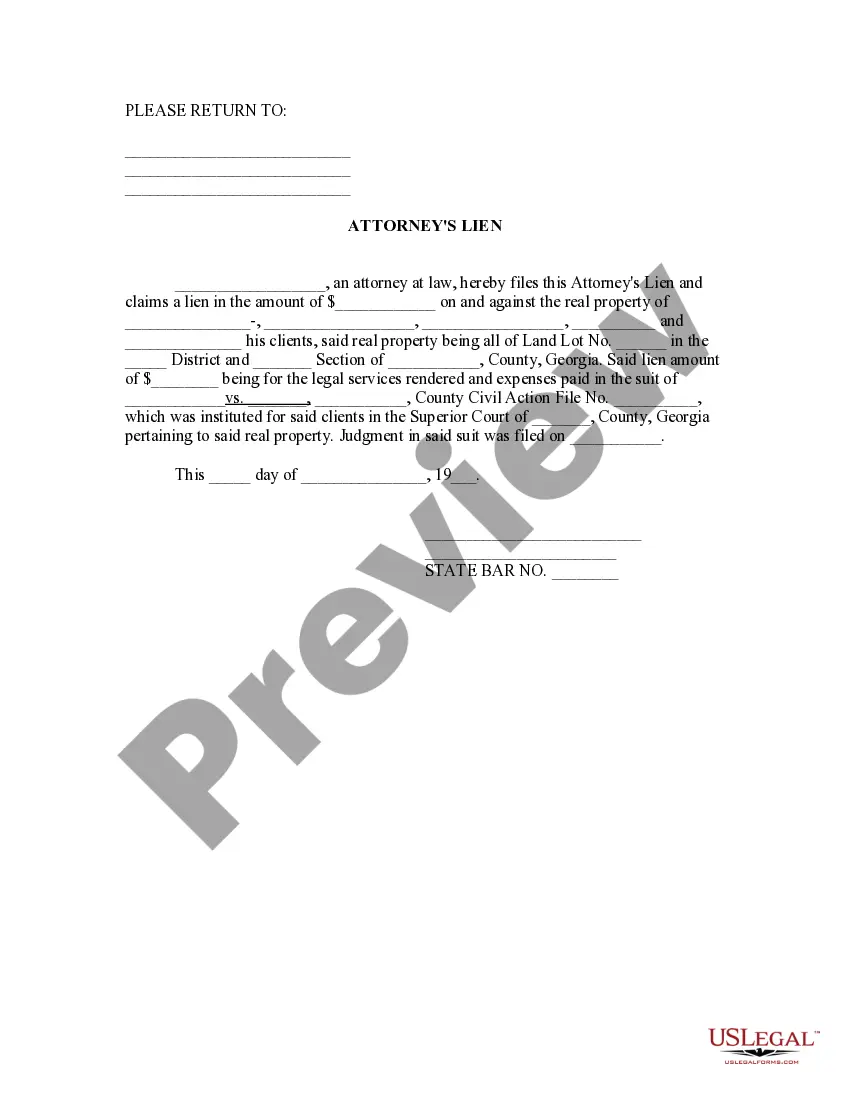

If available, use the Preview option to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Obtain option.

- Next, you can complete, modify, print, or sign the Guam Owner Financing Contract for Land.

- Each legal document template you purchase becomes yours indefinitely.

- To retrieve another copy of an acquired form, head to the My documents tab and click the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your state/town of choice.

- Review the form description to confirm you’ve picked the right one.

Form popularity

FAQ

Getting owner financing on land often involves contacting property owners who are open to this financing method. You can negotiate terms directly with the owner, which can lead to mutually beneficial agreements. Using a Guam Owner Financing Contract for Land helps to formalize the deal, making it clear for both parties. This arrangement allows buyers to secure land without the stringent requirements of traditional banks.

To obtain financing for land, start by exploring various options, including traditional bank loans or private lenders. It's crucial to prepare your financial documents, such as credit history and income proof, to present a strong case. Additionally, consider utilizing a Guam Owner Financing Contract for Land, as this can simplify the process by allowing you to negotiate directly with the seller. By doing so, you may find more flexibility in terms and conditions.

Owner financing for land operates by allowing buyers to make payments directly to the seller instead of through a bank. In a Guam Owner Financing Contract for Land, the seller retains the deed until full payment is completed. This arrangement benefits buyers who may find it challenging to obtain a traditional mortgage and gives sellers a broader pool of potential buyers.

While both a land contract and owner financing are similar, they have key differences. A land contract is a specific type of owner financing that usually involves a written agreement where the buyer makes payments while occupying the land. In contrast, owner financing can encompass various arrangements, including traditional mortgage-like structures. Understanding these distinctions can help you choose the best option for your land acquisition.

Sellers may choose owner financing for several reasons when using a Guam Owner Financing Contract for Land. It allows them to attract more potential buyers, especially those who may not qualify for traditional bank loans. Additionally, owner financing can provide a steady income stream through monthly payments, which can be more lucrative in the long run.

In a Guam Owner Financing Contract for Land, the seller typically retains the deed until the buyer fulfills the payment terms agreed upon in the contract. This arrangement protects the seller’s investment while allowing the buyer to use the land. The seller can reclaim the property through a process known as foreclosure if the buyer fails to meet the payment obligations.

Filling out a land contract requires you to enter specific details, such as the buyer's and seller's names, property description, payment terms, and closing date. Be diligent in ensuring all information is accurate and complete. Using a guide or template, like those provided by uslegalforms, can simplify this process for your Guam Owner Financing Contract for Land.

To do owner financing on land, first, decide on the terms that both you and the buyer can agree upon. Next, draft a legal contract that includes payment terms, responsibilities, and any pertinent disclosures. It’s crucial to ensure that all elements comply with local laws; uslegalforms can assist in creating a proper Guam Owner Financing Contract for Land.

Choosing to owner finance land can be a smart move, especially for those who have difficulty securing bank loans. It often involves reaching a mutually beneficial agreement that meets both the buyer's and seller's needs. However, ensure you fully understand the contract terms and consider consulting resources like uslegalforms for guidance.

The primary downside of owner financing is that it can come with higher interest rates compared to conventional loans. Additionally, if the buyer fails to make payments, the seller may need to initiate foreclosure, which can be costly and time-consuming. As a buyer, it's crucial to consider these risks before proceeding.