Georgia Self-Employed Technician Services Contract

Description

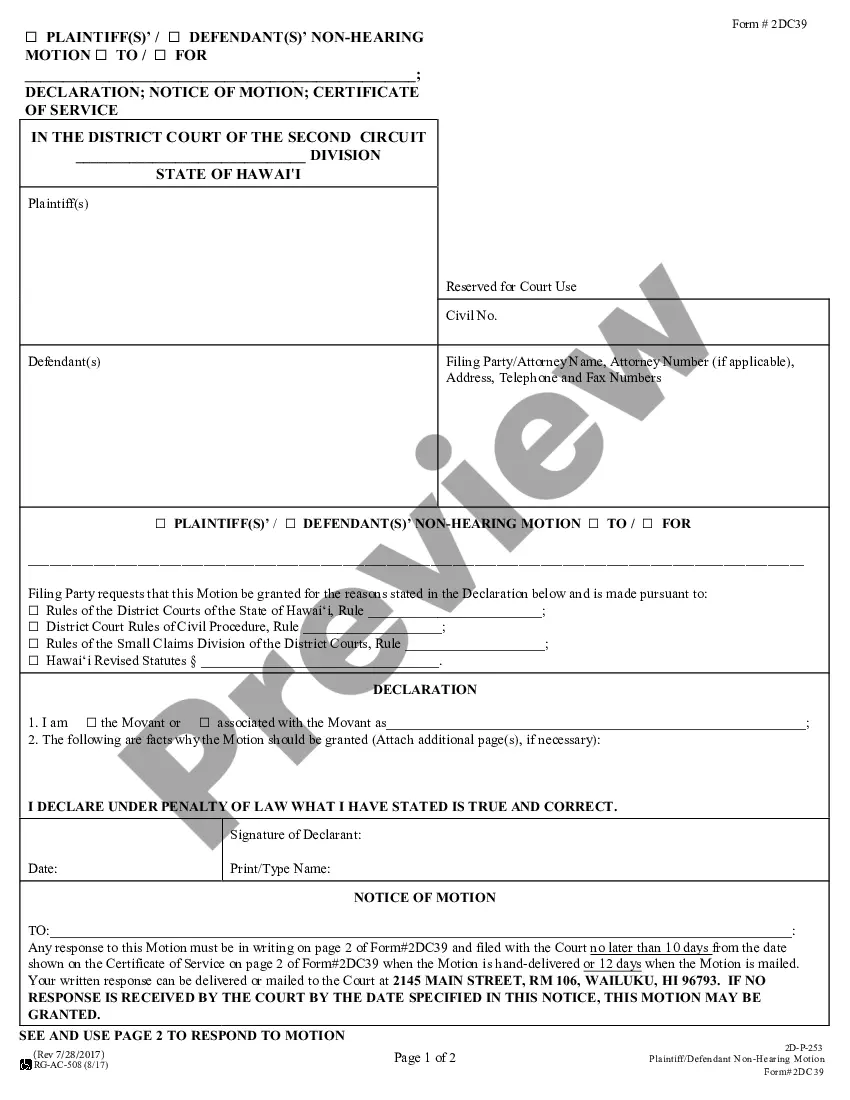

How to fill out Self-Employed Technician Services Contract?

If you wish to finalize, obtain, or generate sanctioned document templates, utilize US Legal Forms, the most extensive selection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to locate the documents you need. An assortment of templates for business and personal purposes are categorized by types and categories, or keywords. Use US Legal Forms to find the Georgia Self-Employed Technician Services Agreement in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download option to access the Georgia Self-Employed Technician Services Agreement. You can also retrieve forms you previously obtained in the My documents section of your account.

If you are using US Legal Forms for the first time, refer to the instructions below: Step 1. Ensure you have chosen the form for the correct city/state. Step 2. Use the Preview feature to review the form's content. Don't forget to read the description. Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template. Step 4. Once you have located the form you need, click on the Get now button. Select the pricing option you prefer and provide your details to register for an account. Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to process the payment. Step 6. Choose the format of your legal form and download it to your device. Step 7. Complete, modify, and print or sign the Georgia Self-Employed Technician Services Agreement.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Each legal document template you obtain is yours permanently.

- You will have access to each form you have acquired in your account.

- Click on the My documents section and select a form to print or download again.

- Compete and acquire, and print the Georgia Self-Employed Technician Services Agreement with US Legal Forms.

- There are numerous professional and state-specific forms you can use for your business or personal needs.

- Explore the available templates to find the one that suits your requirements.

- Utilize the platform's resources to facilitate your documentation process.

Form popularity

FAQ

When writing a contract for a 1099 employee, focus on the specific services they will provide, payment terms, and project deadlines. Specify the independent nature of the relationship to avoid misclassification. A Georgia Self-Employed Technician Services Contract can assist you in drafting a clear and compliant contract tailored for 1099 employees.

To write a simple employment contract, start with the job title, responsibilities, and compensation details. Include information on benefits, work hours, and any conditions for termination. Using a Georgia Self-Employed Technician Services Contract can help you structure your employment contract effectively while meeting legal standards.

You can write your own service agreement by outlining the services to be performed, the timeline, and payment details. It's important to ensure that both parties agree to the terms laid out in the agreement. A Georgia Self-Employed Technician Services Contract can serve as a reliable model to help you create a comprehensive service agreement.

Yes, you can write your own legally binding contract as long as it includes clear terms, the parties involved, and mutual consent. Ensure you follow the legal requirements in your state to make it enforceable. A Georgia Self-Employed Technician Services Contract can provide a solid foundation to help you craft your own contract with confidence.

To create a self-employment contract, define the scope of work, payment terms, and the responsibilities of each party. Make sure to include a termination clause and any confidentiality agreements if applicable. A Georgia Self-Employed Technician Services Contract template can guide you through this process effectively.

Writing a self-employed contract involves outlining the services you will provide and the compensation you expect. Be sure to specify the working relationship, duration, and any additional terms that might be necessary. Using a Georgia Self-Employed Technician Services Contract template can help you include all vital details and maintain clarity.

To write a simple service contract, start by clearly defining the parties involved and the services to be provided. Include the contract duration, payment terms, and any specific conditions or requirements. Utilizing a template for a Georgia Self-Employed Technician Services Contract can streamline this process and ensure you cover essential elements.

An independent contractor typically needs a business license in Georgia, depending on their specific services and local regulations. It is advisable to research your local requirements to stay compliant. A Georgia Self-Employed Technician Services Contract can complement your business license by formalizing your agreements with clients and enhancing your credibility.

Yes, having a contract as an independent contractor is crucial. A contract outlines the terms of your services, payment, and responsibilities, providing legal protection for both parties. A Georgia Self-Employed Technician Services Contract can help you clarify expectations and reduce the likelihood of disputes, ensuring that your work runs smoothly.

While Georgia does not legally require an operating agreement for LLCs, it is highly recommended to create one. An operating agreement outlines the management structure and operating procedures of your LLC, which can prevent disputes and misunderstandings. If you are a self-employed technician, a well-structured Georgia Self-Employed Technician Services Contract can serve a similar purpose in your freelance work.