Georgia Self-Employed Part Time Employee Contract

Description

How to fill out Self-Employed Part Time Employee Contract?

Finding the appropriate official document template can be a challenge. Of course, there is a multitude of formats available online, but how do you locate the legal form you need? Utilize the US Legal Forms website.

This service offers thousands of formats, including the Georgia Self-Employed Part Time Employee Agreement, suitable for business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and then click the Acquire button to locate the Georgia Self-Employed Part Time Employee Agreement. Use your account to browse the legal documents you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Georgia Self-Employed Part Time Employee Agreement. US Legal Forms is the leading library of legal templates from which you can find a variety of document formats. Use this service to obtain professionally crafted papers that adhere to state requirements.

- First, ensure you have selected the correct form for your city/state.

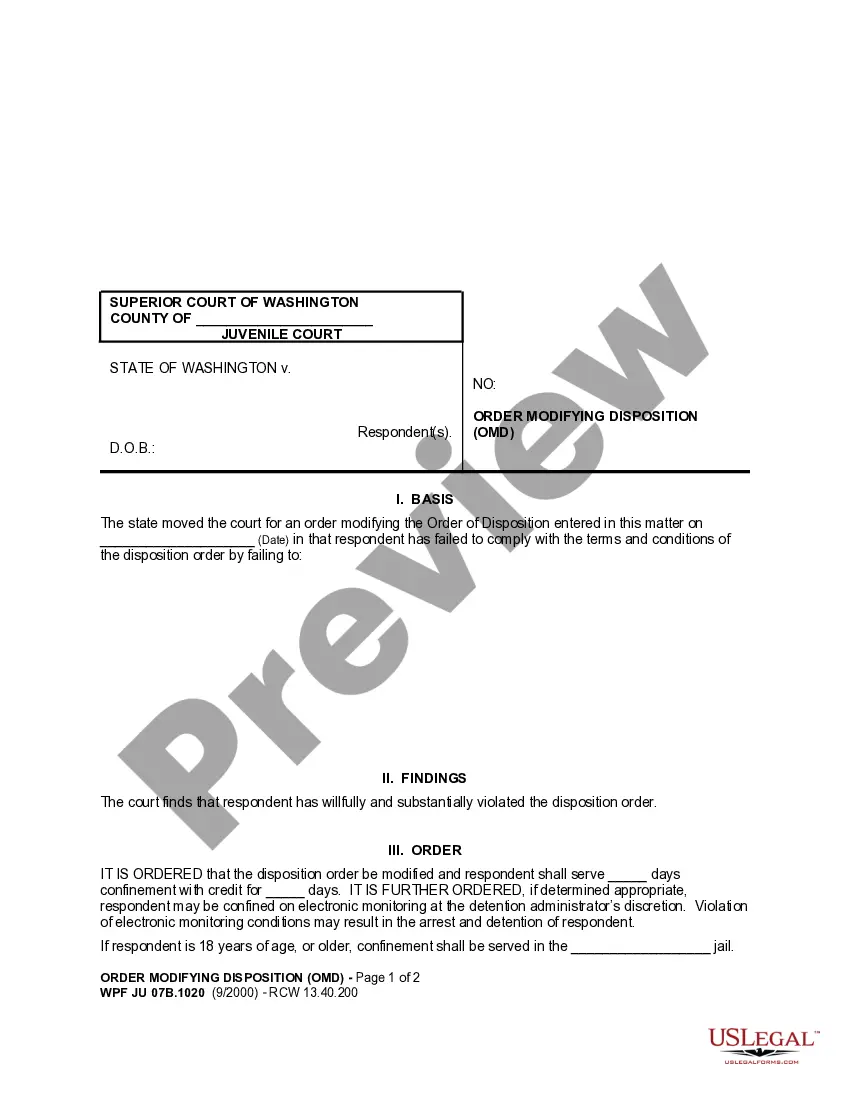

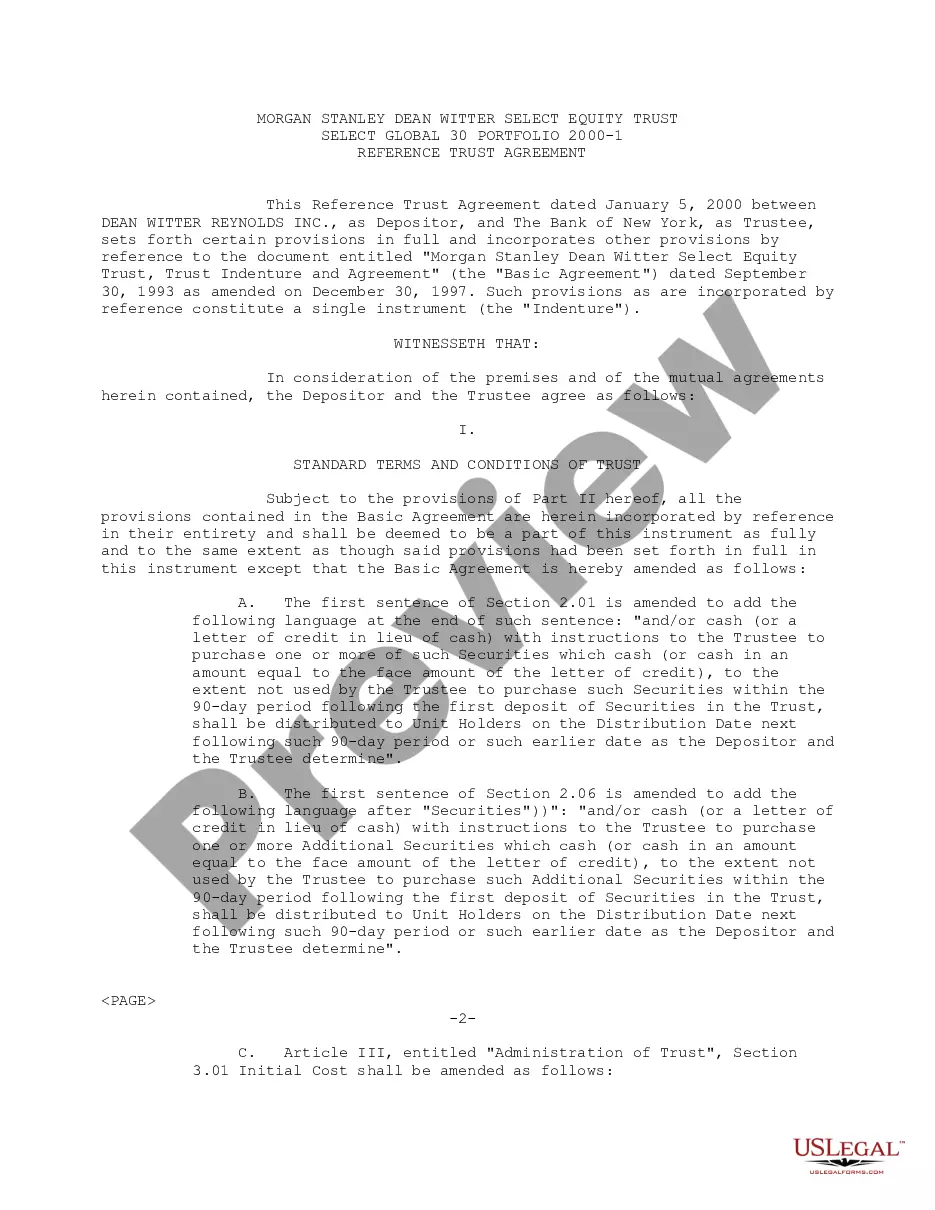

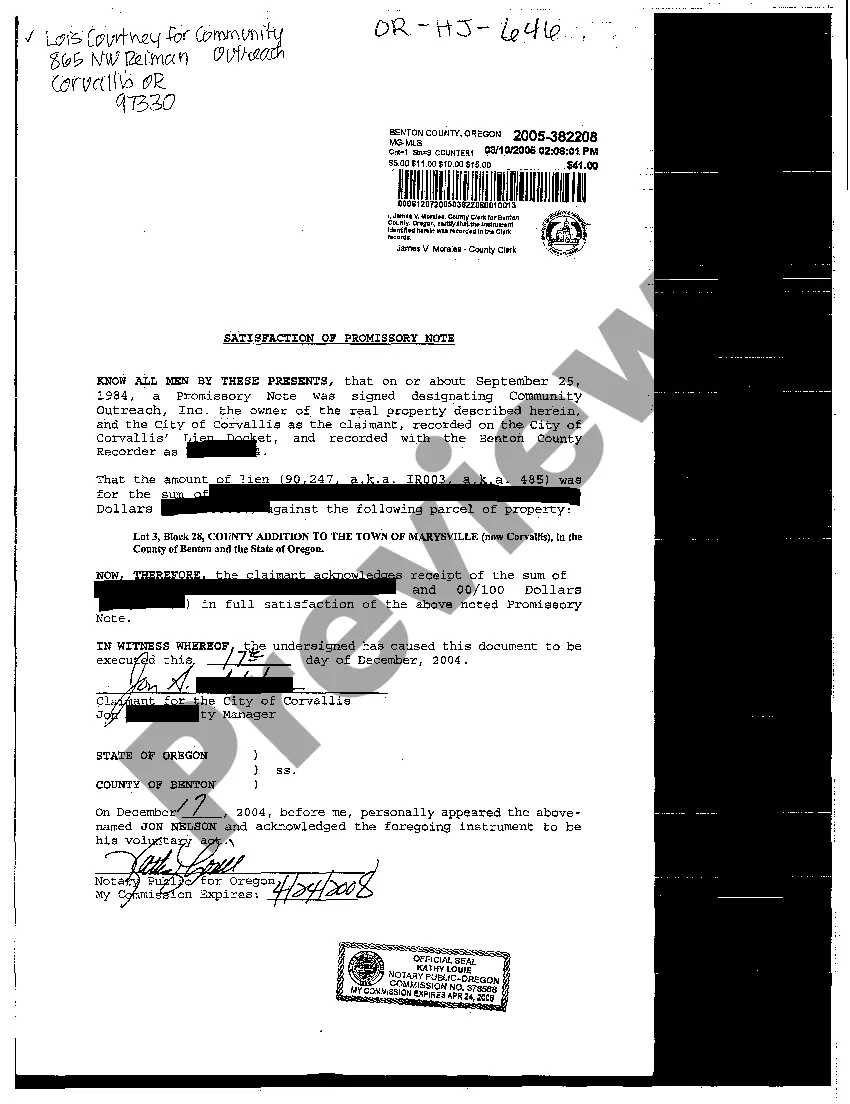

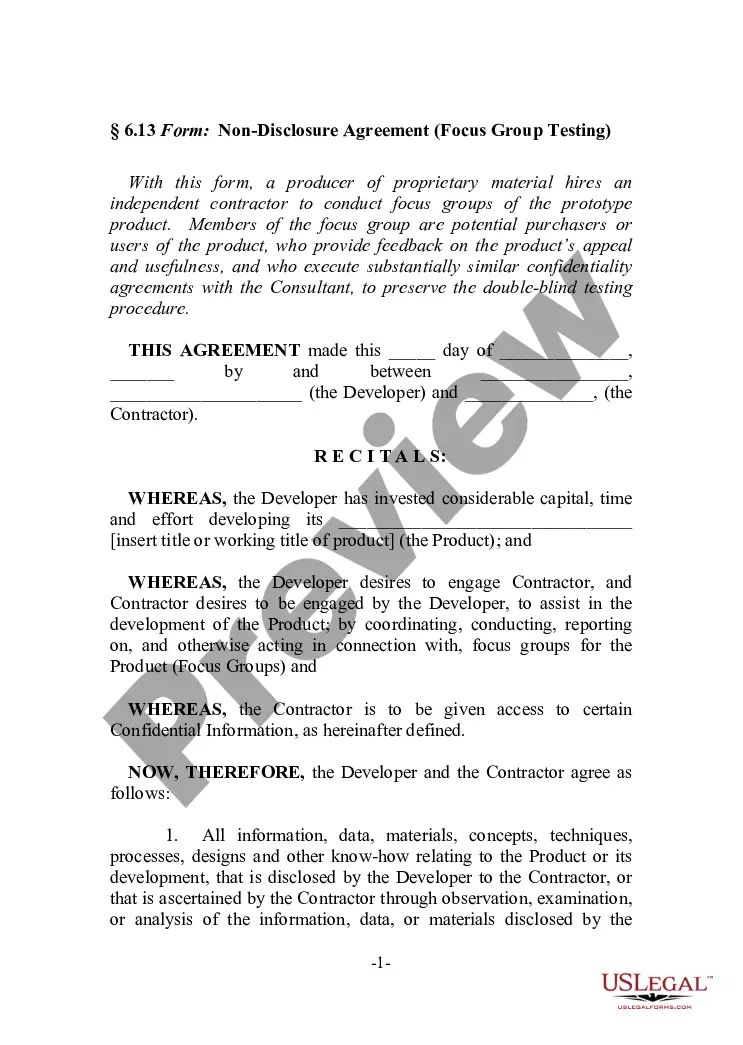

- You can review the form using the Preview option and read the form description to verify it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate document.

- Once you confirm the form is suitable, click the Purchase now button to acquire the form.

- Choose the pricing plan you want and fill in the required information.

- Create your account and pay for the transaction using your PayPal account or credit card.

Form popularity

FAQ

Contract employees Often, contractors work for multiple organizations in order to make a living. These workers may make more money than part-time employees in the short term; however, they also have to pay self-employment taxes on their earnings, which can add up over time.

The Difference Between Part-time vs. In Georgia, there is no state law that determines how many hours an employee needs to work to be a full-time employee. Most companies will hold that 40 hours per week is full-time and less than that is part-time.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Learn below about the four most common types of construction contracts.Lump Sum Contract. A lump sum contract sets one determined price for all work done for the project.Unit Price Contract.Cost Plus Contract.Time and Materials Contract.16-Mar-2020

The number of hours that an employee works to be considered part-time can vary. However, as a general rule, employees who work between 20 and 29 hours per week are considered part-time employees.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time. They set their own hours of work and are paid a fee for completing each set assignment.

Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.

Part-time employees typically work less than 32 hours per week, full-time is usually 32-40. Part-time employees are usually offered limited benefits and health care. Often a part-time employee is not eligible for paid time off, healthcare coverage, or paid sick leave.

Yes. Even part time staff must have a contract. The law applies if employees: Have a fixed employment period.

Most employers determine full-time status based on business needs and typically consider an employee to be full-time if they work anywhere from 32 to 40 or more hours per week.