Georgia Contract for Part-Time Assistance from Independent Contractor

Description

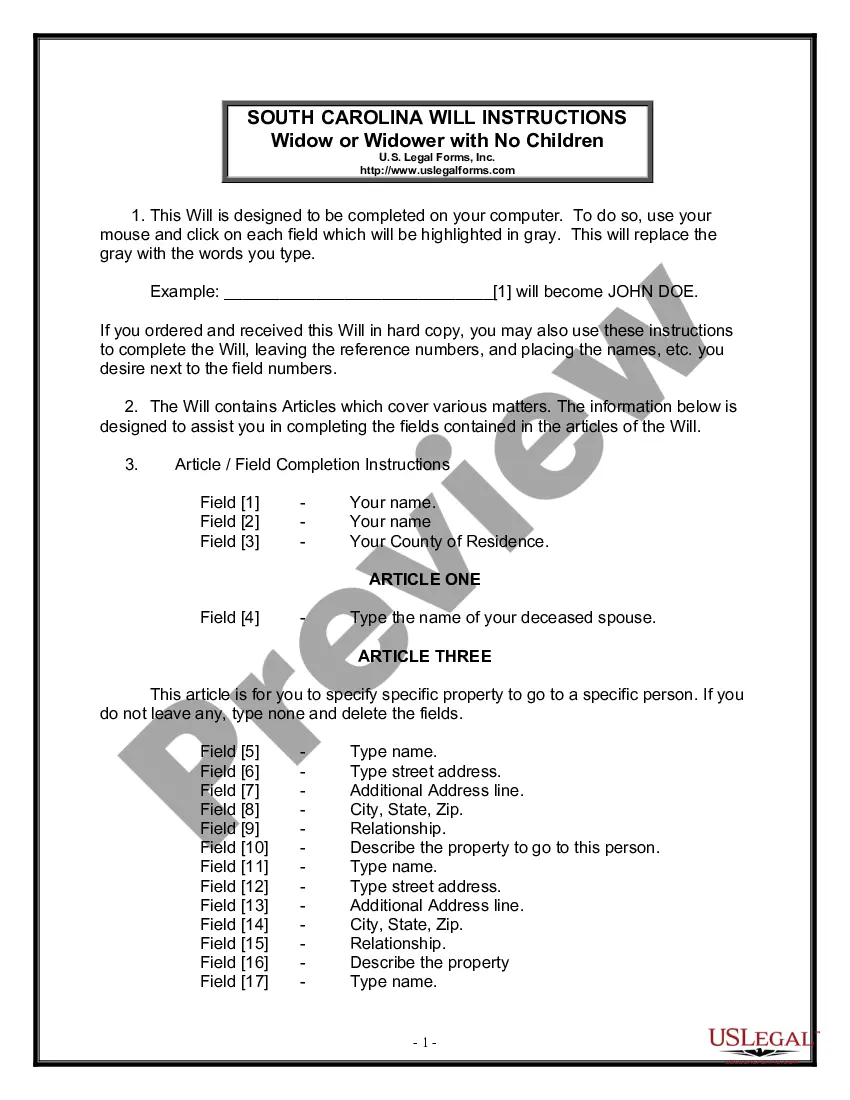

How to fill out Contract For Part-Time Assistance From Independent Contractor?

You can spend hours online searching for the valid document format that complies with the federal and state requirements you need.

US Legal Forms offers thousands of valid templates that have been reviewed by experts.

It's easy to download or print the Georgia Contract for Part-Time Assistance from Independent Contractor using our services.

If available, use the Review option to examine the document format as well. If you want to obtain another version of the document, use the Search field to find the template that suits your requirements.

- If you already have a US Legal Forms account, you can Log In and click the Obtain option.

- After that, you can fill out, modify, print, or sign the Georgia Contract for Part-Time Assistance from Independent Contractor.

- Every valid document template you acquire is yours permanently.

- To get another copy of any acquired document, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the area/city of your choice.

- Review the document description to confirm you have chosen the right form.

Form popularity

FAQ

Filling out a Georgia Contract for Part-Time Assistance from Independent Contractor is straightforward. Start by including the names and addresses of both parties involved. Next, define the scope of work clearly, outlining specific tasks and deadlines. Finally, include payment terms, applicable taxes, and signatures to finalize the agreement.

Independent contractors must adhere to several rules to maintain their classification. They should control how and when they perform their work, invoice for services, and manage their own expenses and taxes. Understanding these guidelines can help you craft a robust Georgia Contract for Part-Time Assistance from an Independent Contractor, ensuring compliance and clarity.

Technically, a 1099 employee can work without a contract, but it is not advisable. Without a formal agreement, there can be confusion regarding the work's scope and payment details. A Georgia Contract for Part-Time Assistance from an Independent Contractor helps clarify these points, ensuring a smoother collaboration.

If you do not have a contract with an independent contractor, you risk misunderstandings over expectations, compensation, and responsibilities. In the absence of a formal agreement, you may find it challenging to enforce terms or resolve disputes. To protect your interests, consider using a Georgia Contract for Part-Time Assistance from an Independent Contractor.

The independent contractor agreement in Georgia is a legal document that outlines the terms and conditions between a business and an independent contractor. This agreement typically covers payment, deliverables, and the duration of the work. A Georgia Contract for Part-Time Assistance from an Independent Contractor can help ensure both parties understand their rights and responsibilities.

Having a contract for an independent contractor is essential for legal protection and clarity. This document serves as a reference point for the services expected and the obligations of both parties. By using a Georgia Contract for Part-Time Assistance from an Independent Contractor, you can maintain a professional relationship and prevent potential issues.

To write a contract for a 1099 employee, start with a clear introduction of both parties involved. Include key details such as the scope of work, payment terms, duration of the agreement, and any termination clauses. Utilizing a Georgia Contract for Part-Time Assistance from an Independent Contractor template can simplify this process and ensure all necessary components are included.

Yes, independent contractors should have a contract to clearly outline the terms of the engagement. A Georgia Contract for Part-Time Assistance from an Independent Contractor establishes expectations, payment terms, and project timelines. This document protects both parties by reducing the risk of misunderstandings or disputes.

Absolutely, you can be a part-time independent contractor in Georgia. This arrangement allows flexibility in your working hours while still providing valuable services. A Georgia Contract for Part-Time Assistance from Independent Contractors can help define your role and responsibilities, ensuring both parties are on the same page.

Several groups are exempt from needing workers' compensation coverage in Georgia, including certain independent contractors and business owners. Sole proprietors who do not have employees may also find themselves exempt. Understanding these exemptions can be vital when negotiating a Georgia Contract for Part-Time Assistance from Independent Contractors.