Georgia Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

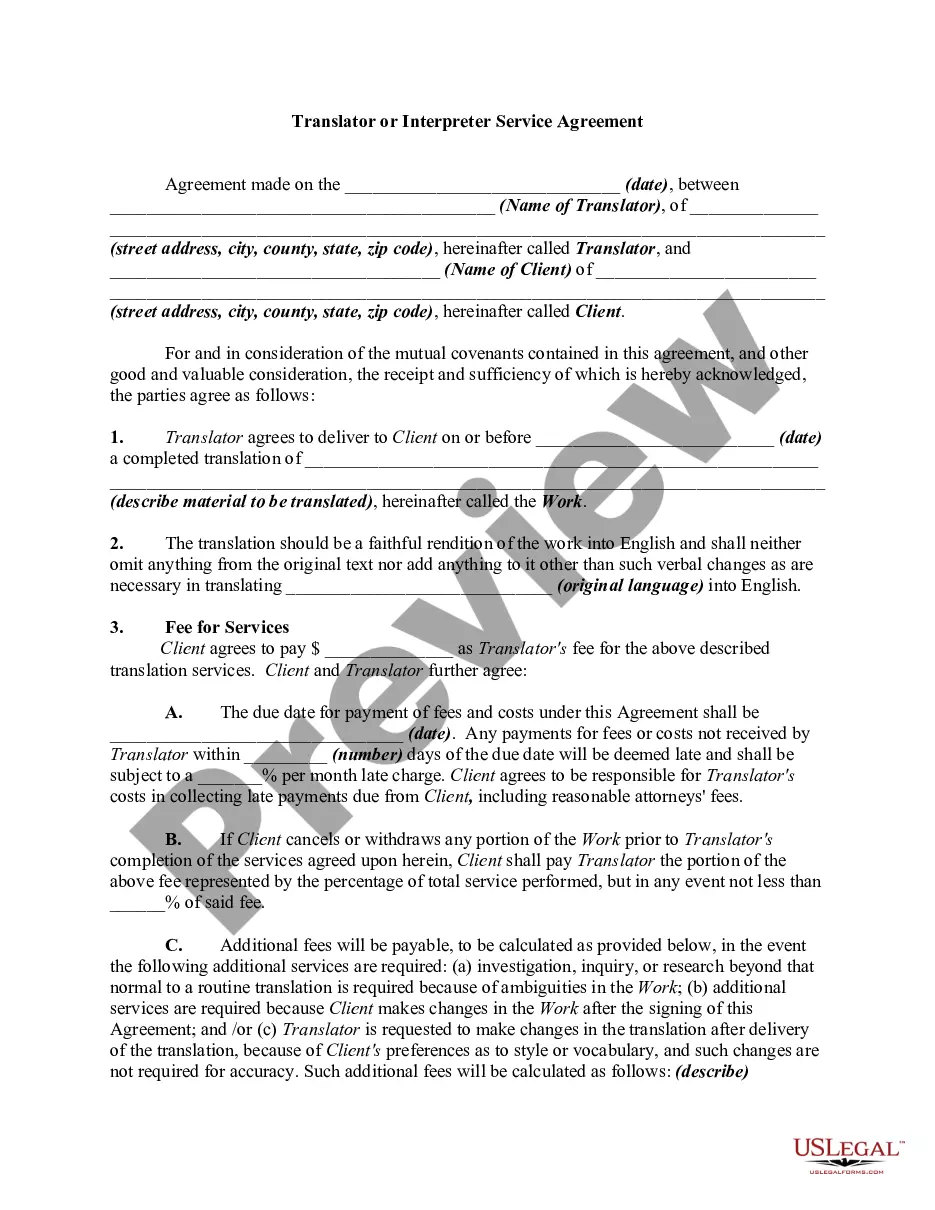

How to fill out Translator And Interpreter Agreement - Self-Employed Independent Contractor?

You can spend multiple hours online looking for the legal document template that satisfies the federal and state requirements you will need.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can easily download or print the Georgia Translator And Interpreter Agreement - Self-Employed Independent Contractor with my help.

If available, utilize the Preview button to review the document template as well. If you wish to find another version of your form, use the Search area to locate the template that meets your needs.

- If you already have a US Legal Forms account, you may Log In and then click the Acquire button.

- Next, you can complete, modify, print, or sign the Georgia Translator And Interpreter Agreement - Self-Employed Independent Contractor.

- Every legal document template you obtain is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure that you have selected the correct document template for your state/town that you choose.

- Check the form description to ensure you have selected the right form.

Form popularity

FAQ

You can definitely be a freelance interpreter. Many interpreters work independently, offering their services to various clients on a project basis. This freelance status allows interpreters to build a diverse portfolio and work in different environments. Using a Georgia Translator And Interpreter Agreement - Self-Employed Independent Contractor helps ensure both you and your clients are on the same page regarding expectations and payment.

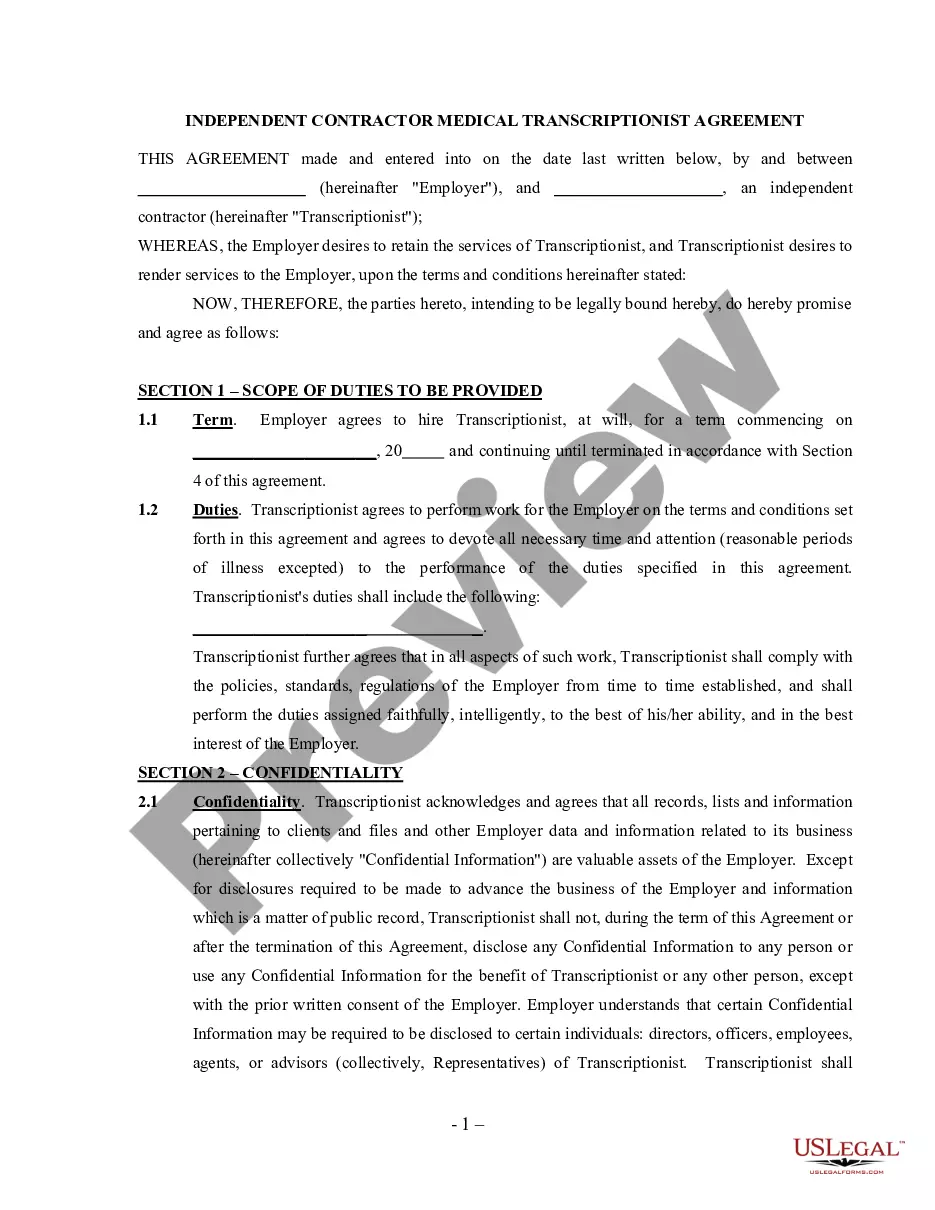

Yes, interpreters often work as independent contractors. They typically provide services to clients without being directly employed. This arrangement gives interpreters flexibility in setting their schedules and choosing assignments. A Georgia Translator And Interpreter Agreement - Self-Employed Independent Contractor can help clarify the terms of this working relationship.

Writing an independent contractor agreement can be straightforward. Start by outlining the specific services you expect from the contractor, including details on payment terms and deadlines. It's important to include clauses regarding confidentiality and dispute resolution. For a comprehensive and legally sound agreement, consider using a template like the Georgia Translator And Interpreter Agreement - Self-Employed Independent Contractor that uslegalforms provides.

The independent contractor agreement in Georgia is a legally binding document that outlines the terms under which a self-employed individual, such as a translator or interpreter, offers services. This agreement is especially important for those operating as self-employed independent contractors because it clarifies responsibilities, payment terms, and the scope of work involved. By utilizing a Georgia Translator And Interpreter Agreement - Self-Employed Independent Contractor, you can protect your interests and ensure a mutual understanding with your clients. Additionally, uslegalforms provides a reliable platform to help you create this essential document tailored to your specific needs.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Freelance interpreters or translators work on a self-employed basis converting written texts from one language to another or providing verbal translations in live situations, such as conferences, performances, or meetings.

Fact #1: A large percentage of all interpreters and translators are independent contractors. There are many reasons that language professionals choose to work as independent contractors. Many prefer the flexibility of making their own schedule and being able to choose their assignments.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Interpreters and translators in California have been granted an exemption from AB 5. It's been almost 9 months since the controversial AB 5 bill went into effect, which reclassified independent interpreters and translators in California as employees, and no longer as independent contractors.